The global financial market has changed dramatically since the 6th Generation Zengin System launched in 2011. Digital advancements have been followed by additional across-the-board digital advancements, so much so that customers are no longer even slightly interested in non-electronic financial transactions. The millennial generation, weaned on the Internet and things digital, and refusing to suffer the inconvenience of anything too analog, is fueling this trend. The Arab Spring, Occupy Wall Street, and the Umbrella Revolution protest movement in Hong Kong made all too clear that financial inclusion is no longer a theme limited to emerging economies. Acute and rapid changes in digital and financial literacy are spurring fragmentation in the financial market, and centralized architecture is clearly reaching its limit if not its breaking point.

These dramatic social changes have also completely altered the financial and payment services landscape. In times of confusion and upheaval, a comprehensive conceptual framework that can guide us toward a better future is essential. Toward this end, Celent uses its payments taxonomy and payments value chain frameworks as lenses to examine evolution in the payment sector. Payments innovation is also informed by change in the behavior of payment services users and exists in the context of the payments value chain. Service providers see this field as a blue ocean, a market space ripe for pioneering new payment initiatives.

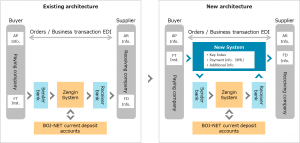

When viewing the already operational new BOJ-NET and the new Zengin System that will succeed them both from a perspective that sees them as legacy systems, this market space should be seen as red ocean, already home to intense competition. At the same time, despite the maturity and competitiveness in this area, there are challenges that include effectively harnessing the existing robust social infrastructure and continuity related to data, assets, and experience. These issues should be considered in the context of how best to make the legacy system coexist and thrive with the new system.

Figure 3: Conceptual Diagram for Financial and IT Network System

Source: Financial System Council, Celent

Source: Financial System Council, Celent

Just published a new report:

Payments Systems Trends in Japan, Part III: Blueprints for the Next-Generation Zengin System