Celent’s 2026 Wealth Management Previsory: The Future of Wealth Management is (Artificially) Intelligent, Inclusive, and Interconnected

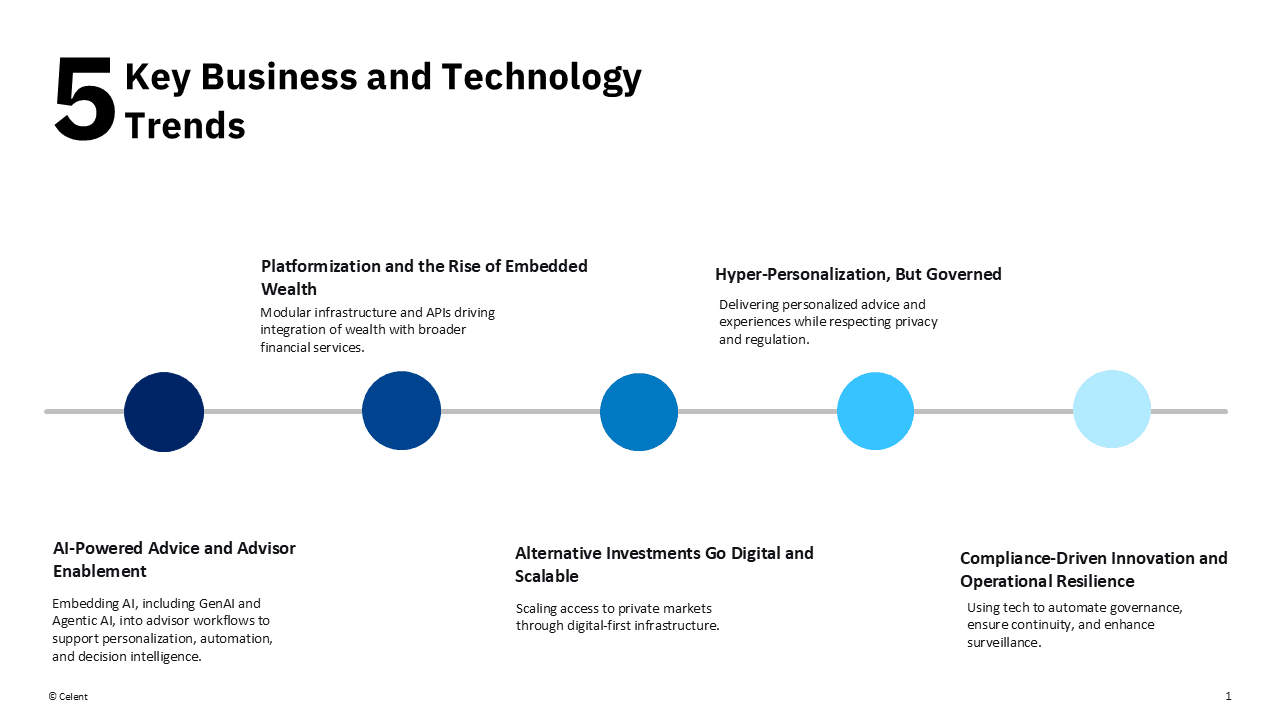

Wealth management in 2026 is being redefined by technology: evolving into an intelligent, inclusive, and seamlessly interconnected ecosystem. AI, data, and platforms have moved from supporting functions to the front line, shaping how clients experience advice, access opportunities, and build trust. Connectivity between stakeholders, systems, and products now forms the foundation of the modern wealth enterprise.

Advisors are empowered by intelligent tools that amplify human advice rather than replace it. With real-time insights, automation, and personalization capabilities, they move beyond product selection to orchestrating holistic, goal-based relationships. Data-informed insights enrich every client conversation, deepening engagement and transforming advisors into curators of personalized journeys, not just portfolios.

At the same time, digital innovation is democratizing access to sophisticated strategies. Tokenization, digital platforms, and fractional ownership are opening the door to alternative investments once reserved for ultra-high-net-worth clients. AI and behavioral data enable personalization at scale, delivering hyper-relevant recommendations, custom portfolios, and communications aligned to each client’s goals and values.

Firms are rebuilding around transparency, trust, and compliance-first principles. Proactive compliance technologies reduce risk while strengthening confidence in the advisory relationship. The firms leading this new era will use technology not only to drive efficiency, but to elevate the quality of advice, shifting the competitive edge from product offerings to experience design and advisor empowerment.