View the next report following this series: Reinventing Small Business Banking Part 2.

"People don’t want to buy a quarter-inch drill. They want a quarter-inch hole.”

Theodore Levitt, Harvard Business School, marketing professor

The banking equivalent is: Small businesses don’t want to buy banking. They want their financial workflows to be easy and well informed. They want guidance and support when they face challenging financial journeys. And they want money to finance their dreams.

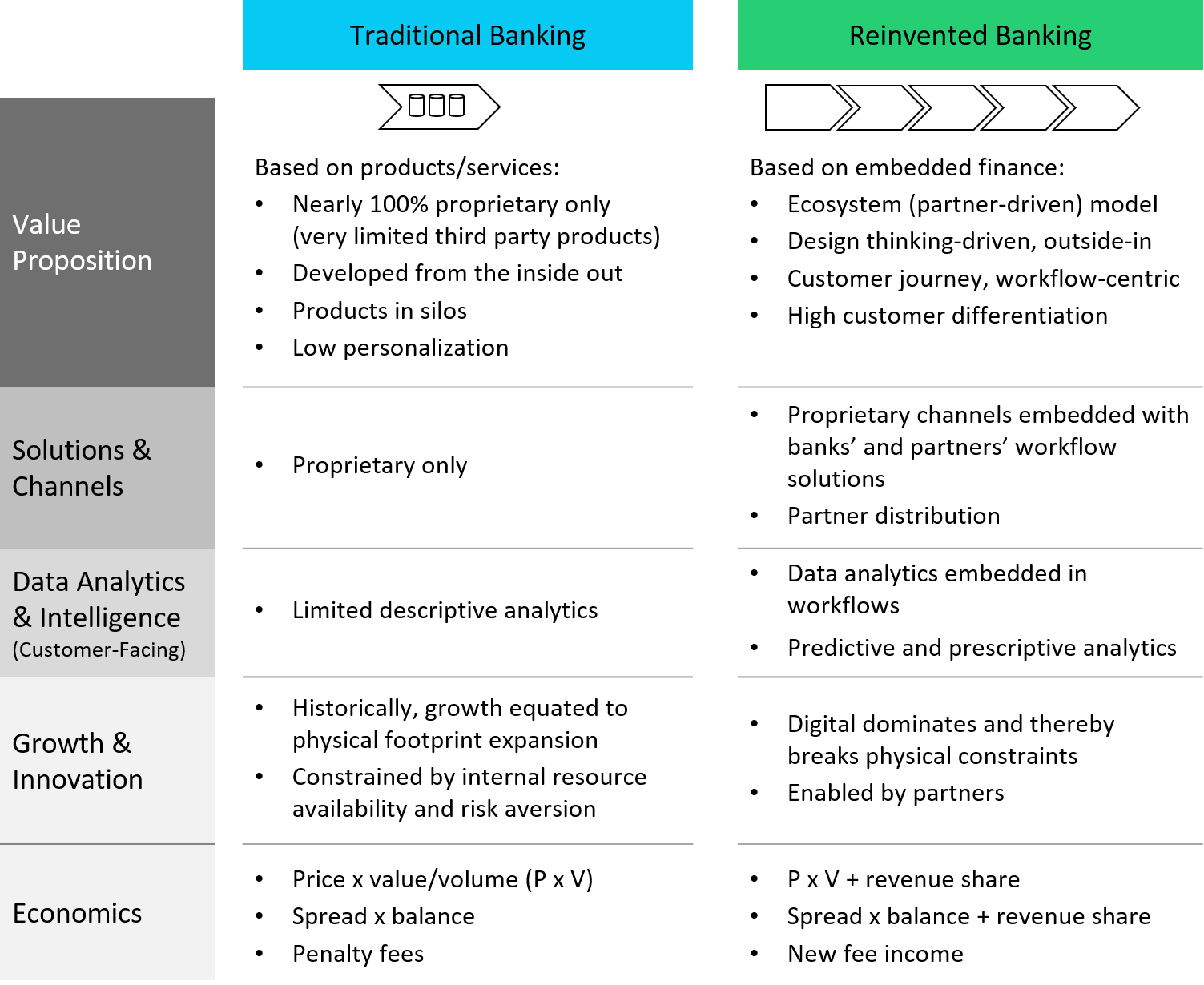

The winners in small business financial services over the next decade will not look like today’s bank. They will take a customer-centric approach and deliver not banking products per se but rather easier financial workflows, simple smart analytics, and actionable advice. They will embed bank products in a broader services-oriented offering. The winners will include both banks and third-party providers, including both big tech and fintech. Banks that rise in the league tables will have transformed both their business and operating models (Figure 1). The non-bank winners will have continued leveraging their platform and building an ecosystem.

Figure 1: Reinventing Small Business Banking

This report begins with a call to action, examining the revenues at risk and the competitive landscape, including an overview of the platform giants. The first action is to understand the customer. The second is to reinvent the bank. We delve into what step change looks like and how banks can deliver embedded finance. We profile seven potential bank partners. Five are digitizing and simplifying workflows: Autobooks, Jack Henry (which has embedded Autobooks in several of its solutions), Bill.com, MineralTree, and FIS (whose Invoice-to-Pay is powered by MineralTree). Two are delivering enhanced data analytics: 9Spokes and Upswot.

Tech firms mentioned in this report include: Autobooks, Jack Henry, Bill.com, MineralTree, and FIS (whose Invoice-to-Pay is powered by MineralTree), 9Spokes, Upswot, Amazon, Square, Stripe, Shopify, and Intuit.