- Banks are under increasing pressure to grow—but their innovation efforts often do not deliver the results they need. Despite rising investment in digital products, AI, and new experiences, many banks continue to face slow product and pricing launches, complex approval cycles, and limited personalization at scale. All the while, costs keep rising.

The challenge isn’t a lack of ideas, it’s execution: legacy infrastructure and operating models make delivery difficult. Most banks are still built around product-centric systems that weren’t designed to support embedded delivery, real-time personalization, or orchestrated experiences across channels and ecosystems. They operate in siloed technology stacks, but also in siloed organizational structures. This creates inherent conflict in advancing business strategy and investment decisions.

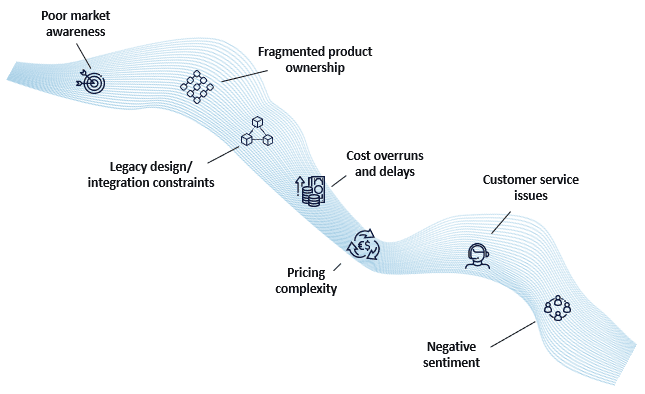

Challenges in Product Design and Development

Source: Celent

To explore this, Celent asks and answers three critical questions:

1. Why are banks struggling to convert innovation into impact?

2. What structural changes are required to compete in digital financial ecosystems?

3. In the era of embedded finance, how can banks extend value while preserving speed, control and differentiation?

In each section of this report, Celent outlines the challenges, architectural implications, and the strategic opportunities for banks to orchestrate growth through modular infrastructure, composable products, and ecosystem-enabled delivery. Finally, the report concludes with five strategic imperatives for action: