2020 marked a watershed with three platform players announcing entry into the small business deposit business: QuickBooks Cash, Square Bank, and Stripe Treasury which will power Shopify Balance and other e-commerce platforms’ banking offerings. As Sherlock Holmes relished saying in the BBC’s eponymous hit series: “The game is on.”

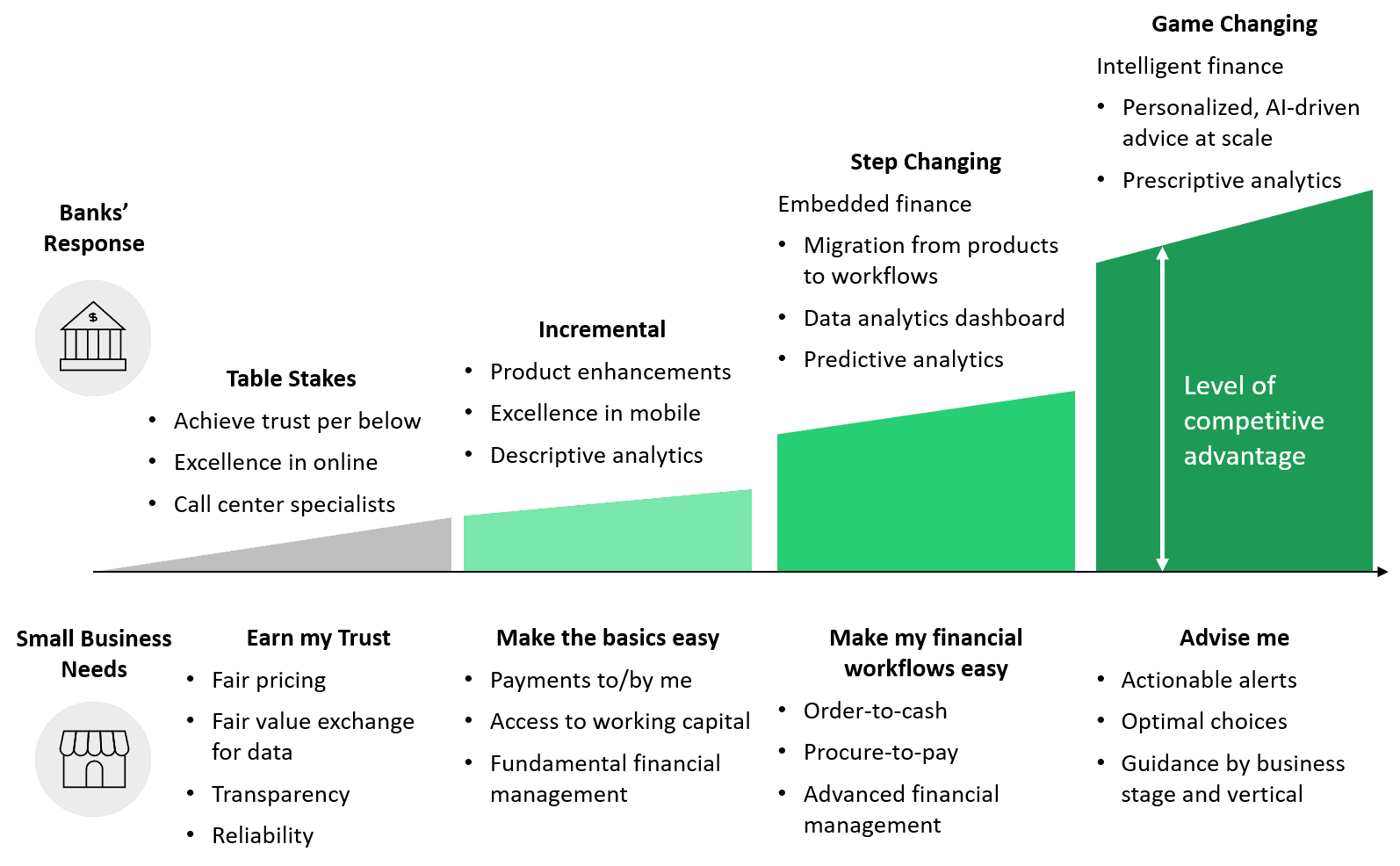

Being a pacesetter in the new game of small business banking requires reinvention and going beyond incremental change. Banks need to achieve step change and/or realize game-changing moves (Figure 1). Achieving step change requires banks to stop selling banking and start selling embedded finance. This translates into embedding their products into a small business’s workflow and enhancing their data analytics offering with third party data. To be game changing requires delivering intelligent finance through AI and machine learning (ML). Banks able to apply AI/ML at scale to personalize their services and deliver prescriptive analytics, will realize a sustainable competitive advantage.

Figure 1: Become a Pacesetter and Change the Game

The $110 billion revenue question in the US is: Will banks lead the charge or will third party providers or will a combination thereof? Celent believes the latter, a bank plus partner model, will dominate. Partners will include fintechs and accounting platforms. They will also include traditional big tech providers to banks that have partnered with fintechs. Big tech recognizes that they can enhance their solution by embedding a fintech’s service into their digital platform or by offering it through their app marketplace. Celent believes few platform players will be able to keep up with the pacesetter banks in small business financial services, particularly when it comes to high touch and when it is time to migrate a small business banking customer to a treasury services customer.

To learn more about how to not only stay in the game but also excel, see my Celent report, Reinventing Small Business Banking Part I: Pacesetters in Embedded Finance. In addition to the macro-level analysis, I profile seven potential bank partners. Five are digitizing and simplifying workflows: Autobooks, Jack Henry & Associates (JHA) (which has embedded Autobooks in several of its solutions), Bill.com, MineralTree, and FIS (whose Invoice-to-Pay is powered by MineralTree). Two are delivering enhanced data analytics: 9Spokes and Upswot.