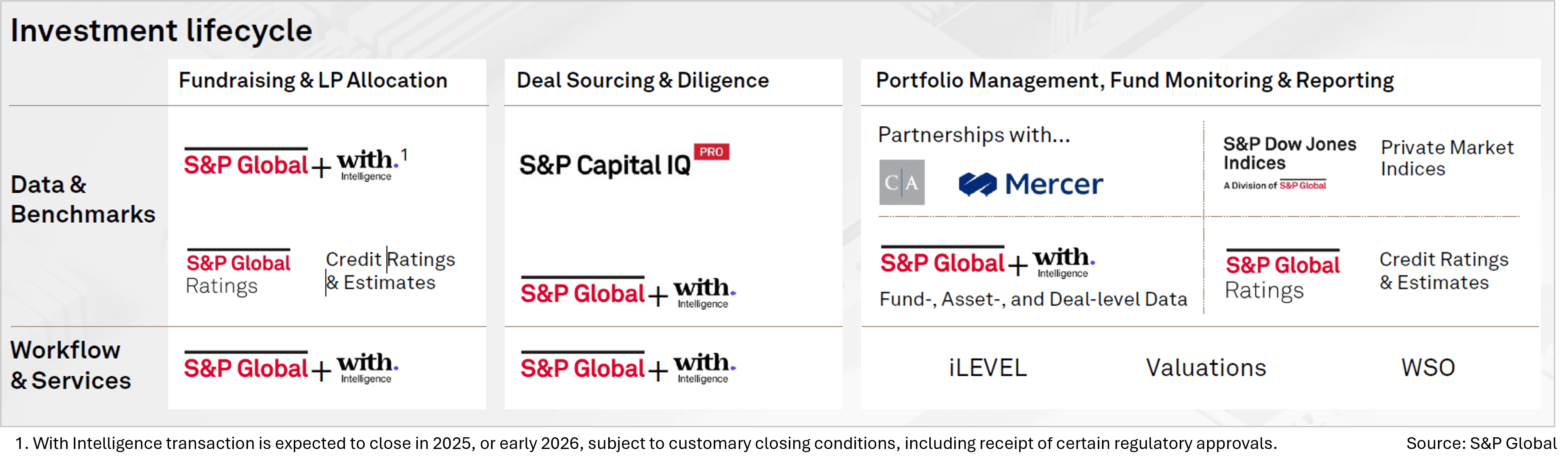

On 15 Oct 2025, S&P Global announced the acquisition of private markets data provider With Intelligence. This move is symptomatic of the fact that across the private markets industry especially, there is an insatiable thirst for hydrated data, and demand for consumable insights continues to grow, but most firms are still catching up on modernizing their enterprise data approaches. Unsurprisingly, the relentless demand for enriched data and actionable insights is fueled by the need for strategy and asset diversification (across public, private, and digital assets), the desire to address data inefficiencies in illiquid markets, the push to implement “AI for investing,” and growing internal and external expectations for transparency. This announcement follows S&P Global's iLevel Data Clearinghouse initiative together with investment consultants Cambridge Associates and Mercer.

Off the heels of these developments and other recent ones across public and private markets (Bloomberg/Hamilton Lane, LSEG/Nasdaq eVestment, Stepstone/Kroll, Houlihan Lokey Private Credit DataBank), I firmly believe that the investment industry is standing at another pivotal juncture.

Off the heels of these developments and other recent ones across public and private markets (Bloomberg/Hamilton Lane, LSEG/Nasdaq eVestment, Stepstone/Kroll, Houlihan Lokey Private Credit DataBank), I firmly believe that the investment industry is standing at another pivotal juncture.

We explore several salient questions: