Two watershed events−Varo’s obtaining FDIC approval for insurance coverage and LendingClub’s proposal to Radius Bank−suggest that the economics of banking aren’t that bad after all! The financial arbitrage of lending at a risk premium and borrowing at a risk free rate works. Payment services paid for by merchants works in favor of consumers.

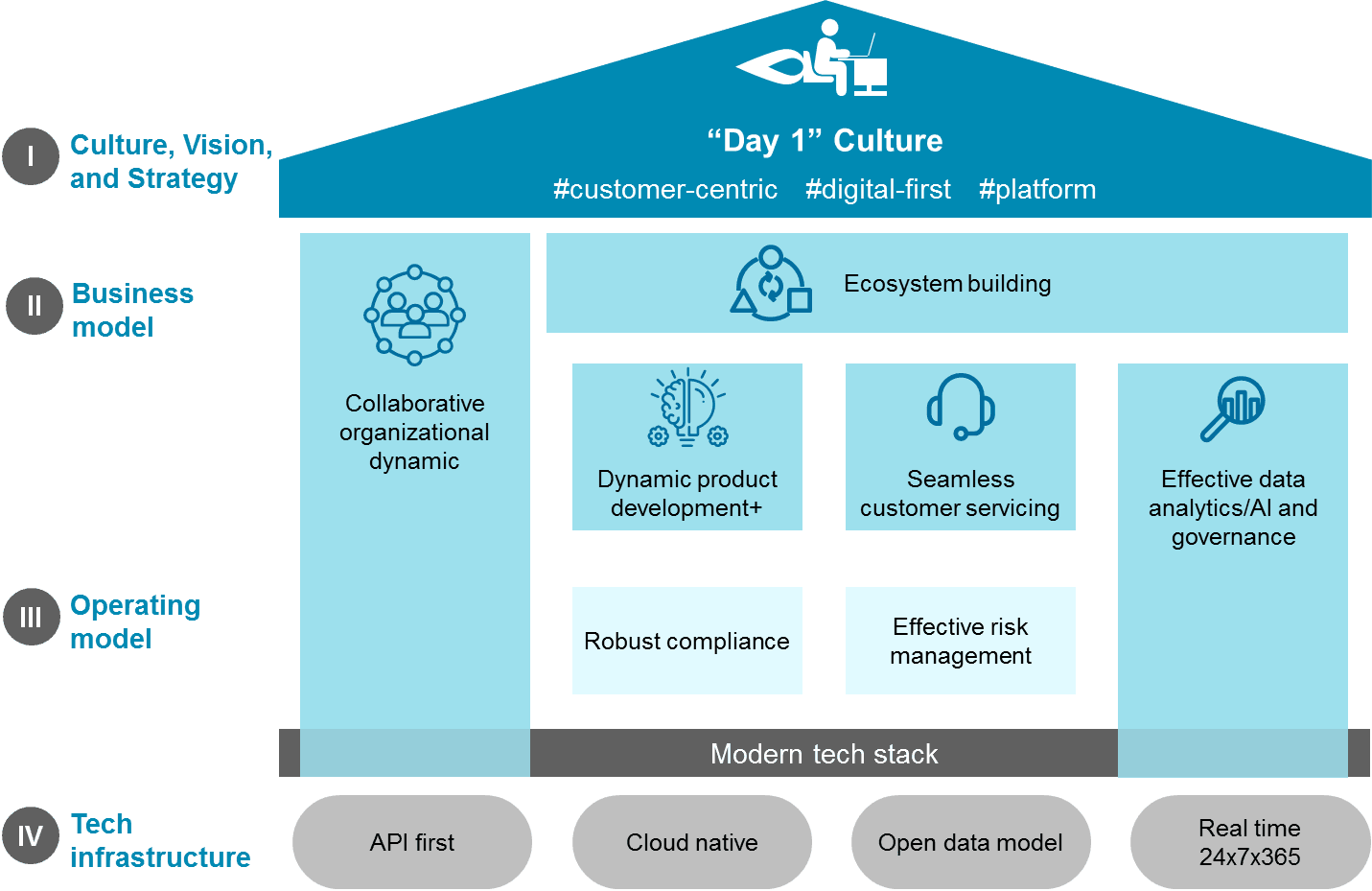

To outperform, however, a bank must have critical success factors in place:

- At the top of the house, customer-centric and data-driven leadership

- A value proposition consumers believe in, that is, one that places them at the center of all decision-making, economic and otherwise

- New business and operating models that break down silos, redefine product development along design thinking, and leverage data analytics

- Light, modern tech infrastructure

For further commentary, please see my reports, From Challenged to Challenger: Becoming a 21st Century Bank and Pacesetters in Customer Engagement: Top Trends and Best Practice Players .

The 21st Century Bank: