What can a somewhat obscure psychological term possibly have to do with banking? And what the heck is the Dunning-Kruger effect, anyway?

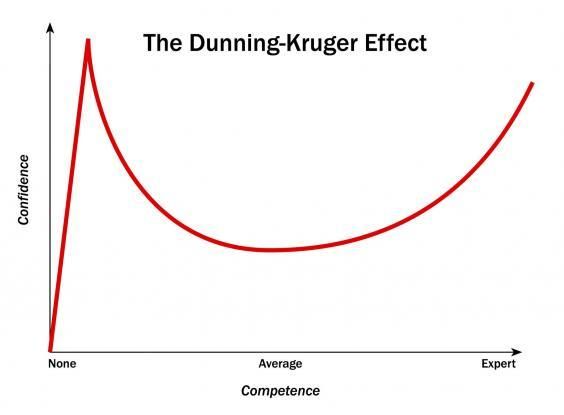

Briefly put, it describes the relationship of a person’s ability and his perception of that ability. Notably, people of low ability tend to overestimate their competence. Put even more starkly, incompetent people can’t recognize their ineptitude. On the other hand, highly competent people tend to underestimate their abilities and assume that tasks that are easy for them are easy for others.

Here’s an illustration:

The paper, published in 1999, is titled Unskilled and Unaware of It: How Difficulties in Recognizing One's Own Incompetence Lead to Inflated Self-Assessment, and was awarded an Ig Nobel prize for stating the blindingly obvious. Nevertheless, I find this fascinating on a lot of levels, particularly in an era of social media where seemingly everyone’s an expert.

But what can this possibly mean for banking?