The life insurance industry enters 2026 facing a constellation of challenges that continue to reshape strategies, operating models, and investment priorities. Interest rate uncertainty—whether prolonged flatness or sharp volatility—remains a central constraint, complicating product economics for offerings with long-dated guarantees. At the same time, overall policy counts continue to shrink even as average face amounts rise, signaling a growing shift toward higher-income buyers. This dynamic leaves large segments of the population underprotected and raises important questions about accessibility, relevance, and the long-term growth trajectory of the industry. With rising costs spread across a smaller policy base, improving cost-to-serve has become essential, prompting carriers to modernize operations and realign product design, service models, and profitability.

Against this backdrop, the emergence of generative and agentic AI is redefining the relationship between people and technology in a way the industry has not experienced since the advent of the smartphone. And as with the smartphone era, progress will not unfold in a straight line. Early AI successes may flourish in select product lines or customer segments, only to fall short when applied more broadly. The technology may accelerate underwriting or guide customers through complex decisions, yet still require human judgment to finalize a bindable policy. These growing pains reflect a technology evolving at extraordinary speed but not yet fully mature—and life insurers will need flexibility and experimentation to navigate its uneven early stages.

Despite the uncertainty, AI is already delivering meaningful benefits across the value chain. The rapid advance of generative, agentic, and predictive capabilities is enabling carriers to move far beyond traditional automation: leveraging real-time data to accelerate underwriting, modernize policy administration, improve beneficiary services, streamline claims, and strengthen actuarial and risk modeling. AI is also opening new pathways to anticipate mortality and longevity trends, identify underserved segments, and design more accessible products—helping address both coverage gaps and cost pressures. Even as investment behaviors around AI appear speculative and vulnerable to correction, the technology’s practical value is undeniable. Insurers must take advantage of what is possible today while staying agile as the ecosystem evolves.

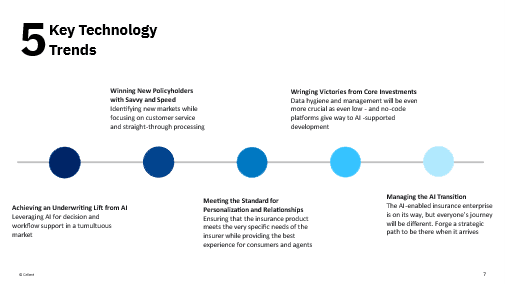

Celent has identified five key themes driving this next era of transformation, extending the direction first outlined in our 2025 Previsory and now accelerating across carriers of all sizes.

We see this as a defining moment for life insurers—one grounded in clearer purpose, smarter deployment of technology, and deeper collaboration across the value chain. Lessons from recent years are being translated into executable strategies for sustainable growth, modernization, and long-term relevance.

Yet significant challenges remain. Achieving scalable transformation—whether digital, operational, or AI-driven—requires foundational investments in data quality, governance, interoperability, and risk controls. At the same time, the workforce is undergoing rapid transition as experienced professionals retire, leaving gaps across underwriting, actuarial functions, distribution, and operations. Capturing this expertise, embedding it into intelligent systems, and equipping the next generation with modern tools will be essential to sustaining momentum and ensuring resilience.

Throughout 2026, Celent’s research will focus on how life insurers can not only adapt to these changes but lead with confidence. From evaluating emerging technologies and vendors to shaping strategy and informing execution, we’re committed to helping carriers translate innovation into impact. There is significant opportunity in the year ahead—and we look forward to partnering with you to unlock its full potential.