Since the first Celent financial services innovation survey in 2013, the pace of innovation has continued to increase. According to this most recent survey of 194 industry professionals in banks, insurers, and securities firms, the financial institutions are beginning to realize positive results.

Celent has released a new report titled Innovation in Financial Services Survey 2017: Leaders Emerge. The report was written by Michael Fitzgerald, a Senior Analyst with Celent’s Insurance practice.

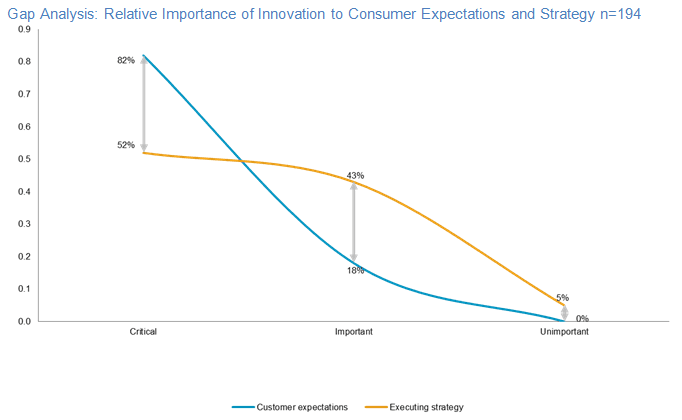

According to survey respondents, innovation is critical to meet customer needs, but the same urgency is not reflected in business strategy. They also report that, while financial services firms innovate more poorly than other industries, they are about even with their peer group.

Compared with previous surveys, the 2016 respondents report increased satisfaction with innovation results and improved support for innovation efforts from C-level executives. For the first time, more than half of the participants identified that innovation is “critical” to executing business strategy. The best practitioners approach innovation as a cultural challenge, requiring changes to organization structure, leadership expectations, incentives, and work processes.

“The top barriers to innovation are the same as in previous surveys: the press of day-to-day business and the difficulty in changing existing work processes. Overcoming these obstacles requires leadership capital in addition to technology investments,” commented Fitzgerald.

“Survey participants see C-level leaders as champions of innovation. In contrast to previous surveys, respondents view almost every leadership role in their companies as promoters of change,” he added.