Abstract: Navigating Liquid Risk — Rethinking Insurance for a World of Disruption

What happens when protection can no longer keep up with perception?

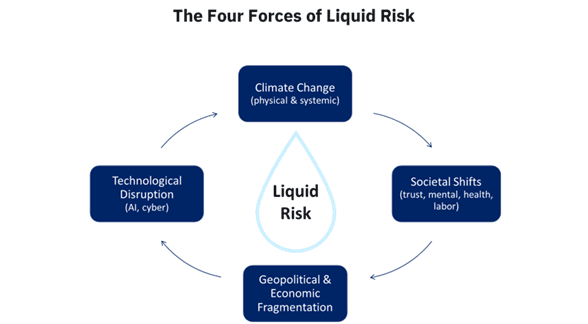

In a world where volatility moves faster than traditional models can track, this is no longer a theoretical question—it’s the new reality insurers must face. This report dives into the concept of ‘Liquid Risk’: a new paradigm for understanding threats that are fluid, systemic, and in constant transformation. These risks don’t arise in isolation—they emerge from the convergence of four accelerating forces:

Climate change, geopolitical instability, social fragmentation, and the rise of AI are converging to collapse traditional models of risk. In this new reality, volatility is not a deviation—it is the baseline. Underwriting can no longer rely on static policies and backward-looking models. It must operate in sync with real-world disruption. At stake is more than operational efficiency. In an age of synthetic data, misinformation, and engineered narratives, even the most basic question—“What is true?”—has become contested. Trust, the core currency of insurance, is under pressure. And most legacy systems—designed for a slower, solid world—are ill-equipped to respond.

This report offers more than diagnosis. It delivers:

- A strategic definition of liquid risk and the forces rendering traditional models obsolete

- A real-time response framework based on modular, event-driven, and cloud-native architectures

- New product directions aligned with systemic, contextual, and continuous risk

- A philosophical and technical call to rethink what protection means when risk itself is no longer solid

This report is a guide for leaders ready to question inherited assumptions and build relevance in a world where the logic of change has changed.