Digital corporate banking is a perennial front-runner in product and technology investments – with good reason. It is the window to the bank, where experiences can make or break a relationship. Large banks in particular tend to have complex digital infrastructure connecting multiple product applications and services together under a single umbrella. Investment in this space is not a “one and done” investment. It is a perpetual race to stay ahead in a highly competitive market.

In Celent’s conversations with leading transaction banks, it is clear that the banking experience is now as important as the product feature/functionality. The “how” is as important and the “what” – and that means new ways of designing, building and delivering solutions to clients. Non-functional requirements and the “surrounding experience” also become more prominent.

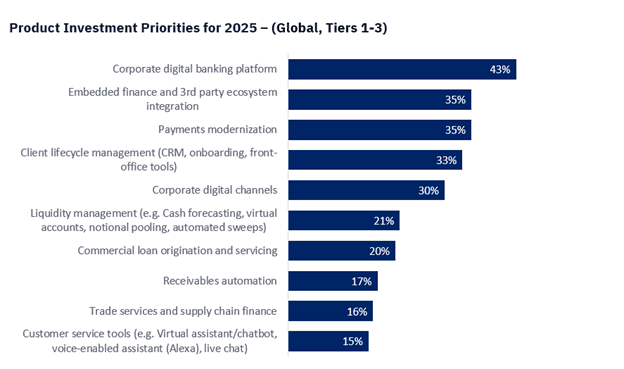

Investment Priorities for Digital Platforms and Channels in Large Banks

Source: Celent Dimensions Survey 2025

As we near the end of 2025, this is an opportunity for banks to calibrate against regional investment trends in digital banking and determine if any adjustments are needed to their 2026 plans. To support that, this report identifies where the priority 2025 investments were applied before rolling into 2026. This is less about banking product functionality, and more about building a better, more robust, banking experience.

Even if a bank is a committed “builder” Celent recommends that they take time to review the capabilities of leading corporate digital banking vendors – the best-in-class offerings available in the region of operation. Beyond a broad range of functionalities and advanced technology stack, these vendors also differentiate in how the banking experience is delivered. Many of the priorities highlighted in this report are now baked into these vendor platforms – or are available through their third-party partnerships.

This report also looks at differences between the regions and compares regional priorities to the global trend, and shared examples of solutions that highlight trending capabilities from a bank in each region. Banks can align digital investment priorities with the leaders in each region.