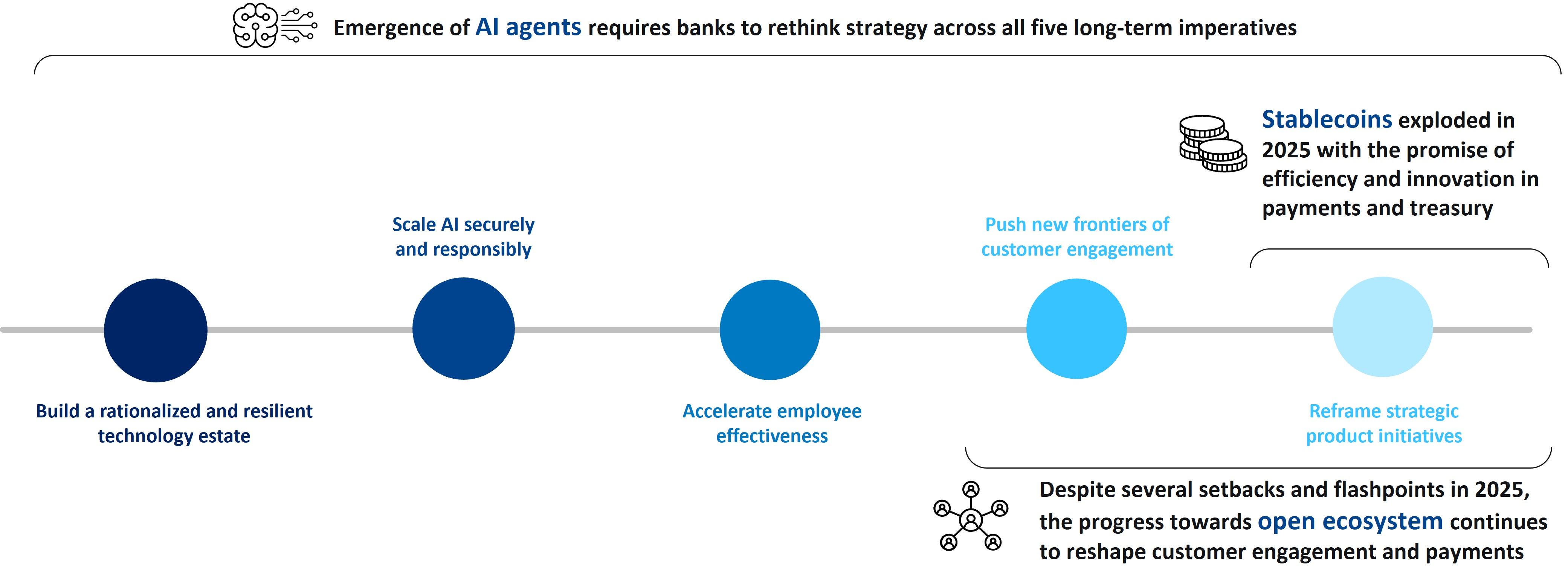

Some years bring steady evolution; others ignite transformation. For banking and payments, 2025 has been the latter. AI agents have emerged seemingly overnight, stablecoins are finally gaining traction, and open ecosystems are redefining what banking means. Together, these forces are reshaping the landscape that executives must navigate in 2026 and beyond.

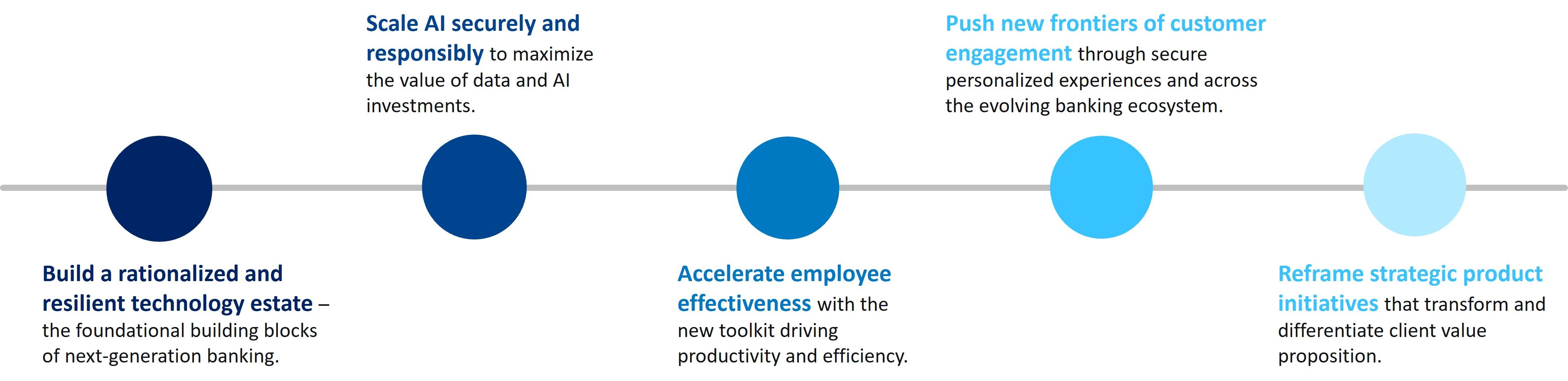

Previsories are Celent's annual forward-looking view of financial technology trends and advice on how to respond to them. Last year, Celent organized the Previsories in Banking and Payments around five key technology trends and imperatives, which also provided the backbone of our research agenda through 2025.

Celent believes these trends and imperatives remain valid long term and will continue to frame our agenda. However, for 2026, Celent decided to focus on three major developments that occurred in 2025 and will shape 2026 and beyond. Each of these imperatives impacts one or more of the long-term pillars of banking transformation.

This is the Corporate Banking edition of Celent's Top Tech Trends Previsory for 2026.