The P&C insurance industry enters 2026 at a pivotal moment. The last several years of economic stress, climate volatility, social inflation, and geopolitical instability have challenged long-standing assumptions and exposed the limits of traditional operating models. While carriers initially leaned on rate increases and underwriting discipline to manage volatility, it has become clear that a contraction-driven approach cannot carry the industry forward. Long-term success will depend on expanding insurability, strengthening risk partnerships, and delivering new forms of value to policyholders.

As we begin a new year, the momentum has shifted toward reinvention and forward-looking growth. Insurers are rearchitecting processes, modernizing core systems, and reshaping risk frameworks to compete in an era of constant disruption. Transformation is not purely focused on efficiency—it’s also about enabling new revenue streams, building adaptive risk solutions, and creating more intuitive, personalized experiences. Resilience is emerging not as a defensive stance, but as a catalyst for smarter, more innovative ways of operating.

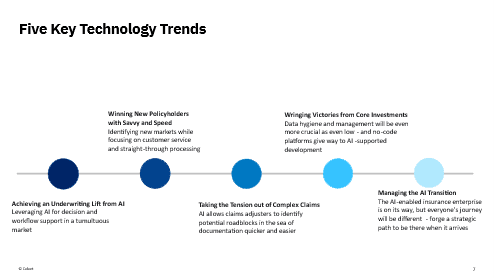

Artificial intelligence continues to sit at the center of this evolution. The rapid maturity of generative, agentic, and predictive AI is extending insurer capabilities far beyond workflow automation: dynamic underwriting, instant claims decisions, multimodal risk insights, and highly tailored customer interactions are increasingly within reach. These technologies are enabling carriers to eliminate operational friction, anticipate emerging exposures, close widening protection gaps, and redefine their role as trusted risk advisors. With AI accelerating, the industry is poised to move from incremental modernization to truly transformational growth. Celent has identified five major themes shaping the next chapter of insurance technology—expanding on the direction first outlined in the Previsory and now accelerating across 2026.