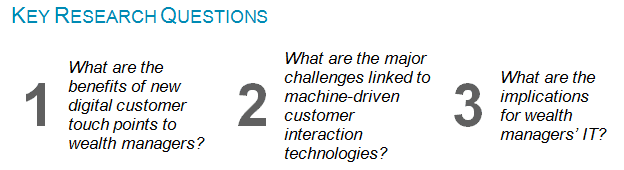

This report shares ideas on how wealth managers and banks can implement new AI technology to reap the benefits of new digital customer touch points.

Celent has released a new report titled Applying Conversational Commerce to Wealth Management: Aligning IT to the Machine World. The report was written by Kelley Byrnes, an Analyst with Celent’s Wealth Management practice, and Craig Beattie and Nicholas Michellod, Senior Analysts with Celent’s Insurance practice.

Digital customer touch points provide a new way to interact with customers that emphasizes mobility, speed, and comprehensiveness. We think wealth managers need to identify how these technologies impact sales, portfolio management, and customer service and then adapt their organization to minimize negative consequences.

Wealth managers need to move to an open modular architecture, leveraging digital front ends and combining a powerful product configuration and automated back end components.