What does leading-class digital insurance look like today? And what are the key gaps to getting there? We recently explored these questions through interviews with senior executives who are each responsible for digital insurance at their respective organizations. They represent companies that are at the vanguard for digital transformation (each are significant participants in their respective markets). The exploration of the animating questions resulted in fascinating case studies that, surprisingly, reveal a few unexpected and, in some cases, contradictory results along two dimensions:

1. Customer engagement beyond the product transaction (or post-sale digital engagement)

2. Greenfield vs. heritage investment as a method to build a digital platform

To grasp the richness of each respondent’s journey including their views on digital insurance and engagement, please check back here over the next few weeks—the report, now published is accessible here https://www.celent.com/insights/616207827 I’d like to share the capability gaps that we exposed during the study by using an evaluation tool we co-developed with Oliver Wyman to analyze an organization’s pursuit of leading-class digital insurance. (The tool is a framework called “The Digital Insurance Wheel”—it is designed to explore the intent and digital capabilities of insurance companies.)

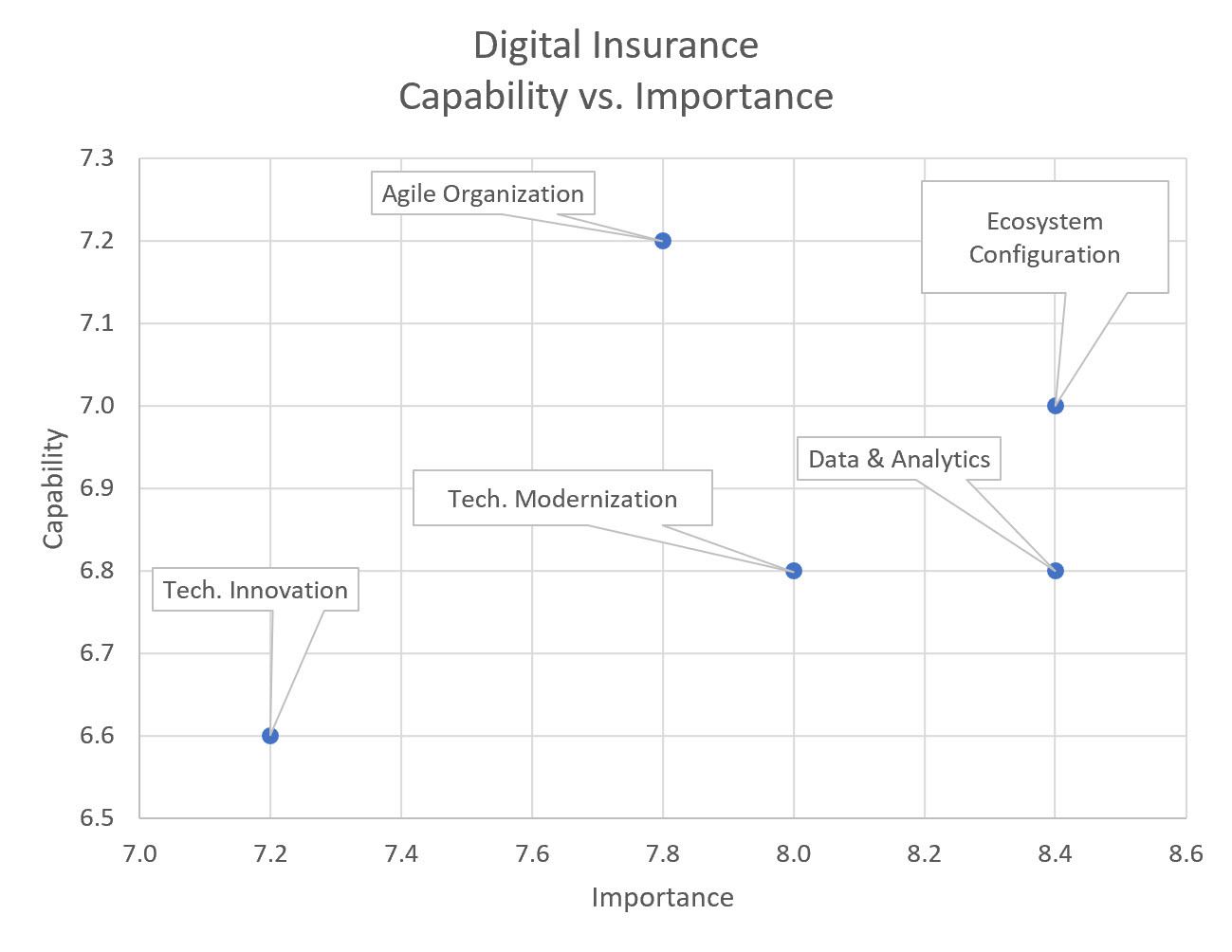

Charted below are measures taken from the study mapping the averages for all the participants’ results for their ranking of the importance of key capabilities, against their ability to execute those capability (using a 1 to 10 scale where 10 is very good). In short, it is a summary of importance vs. ability, and it reveals that our participating insurance companies are experiencing their largest gaps with data & analytics and ecosystem integration. This is a trend change for the results we are seeing seen over the past few years suggesting that effective integration with partners and data analytics are faster routes to value—relieving some pressure on the demands for modernization.

Source: Celent

We believe this provides further evidence for recent drivers to digitally access customers and new insurance markets. We are seeing an increasing reliance on third parties as partners to create connected ecosystems including affiliated partners—all of whom rely on seamless and rapid technical interoperability. For others, disaggregation of the value-chain to plug in participants is a driving requirement. In short, insurance carriers are increasingly connecting to to partners “outside of their four walls”—creating a capability gap to the accelerating demands for advanced integration technologies (e.g., API), interoperability and the security dictated by externally connected systems.

We also see increasingly common themes for analytics with success hinging on two key outcomes—scaling the analytics capability, and the organizational agility required to implement digital flywheel concepts. Data is the lifeblood of insurance, but many continue to be encumbered by data silos, skill gaps and scaling challenges.

The technology enablers for digital insurance are shifting and while some may see evidence for relief in the deemphasis of technology modernization—technology debt, defined as increasing encumbrances or constraints (or less and less flexibility and speed)—remains the bane of insurance companies. New demands for better, broader and scalable analytics and secure integration and interoperability are not unrelated to technology modernization—finding ways to press legacy systems into the demands of real-time ecosystems, will remain both important and a key challenge.