生命保険業界ではBPOが注目を浴びています。果たしてその理由とは?

本レポートでは、生命保険会社の戦略上でBPOが担う役割と意味合いを明らかにします。

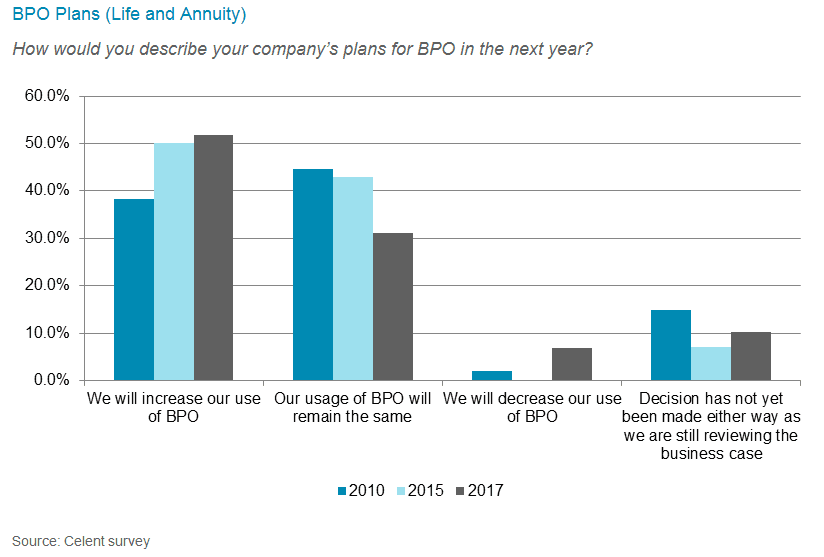

本レポートは、保険会社のBPO利用に対するスタンスを調査するレポートの第3弾で、2010年、2015年に続くものです。コスト圧縮に努めつつも、業務改革やシステム改革に多額のコストが発生する現状において、BPOは保険会社にとって戦略上の選択肢を広げる手段となっています。

本レポートでは、世界の生命・医療保険会社を対象に行ったサーベイの結果に基づき、BPOに対する保険会社の経営幹部の認識と活用実績を取り上げます。