Private markets are entering a new phase of growth and change. To fully capitalize on the investment prospects and business opportunities arising from the evolution of private market investing, asset managers, asset owners, advisors, and solution providers need to enhance their operational foundations, adopt next-generation technology strategies, and engage in collaborative approaches throughout the value chain to succeed.

The fragmentation of investment practices and varying definitions of strategies among market participants complicate communication and decision-making. To address these challenges, there is a pressing need for standardized metrics and high-quality data, which can enhance transparency and facilitate better investment outcomes. The private markets investment sector is entering a new phase that requires robust operational foundations, innovative technology, and a collaborative approach among stakeholders to thrive.

To meet these aspirations, private market participants must upgrade their strategic data enablement capabilities to remain viable in the digital age, while regulatory operations must become more efficient, predictable, and error-free. The ability to face off against market demands, adapt and respond to business imperatives, and capitalize on emerging opportunities is inevitably intertwined with core operational and technology capabilities.

This solution brief explores the significance of S&P Global's new data initiative developed in conjunction with prominent investment consultants Cambridge Associates and Mercer. It will provide Celent's independent perspectives on the potential for scaled expansions, the opportunities for continued impact on the alternatives and private markets sector from network effects, as well as innovative methods and technologies.

This research is part of Celent's ongoing coverage into private markets technology, operations, and data enablement strategies and solutions. Across the investment industry, Celent observes primary use cases by firms to use and leverage data (and data enablement technology) to:

- Increase investment performance and operational alpha.

- Enhance operational efficacy in data lifecycle and operations.

- Facilitate higher client satisfaction and more personalized service.

- Improve product and content differentiation.

- Streamline and reduce tech/op costs.

- Monetize data as a direct revenue source.

----------------------

Subscribing clients can access the full report through their Capital Markets research membership. For more in-depth research around future buyside, sellside and market infrastructure trends and technology insights, please explore Celent's Capital Markets practice.

Other companion studies include:

- Dimensions: Global Buy Side IT Pressures & Priorities 2025, Global Edition

- Top Technology Trends Previsory: Buy Side Edition, 2025

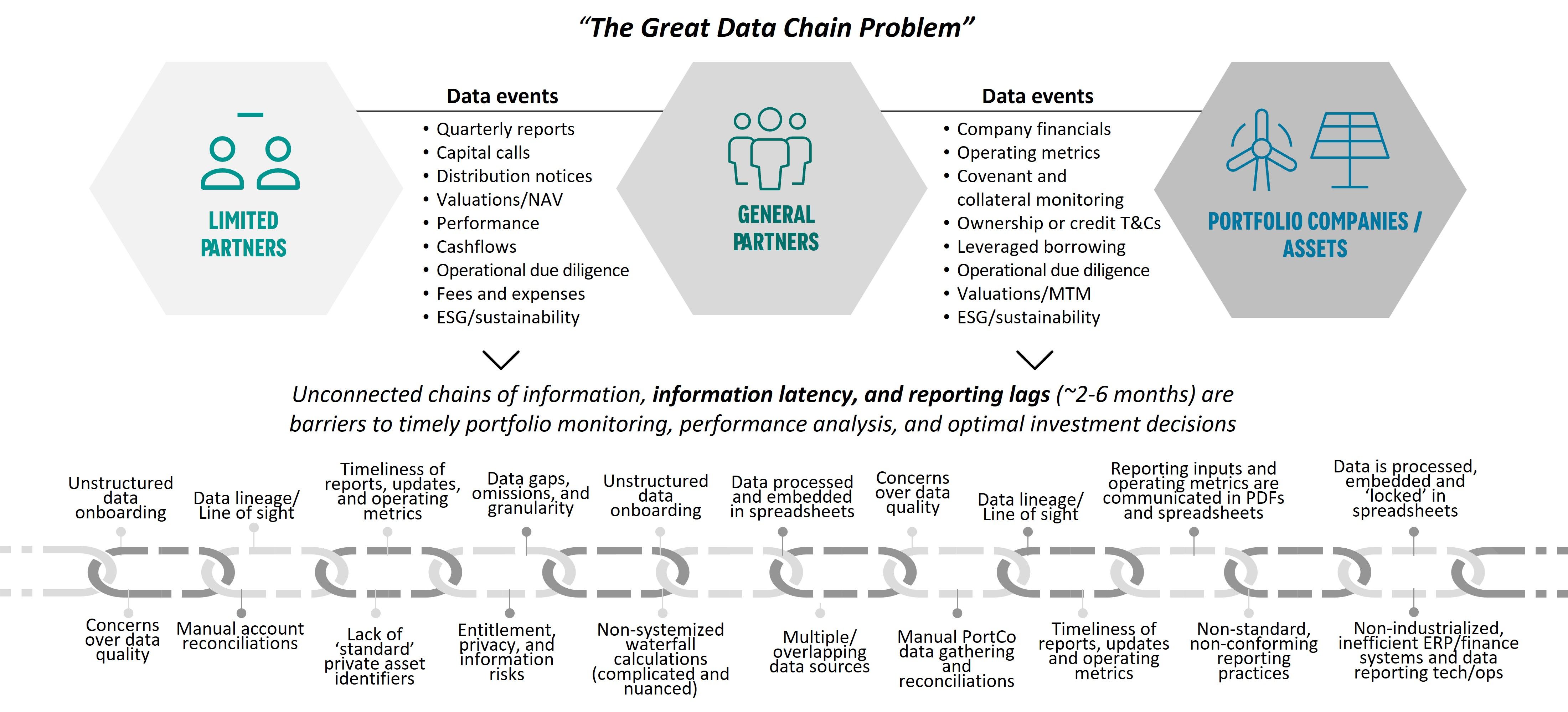

- Overcoming Fractured Data Chains and Achieving Operational Brilliance in Private Markets

- Investment Data Ecosystems (Part 1): Sharpening the Data Enablement Edge in an Age of AI

- Investment Data Ecosystems (Part 2): Reimagining Strategies & Tactics for Beyond the Here & Now

- Investment Data Ecosystems (Part 3): Solutions and Competitive Constellations

- Enterprise Data Management Visions and Trajectories: Capital Markets and Investments Edition Part 1 and Part 2