Banks are grappling with the impact of squeezing net interest margins, regulatory pressures on fees and pricing, and impact of higher interest rates on credit provisions. This is challenging Return on Equity performance, while banks need to maintain investment to address customer digital service expectations, ability to tap into new business models, and harness potential of artificial intelligence.

Effective IT capability in banking has become critical as institutions rely on technology to operate efficiently and effectively, with most bank products and services underpinned by IT systems. The growing complexity of IT system, the need to maintain operational resilience, and the need to innovate while managing cost, means that banks need to be able to access and leverage latest IT skills, resource, and expertise to support current and future requirements. Most institutions this will require a mix of internal (bank’s own workforce) and external (third-party provider) IT services.

This report analyses the current landscape of IT services vendors within the banking sector, highlighting key trends, challenges, and opportunities that banks face in this rapidly evolving digital era.

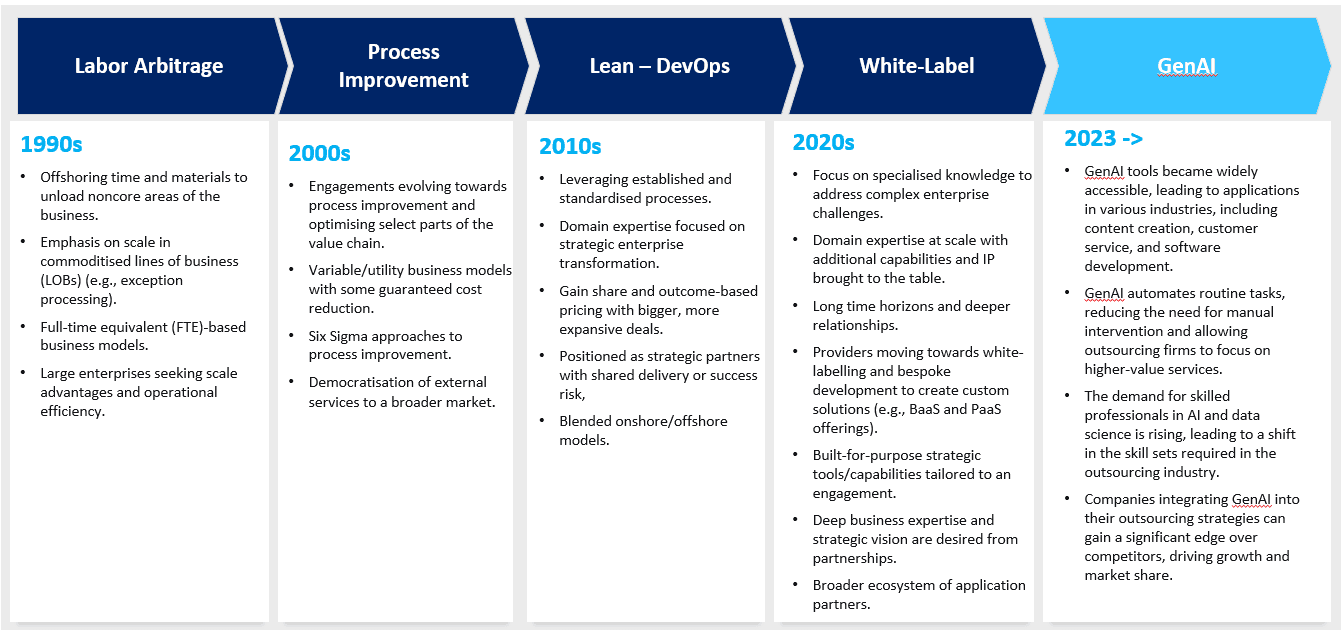

Over the years, the IT services industry has shifted significantly towards focusing on high-value engagement areas, moving away from the traditional staff augmentation approach. The emergence of Generative Artificial Intelligence (Gen AI) is poised to impact the industry profoundly. With its ability to generate human-like text, images, and even code, generative AI can revolutionise software development by rapidly generating code snippets, prototypes, and even complete applications based on user requirements. This capability enables faster software development and delivers solutions more efficiently than ever.