I had a briefing in December 2025 on FIS® AffinityEdge core banking system. The solution is much changed from its initial product (MISER, a legacy core banking platform that has been in service for several decades) and represents a significant upgrade from previous AffinityEdge updates.

The general assumption in banking technology is that cloud native systems are better than mainframe solutions. In principle, I agree. In practice, this isn’t always the case. Core system replacements have many risks and costs, and some financial institutions (FIs) lack scale to convert and choose to remain on their incumbent system.

Given that the majority of FIs choose to remain on incumbent systems that they and their core vendor continue to modernize, it is instructive to examine AffinityEdge’s continued renovation to understand why FIs choose core renovation over replacement, the pros and the cons of this decision, and the outcomes and benefits.

Summary of the FIS AffinityEdge Core Banking System

FIS AffinityEdge is a comprehensive, real-time core banking platform originally built on the MISER core banking engine. It supports credit unions, banks, savings institutions, and fintech lenders. FIS has just relaunched AffinityEdge as its strategic core solution for credit unions. It has native support for credit union functionality such as shared branching, NCUA reporting, and member-centric processing language. Unlike “headless” or deposit-only cloud native core banking platforms, AffinityEdge supports full-service retail and commercial banking, including deposits, loans, payments, and integrated commercial capabilities.

A defining characteristic of AffinityEdge is that it is natively real-time, just like cloud native core systems. All transactions post immediately during the business day, eliminating heavy overnight batch cycles and enabling same-day ACH, instant loan disbursements, and near-real-time operational reporting. Business intelligence data can be replicated from the core to SQL-based analytics stores in real time, allowing credit unions and fintech clients to build dashboards, reconciliations, and trading or loan-sale workflows without waiting for nightly updates. This real-time architecture significantly improves staff efficiency, reduces operational friction, and supports modern fintech use cases.

AffinityEdge has also been modernized with a browser-based user interface, a highly configurable workflow engine, and extensive API frameworks—approximately 3,000 APIs exposed through FIS’ AffinityEdge Cohesion layer and increasingly through the enterprise-wide _FIS® Code Connect_™ developer portal. Credit unions can configure or extend workflows without creating technical debt, including embedding third-party services or advanced logic directly into operational processes. The platform is tightly integrated with the broader FIS software ecosystem, including digital banking, payments, fraud, money movement, and commercial lending solutions. This helps credit unions expand from retail banking into more sophisticated commercial banking offerings.

From an infrastructure perspective, AffinityEdge can be deployed on-premises, in FIS data centers, or in virtualized private cloud environments. This “modernized mainframe” approach delivers mainframe-class performance while supporting virtualization and cloud portability. The system is highly scalable, with production clients exceeding $50 billion in total assets, and is stress-tested for banks with over $100 billion in total assets. FIS reports clients ranging from $500m to $30b in asset size currently, which are roughly evenly split between banks and credit unions. FIS is also providing a renewed IT roadmap, which further supports client retention and a reported growing pipeline led by recent fintech and credit union wins.

Overall, AffinityEdge represents FIS’ effort to modernize a proven real-time core engine into a credit union-centric, API-driven, cloud-capable platform that bridges traditional core reliability with next-generation digital, commercial, and fintech use cases. Celent believes this is a very viable alternative for credit unions considering a cloud-native core banking system.

Celent’s View-Core Banking Platform Renovation Will Help AI-Enable Banks

The need for core banking renovation is becoming even more urgent as financial institutions need to incorporate all forms of artificial intelligence (machine learning, GenAI, and Agentic AI) into their core platforms. The inability to move fast enough impedes business growth, so the need for legacy system transformation to introduce new products and AI-enabled services more quickly is more urgent than ever.

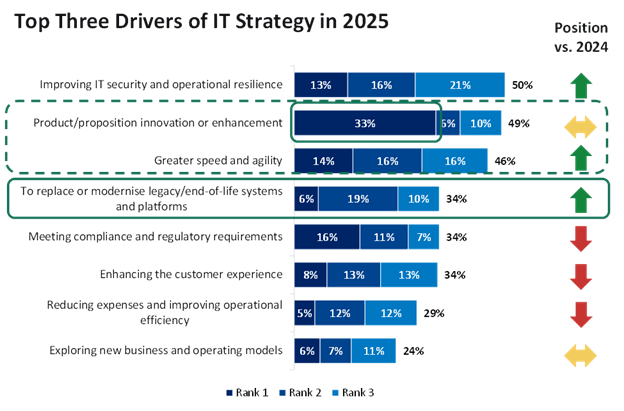

Figure 1 shows the top three drivers of bank IT strategy from 2025 through the first half of 2026. Almost half of all banks see product or proposition enhancement as one of their three most important priorities.

Figure 1: Replacing/Modernizing Legacy Systems Is Increasing in Priority

Base: All retail banking respondents (sample: 245) Question: What are the top three drivers of your institution’s IT spending strategy for the next 18 months? Source: Celent Dimensions Survey 2025

Product/proposition innovation was also high on the agenda last year, but what’s really changed is that one in three views this as their single biggest focus area. The emphasis on product development is a response to concerns over customer retention and the challenge from fintechs, as well as a chance for some banks to unlock the benefits of recent investments in modernization and agility.

Core banking platforms are legacy and end-of-life systems that rank third as an IT strategy and spending driver. However, core modernization also plays a key role in product/proposition innovation and creating greater technology speed and agility. Accordingly, core banking platform transformation remains a top IT strategy driver and spending priority for banks.

In Closing: Renovation Will Outpace Replacement

Cloud-native core banking systems are the long-term future of the financial services industry. However, mainframe-based core systems also have a viable long-term future. Banking and other industry surveys support this assertion. For example, according to Luxoft, 44 of the top 50 global banks were still using mainframe-based core systems in 2020. While problems due to mainframe-based core systems still occur and some have been painful to the bank and its customers, none have been fatal.

Pursing core banking platform modernization will help banks transform with less business disruption that results from full system replacement. Modern enterprise application architecture will help banks decide which functional parts of the core to pull out of the existing core, and in what sequence. Huge IT services and software firms (Accenture, AWS, Capgemini, Cognizant, Deloitte, HCL, Hitachi, IBM, Infosys, Luxoft, Microsoft, TCS, Tech Mahindra, Wipro and others) continue to fully support and in some cases grow their mainframe modernization businesses. Incumbent core system vendors continue to support their systems in most cases although they may sunset one core system in favor of another system that they can then devote additional modernization resources to.

The need for modernization will continue to be driven by the same business issues: the need for improved operational agility and IT processing speed, business continuity and resiliency, information security, and regulatory compliance. Moreover, some mainframe-based core banking systems are being modified to migrate to the cloud. Although not cloud native, financial institutions can combine the benefits of their full feature/function mainframe-based system with many of the benefits of cloud deployment.

Contact me at info@celent.com or cfocardi@celent.com if you would like to discuss these or other topics.