Many of the fintechs directly responsible for siphoning lockbox revenue are now openly courting banks as reseller partners, providing a win-win opportunity for banks willing to act quickly.

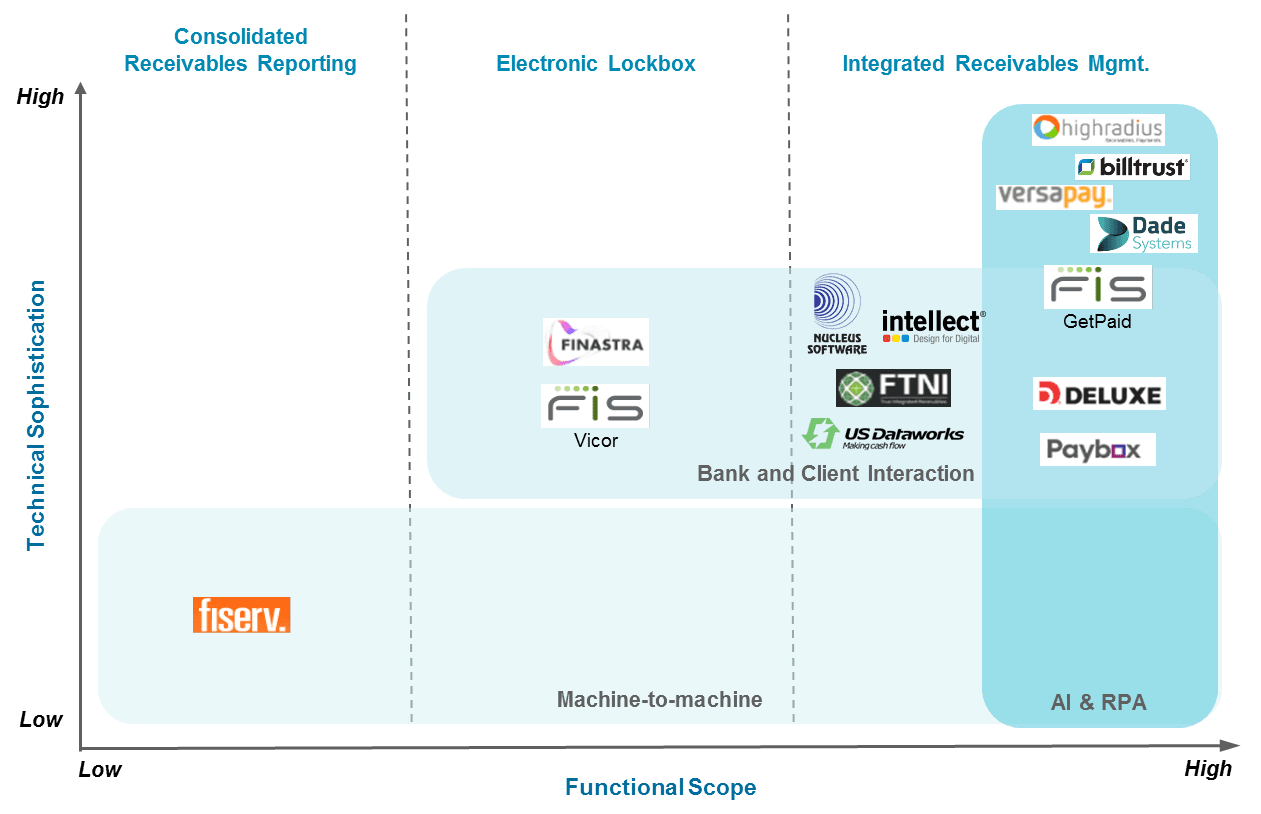

Figure 1: Solutions Fit into One of Three Categories Spanning Widely Ranging Functional Scope

Steady growth in electronic invoice presentment and electronic B2B payments has ironically complicated cash application for businesses. Banks are responding with integrated receivables solutions, but massively lag fintechs in seizing the market opportunity. Celent explores this rapidly changing vendor landscape to identify the most attractive options for banks.

In a previous report, Digitizing Accounts Receivables: Banks as Frontrunners, Celent examined the pain points along the accounts receivables value chain and profiled third party providers alleviating the pain by digitizing processes with a variety of technologies from basic intelligent character recognition (ICR) to robotic process automation (RPA) and advanced artificial intelligence (AI). In this report, we rigorously compare 14 solutions from 13 vendors using Celent's ABCD Vendor View methodology.

Receivables have always been important to commercial clients — and therefore, to banks. As both invoicing and payments become increasingly electronic, bank's venerable wholesale lockbox services are losing relevance — and revenue. Many of the fintechs directly responsible for siphoning lockbox revenue are now openly courting banks as reseller partners, providing a win-win opportunity for banks willing to act quickly.