As part of Celent’s research into the Life insurance industry, we have done benchmarking on new business and underwriting across multiple insurers. These have been time-consuming reports but provide fascinating insights into not just the costs of new business and underwriting but how effective the use of technology can be.

The bad news is that we have not refreshed this report in quite some time. Our last reports were in 2019, just prior to the pandemic. So much has happened since that report, including the increased use of fluidless underwriting, and the massive application of automated underwriting technology. The industry has almost moved too fast to benchmark.

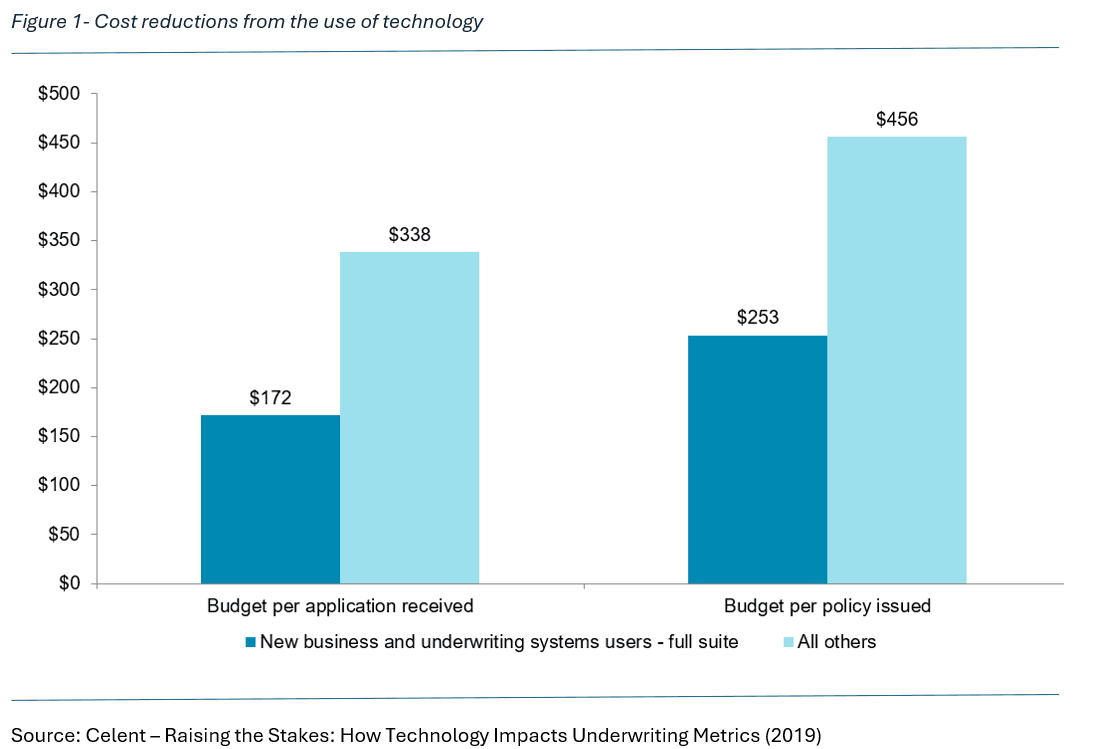

As a refresher, I thought I’d share some key insights from that 2019 reports. For example, the cost per application and the cost per issued policy were both dramatically lower for insurers that implemented a full suite automated underwriting program.

On the left, the figures are the cost per application. That cost applies for every disposition of the application, including a decline. On the right, the figures are for policies that are actually issued. The difference between insurers applying a full suite of underwriting technology versus insurers processing the cases manually is pretty staggering. And this is prior to the latest improvements in automated underwriting technology, including many new data sources and the application of AI and GenAI.

Now those last two technologies are interesting, because we are in the very early stages of integration of those technologies into automated underwriting. It will be fascinating to compare the costs in 2025 with the costs in 2029.

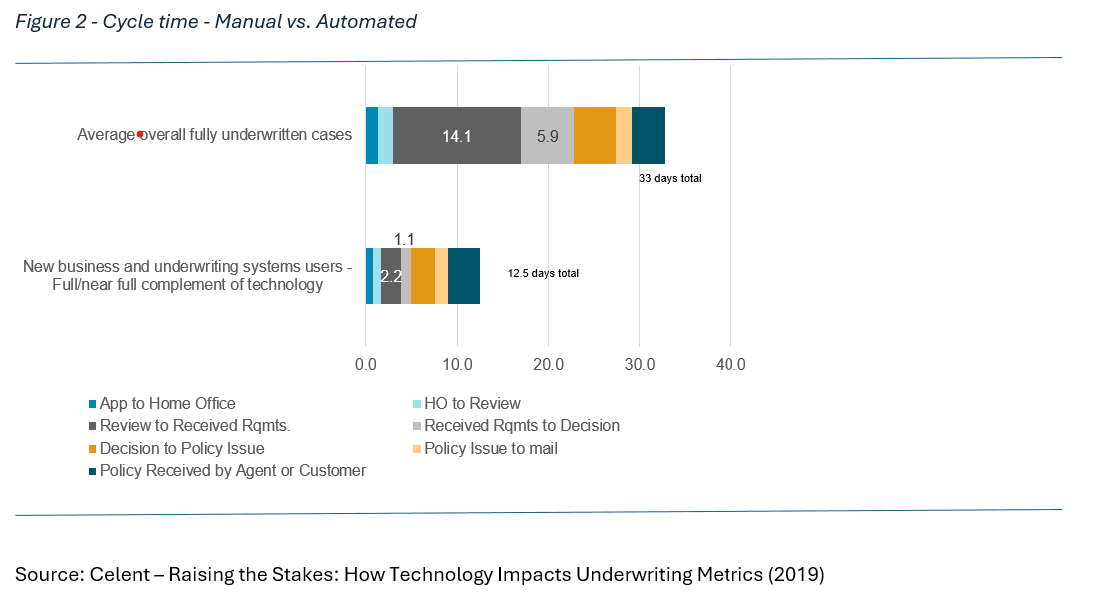

Beyond costs, the difference in cycle time between a manual and automated process was equally interesting.

On the left, the figures are the cost per application. That cost applies for every disposition of the application, including a decline. On the right, the figures are for policies that are actually issued. The difference between insurers applying a full suite of underwriting technology versus insurers processing the cases manually is pretty staggering. And this is prior to the latest improvements in automated underwriting technology, including many new data sources and the application of AI and GenAI.

Now those last two technologies are interesting, because we are in the very early stages of integration of those technologies into automated underwriting. It will be fascinating to compare the costs in 2025 with the costs in 2029.

Beyond costs, the difference in cycle time between a manual and automated process was equally interesting.

In the chart, the colors represent the different components of the new business and underwriting process, such as review requirements and decision to policy issue. Looking at the totals, for fully underwriting cases done manually, the average time from app in the door to policy issued, was 33 days. That’s a long time, but significantly shorter than our 2007 report. Just three years before, in 2016, the cycle time without technology was a staggering 53 days!

The revelation is the cycle time for applications that make it through the automated underwriting process. The automated cycle time is a mere 12.5 days. Now we’re getting closer to an acceptable time. In 2025, we expect the cycle time to be shorter using automation and the percentage of cases that flow through the automation should increase too.

For the purposes of this blog, we’re just showing a small amount of the data gathered in our benchmarking process. We’re pleased to say that we’re going to redo this report for 2025. If you, or your company, has an interest in participating, please reach out to me at Tom Scales (tscales@celent.com). As a participant, you would receive a copy of the report, whether you are a Celent customer or not.

In the chart, the colors represent the different components of the new business and underwriting process, such as review requirements and decision to policy issue. Looking at the totals, for fully underwriting cases done manually, the average time from app in the door to policy issued, was 33 days. That’s a long time, but significantly shorter than our 2007 report. Just three years before, in 2016, the cycle time without technology was a staggering 53 days!

The revelation is the cycle time for applications that make it through the automated underwriting process. The automated cycle time is a mere 12.5 days. Now we’re getting closer to an acceptable time. In 2025, we expect the cycle time to be shorter using automation and the percentage of cases that flow through the automation should increase too.

For the purposes of this blog, we’re just showing a small amount of the data gathered in our benchmarking process. We’re pleased to say that we’re going to redo this report for 2025. If you, or your company, has an interest in participating, please reach out to me at Tom Scales (tscales@celent.com). As a participant, you would receive a copy of the report, whether you are a Celent customer or not.

If you’d like to see the 2019 reports, we’ve made them public, and you can see them here:

Raising the Stakes: How Technology Impacts New Business and Underwriting Metrics

Upping The Bar: Key Metrics In Life New Business And Underwriting

All information provided as a part of this project will be held in the highest confidence. Data will only be used in aggregate, as seen in the above graphics. You’ll be known only by a company code, such as Company H. When you receive the report, we will share which code belongs to your company so you can compare yourselves to others. We’re hopeful you’re interested. It is an amazing report.