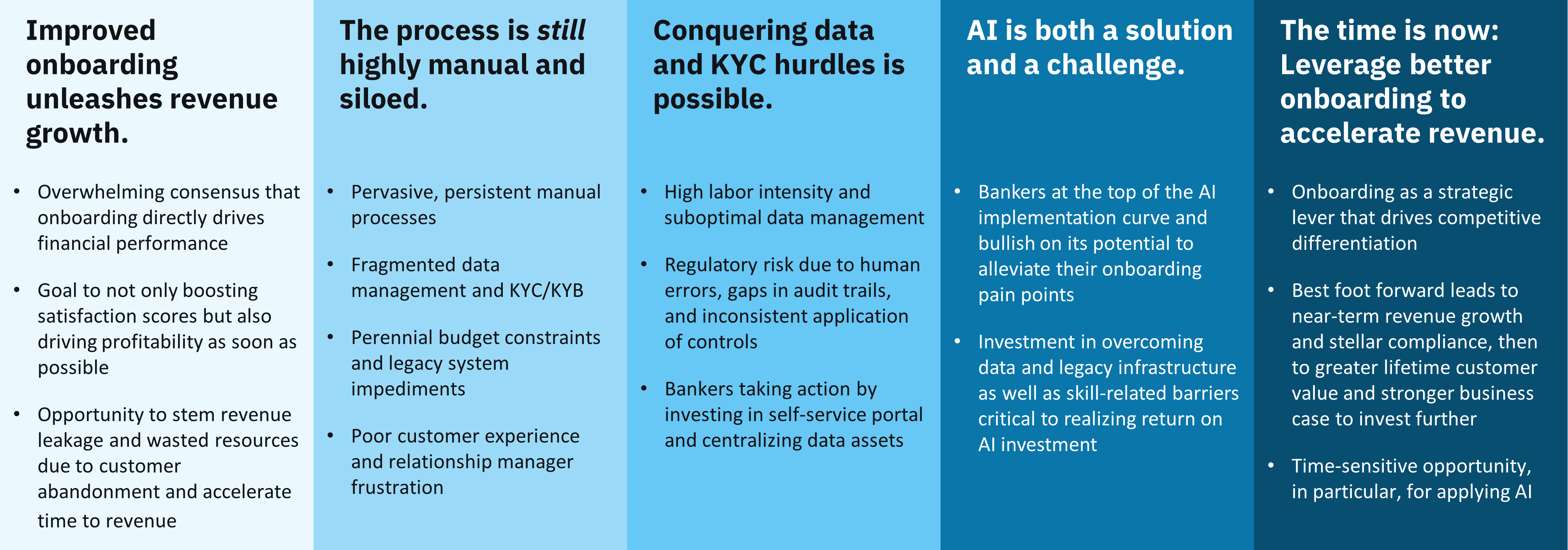

Commercial and corporate client onboarding is becoming a top priority for banks. Based on Celent’s quantitative survey and interviews, we have found that banks recognize that their processes are inefficient and consume immense resources. They recognize the need for speed and accuracy. Nearly uniformly, they are eager to invest in driving step change. Some have end-to-end ambitions while others are targeting specific stages of the process. Either way, the game is on to realize these ambitions and differentiate.

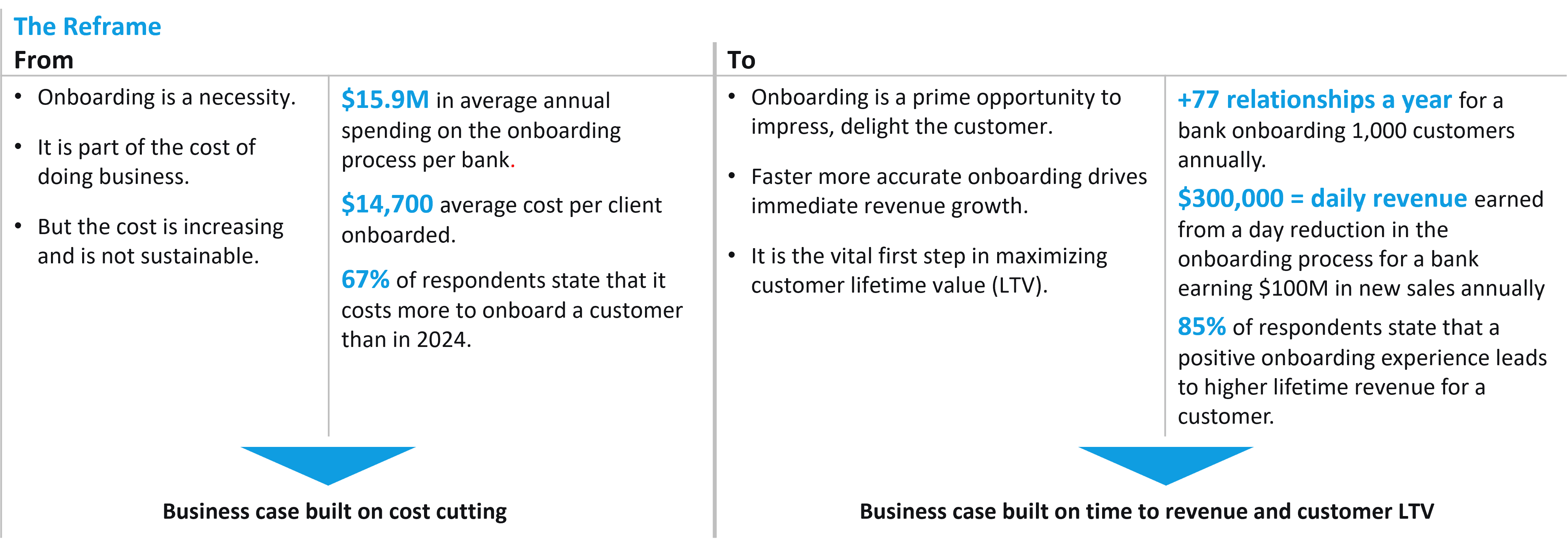

Celent concludes that leading banks are reframing onboarding from a necessity, a cost and operational drag, to a virtuous circle that drives revenue growth and regulatory best practice. “While 72% of bankers believe there is still more they could do to automate, many are already taking decisive steps—modernizing their data infrastructure and investing in AI to move beyond digitalization toward smarter, faster, and more efficient processes.” – Celent