Celent has released a new report titled Slice Labs: A Case Study of Insurance Disruption. The report was written by Michael Fitzgerald, a Senior Analyst with Celent's Insurance practice.

How can insurance cover a person that sometimes faces personal risks and at other times have commercial risks?

Slice Labs meets the definition of disruption in that it provides a new product which leverages emerging technology to an underserved market. Slice Labs combines personal and commercial coverage in a single homesharing insurance contract and delivers it on a per-use basis through a digital automation platform. The cost and speed benchmark established by Slice Labs challenges traditional innovation approaches.

"Slice Labs is an exception in that it seeks to change both the product and the delivery system and serve an underserved, emerging market," commented Fitzgerald.

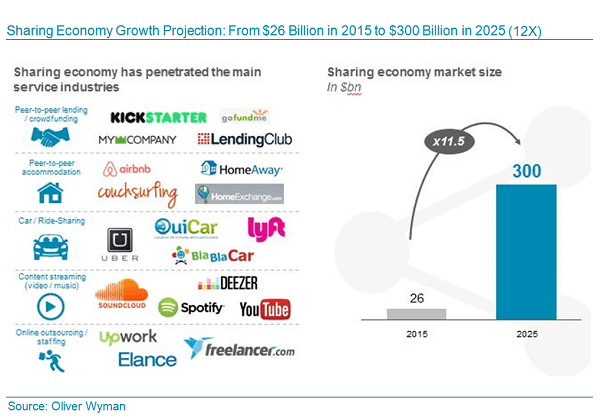

"No doubt the sharing economy will grow. The question is how fast. Insurance solutions such as Slice Labs will help speed the process by offering appropriate coverage tailored to specific perils," he added.