The P&C insurance industry has undergone profound shifts in recent years, driven by economic pressures, climate-related catastrophes, and global disruptions that have tested traditional business models. While many carriers initially responded with tightened underwriting and higher rates, it is increasingly clear that risk retreat alone is not a sustainable strategy. The future of P&C lies in expanding—not contracting—the boundaries of what can be insured.

As 2025 draws to a close, the industry’s focus has shifted toward reinvention and growth. Insurers are reimagining core processes, risk frameworks, and customer engagement strategies to thrive amid volatility and uncertainty. Transformation is no longer just about efficiency; it is creating opportunities for new products, innovative services, and deeper, more personalized relationships with policyholders. Resilience has evolved from a defensive posture to a platform for proactive innovation.

At the center of this transformation is artificial intelligence. The rapid rise of generative and agentic AI is enabling capabilities far beyond simple automation: adaptive underwriting, accelerated claims resolution, predictive risk modeling, and personalized experiences at scale. These technologies are helping insurers remove friction, anticipate emerging risks, close protection gaps, and expand their role as societal risk managers. As a result, the industry is positioned to move from incremental improvement to transformational growth—reshaping P&C insurance for a world defined by complexity, uncertainty, and opportunity.

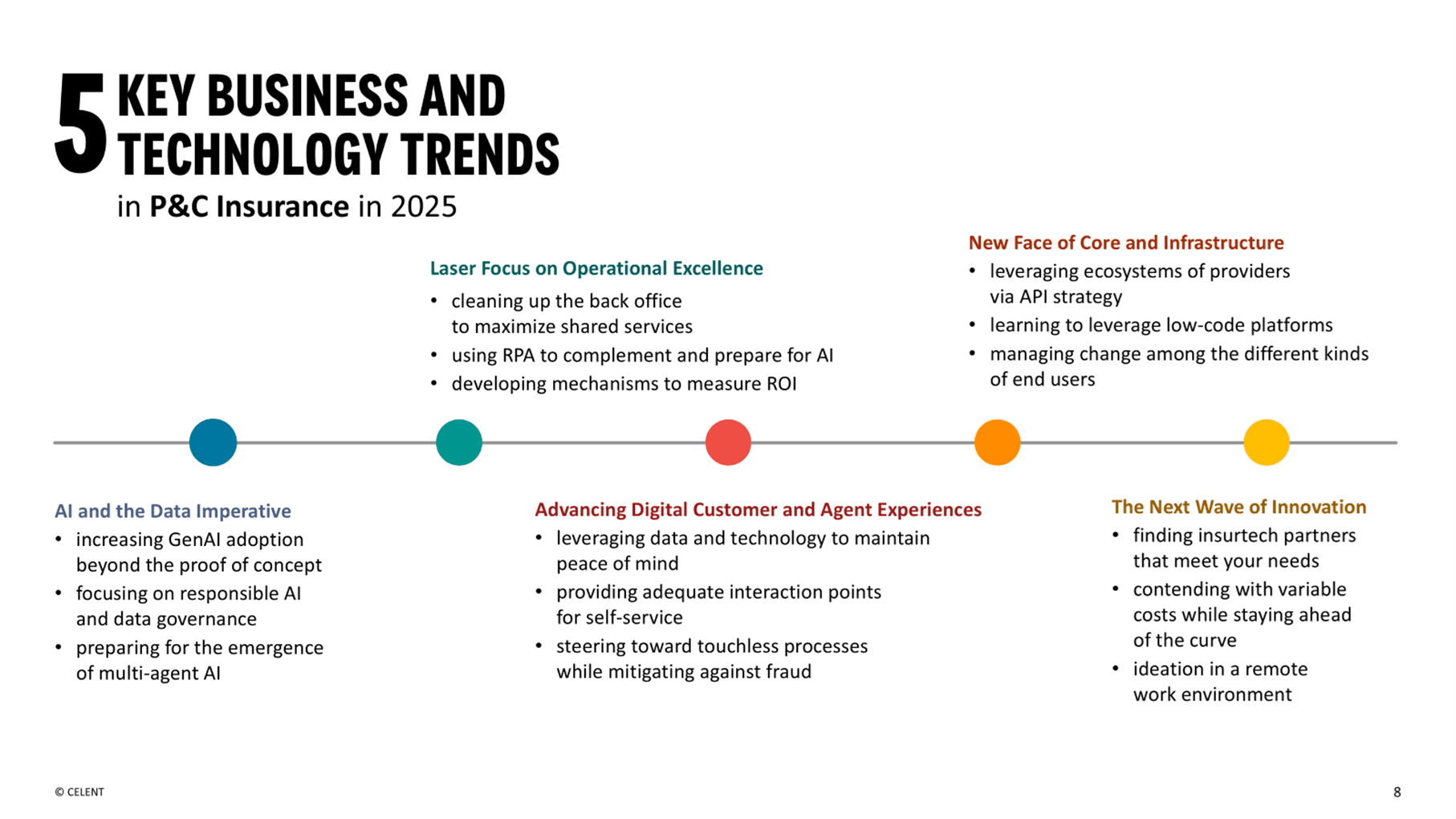

Celent has identified five themes shaping the future of insurance technology, first outlined in our 2025 Previsory.

These themes continue to guide our research this year as insurers pursue efficiency and growth with new clarity and intent. The momentum is strong, but challenges remain.

Unlocking the full potential of digital transformation will require bold investments in data quality, integration, and governance. At the same time, insurers are navigating workforce shifts as seasoned professionals retire, taking with them decades of expertise. The challenge—and opportunity—lies in capturing that knowledge, embedding it into AI-powered systems, and equipping a new generation of talent to work in smarter, tech-enabled ways. Done well, this transition will not just sustain transformation, but accelerate it.

Celent will explore how insurers can use technology to address these challenges and capitalize on emerging opportunities. We invite our clients to shape these discussions with us. Whether it’s vetting vendors, shaping strategy, or navigating the next wave of innovation, we’re here to help. There’s significant headroom for innovation in insurance this year—let’s explore it together.