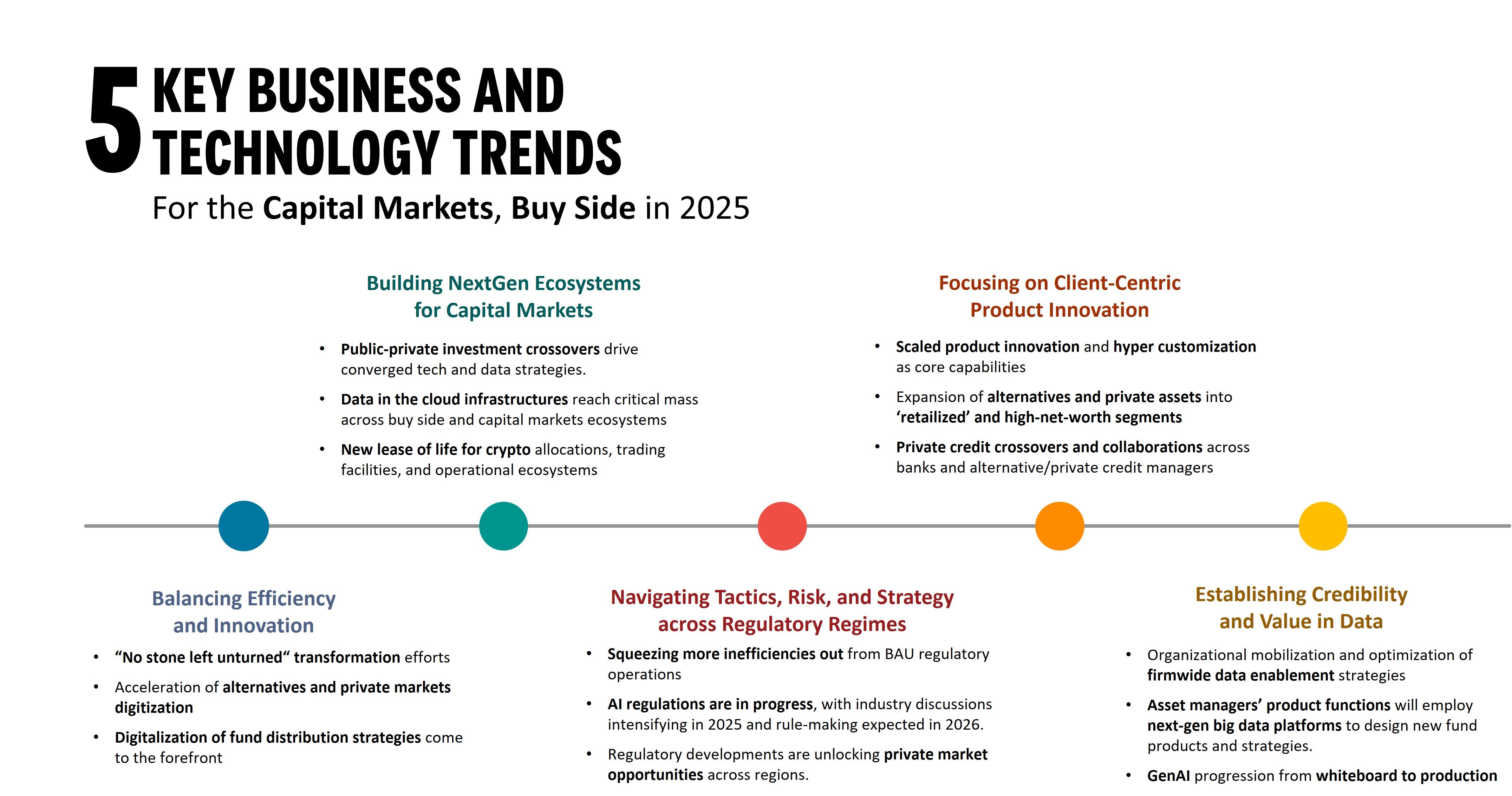

Investment managers are reaching a critical juncture marked by stagnating revenues and unyielding pressures on fees and costs that are eroding margins. In the light of harsher realities, firms are leaving "no stone unturned" in their pursuit of transformative change to fortify their business and operating models -- merely 'tinkering around the edges' is no longer a viable option for the buyside industry.

Through Celent's ongoing engagements and industry surveys, we see investment managers raise the bar to establish clear points of differentiation in their product offerings and distribution channels, while also striving for greater efficiencies in portfolio servicing and operations. Technological advancements are facilitating significant shifts in delivering to client needs and investment strategies, reshuffling the balance across public, alternative, and private assets. Digitization and data-centricity are reshaping go-to-market strategies and client engagement.

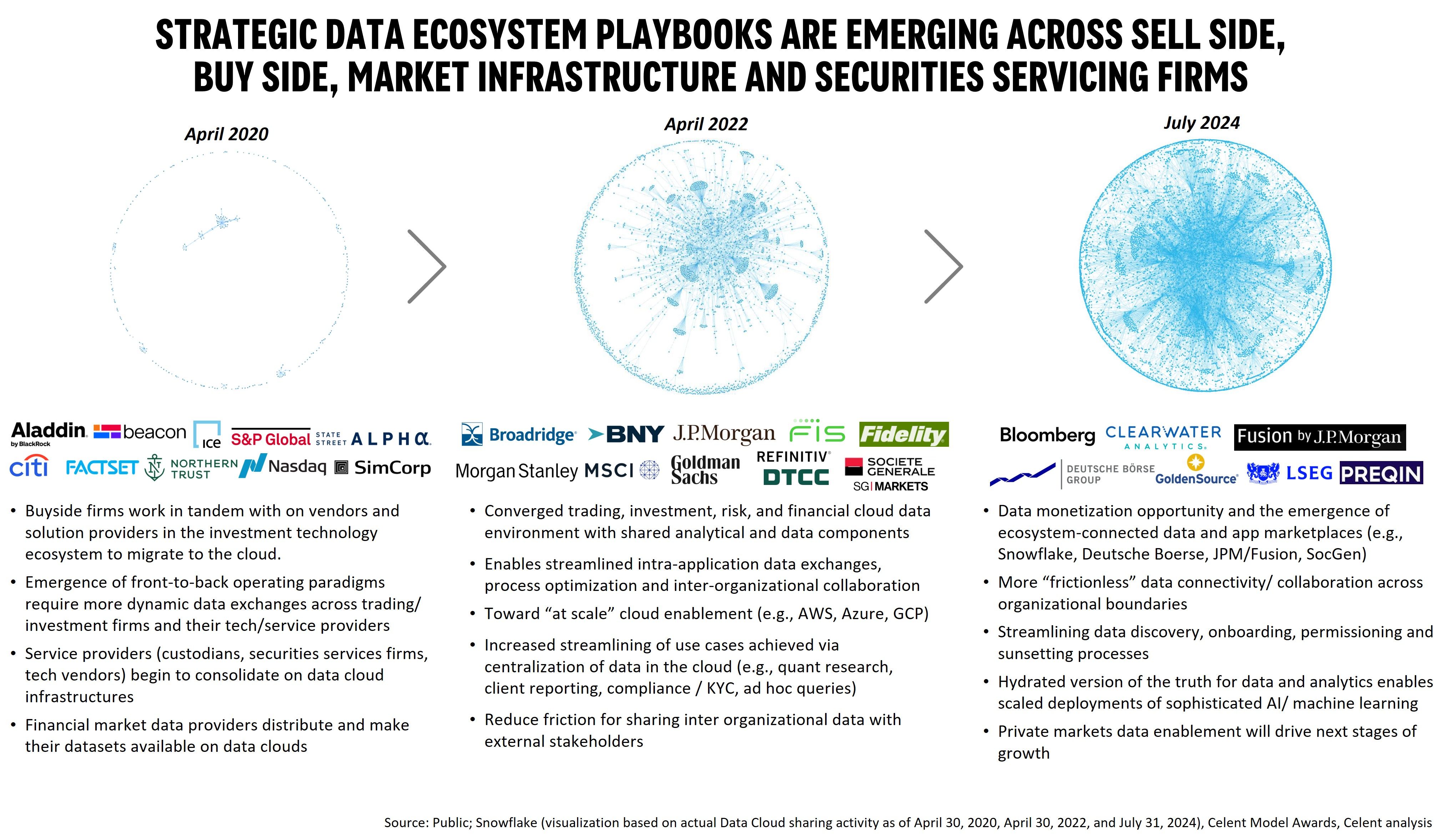

Across capital markets more broadly, strategic data ecosystems are taking shape across various sectors, including sell-side and buy-side firms, market infrastructure, and securities servicing entities. This transformation is largely driven by the swift adoption of data cloud infrastructures, which are reshaping the landscape of connectivity and collaboration. Adoption dynamics and network effects are characterized by an exponential growth around these ecosystems:

As these data ecosystems develop, we expect them to facilitate more seamless interactions among participants throughout the trading and investing value chains. When employed and architected correctly, firms can leverage these ecosystems to develop operational strategies that are agile, data-driven, and differentiated. This evolution not only enhances efficiency but also fosters innovation, enabling firms to leverage shared data and insights to make more informed decisions and respond more agilely to market dynamics.

This Previsory report specifically examines the business and technology dynamics through a buy-side lens, emphasizing emerging themes and changing playbooks for 2025. The themes have been identified by the Capital Markets team based on our ongoing research and forward-looking discussions with industry executives.

----------

Celent clients can also access relevant buyside studies:

- Global Buy Side IT Priorities and Strategies 2024

- NextGen Investment Accounting Solutioning Guide: A Playbook for Success

- Alternatives and Private Markets: Charting New Technology Frontiers and Digital Pathways for Next-gen Operational Ecosystems

- Pivoting to the Front: The Quest for Greater Differentiation as the Alpha Race Intensifies

- Operational Alpha on the Buyside: Crystal balling future hybrid provider propositions and ecosystem innovations

- ESG Delivery Under Scrutiny: "Walking the Talk" to Resolve the Credibility Gap

- NextGen Invest and Risk Tech: Gazing Through A Crystal Ball Into 2030

- End-to-end solutions set to revolutionize investment technology

- Enterprise Data Management Visions and Trajectories: Capital Markets and Investments Edition Part 1 and Part 2

For more in-depth research around buyside, sellside and market infrastructure trends and technology insights, please explore Celent's Capital Markets practice.