Digital is pervasive. Ask a bank to characterize the financial behavior of a millennial and it’s unlikely the branches will even be mentioned. They’re digital-only, mobile-only, etc. Engagement models for capturing this demographic tend to focus almost exclusively on digital interactions. However, it’s important to remember that channels come down to a use case, and there are some things that digital just doesn’t do well. Namely, cash.

I recently moved apartments in New York City, and unlike other parts of the country, it’s common to pay a broker fee to a real estate agent. Typically, this ranges from 10-15% of the annual rent. Not cheap. Many agents, however, will negotiate the percentage. In my case, they offered to knock off a few percentage points if I paid the fee in cash. Since this saved me a few hundred dollars, it was an easy decision.

The real estate market in New York, especially for renters, moves at lightning speeds. Many apartments, especially good apartments, are only on the market for a few days tops. People will walk into an open house ready to immediately put down a deposit. I liked the place I saw and needed to finalize everything ASAP, otherwise, I risked losing it. I planned to head over to the agent’s office the next day with the checks and cash for the broker fee.

I bank with Charles Schwab, which as many of you know is a direct bank based in San Francisco. I’m extremely happy with Schwab and have personally recommended them to all my friends (if Schwab is reading this, gifts are welcomed), but its branch footprint is minimal and caters almost entirely to advisory services. To get around this, ATM fees are reimbursed, but consumers still have daily limits imposed by the bank as well as limits imposed by the ATM.

Needing large amounts of cash for a large purchase or (in my case) a broker fee can present a challenge. I called Schwab to temporarily raise my limit, but I still had to use ATMs with their own limits. They also only dispensed 20s!

In the age of digital, I found this use case compelling for two reasons:

- First, cash is still a major aspect of payments, at least in major American cities.

- Second, while digital can handle most transactions, sometimes consumers could really use in-person help, and it turns out that consumer survey data bears this out.

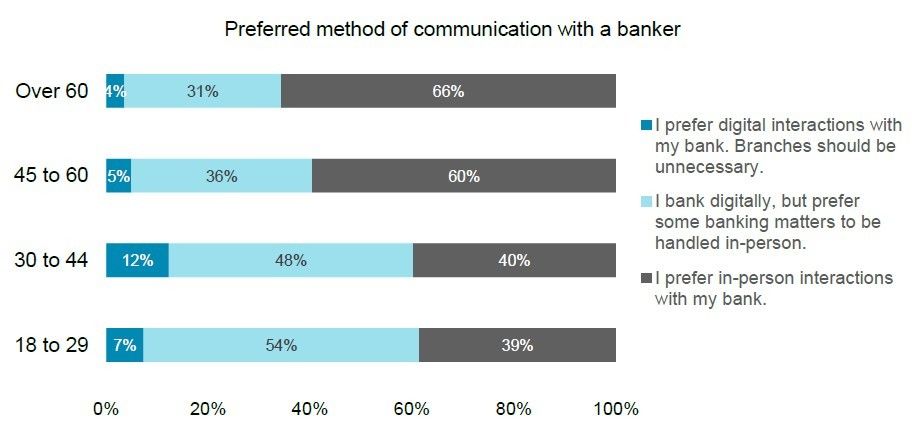

A recent report by my colleague Bob Meara looks at the behavioral patterns and interaction preferences by consumers. Interestingly, 40% of consumers younger than 44 years old preferred in-person interactions with their banks! Around half preferred digital, but if I wanted to the option to speak with someone for more complex needs. Only 7% of 18-29-year-olds found the branch unnecessary.

![]()

These results tell a markedly different story than what some of the digital disruptors in the industry are trying to push. It’s easy to get caught up in the hype that digital and millennials are completely upending traditional financial services. Digital offers some incredible advantages, but there’s still significant value to be had from all interactions, and sometimes you just need a branch.