Traditional credit scoring has long been the cornerstone of retail loan underwriting for decades. A traditional credit score is based on a snapshot of a consumer’s loan repayment data at a point in time, uses statistical methods such as regression analysis, and reflects the loan payment information available on a standard credit report when the score is requested. In 1989 FICO (US) introduced the first general purpose credit score (developed in collaboration with the major US credit bureaus). CIBIL (India), SCHUFA (Germany), and VantageScore (US) have since introduced general purpose credit scores.

Advances in Credit Data and Underwriting

The predictive lift of credit scores has improved steadily over the decades due to the growth of credit usage, advances in statistical analytic techniques, and the addition of new data sources. For example, newer FICO models such as FICO® Score 10T and VantageScore 4.0 are designed to incorporate alternative data (data (i.e., utility payments, rent payments and other bill payments) new analytic techniques, and trended data (monthly consumer credit data for multiple months).

In recent years, cashflow underwriting for business lending has expanded to consumer lending to augment static, point in time credit score-based underwriting. Cashflow data (income, expenses, financial behavior, bank account balances, and cash reserves) have made cashflow underwriting possible. Early developers of cashflow underwriting include Nova Credit, Petal, Plaid, and Prism Data.

Cash flow underwriting analyzes a borrower's real-time income and spending to assess repayment ability. It provides a more complete credit picture than traditional credit scoring and is especially beneficial for consumers with limited credit history. Current vendors of cashflow underwriting now include eNoah, Experian, FICO, Ocrolus, MeridianLink, Nova Credit, and Plaid. Casca and Wolters Kluwer support small business/commercial loan cashflow underwriting.

Cashflow underwriting may require more complex data collection and analytic software than just ordering and receiving a credit score that the lender then links to credit guidelines to make loan decisions. This is especially true as cashflow underwriting (and trended data) use expands from simpler unsecured credit card underwriting to secured auto, home equity, and mortgage loan underwriting.

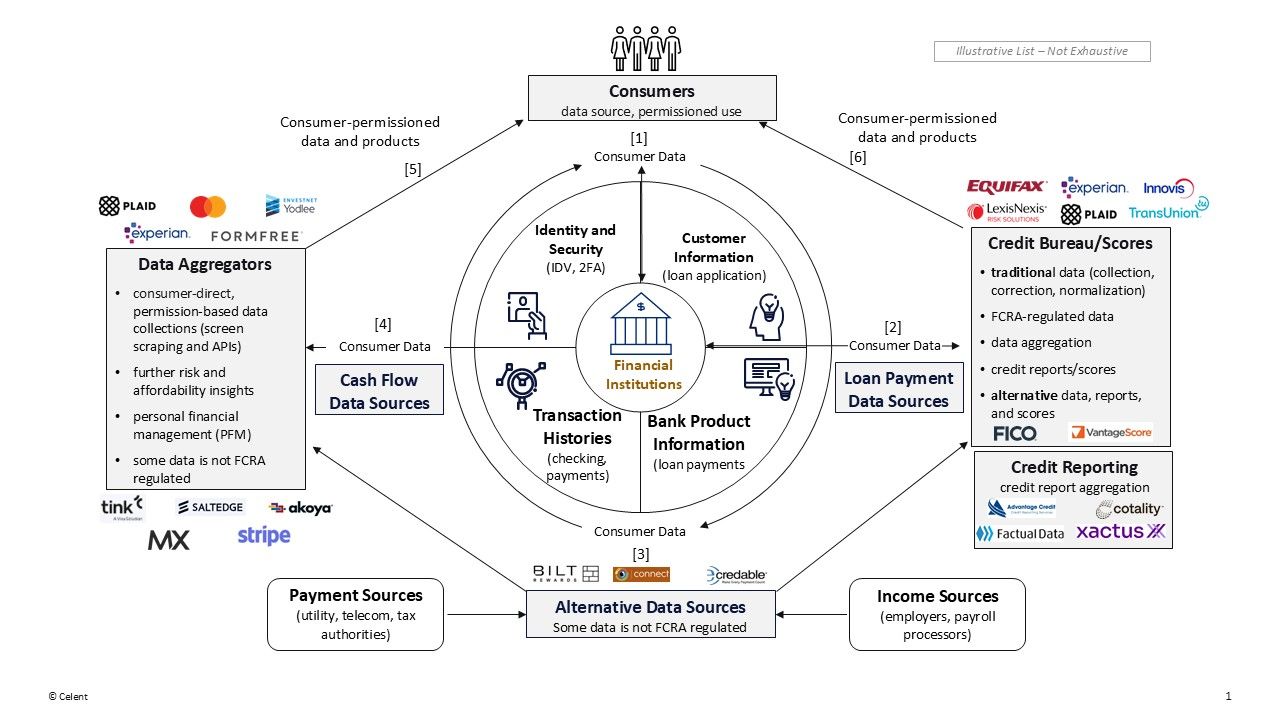

Figure 1 diagrams the consumer data collection, storage, aggregation, and products ecosystem in the US (the ecosystem is similar in many other countries).

Figure 1: The expanding US consumer credit data collection, analytics, bureau, and distribution ecosystem

Source: Celent

Figure 1 shows how retail consumer loan, payment, and public record data is aggregated by financial institutions from consumers and shared with credit bureaus which then aggregate the data to create credit information products. Processes [1] and [2] above show the foundation of this ecosystem. Figure 1 also shows that consumer data collection and usage in retail banking now includes alternative data sources, cashflow underwriting as discussed.

Combining Cashflow Underwriting and Credit Scoring

The new advance in credit scoring is the combination of traditional credit bureau data, cashflow data and alternative data with modern scoring analytics to create one comprehensive score. Three new scores provide this capability:

Plaid LendScore

The Plaid LendScore (announced October 15, 2025) combines income analytics, cashflow (spending and bank balances), and network insights (mobile app connections) usage to improve predictive lift compared to traditional credit bureau or cash flow data. Plaid LendScore:

- is delivered through Plaid Check, Plaid’s consumer reporting agency. The loan applicant consents in real time to share bank account data using Plaid Link

- uses cash flow attributes, income patterns, and financial account connections from Plaid’s digital financial network

- provides differentiated real-time cash flow signals about a borrower's financial health

- is usable alongside traditional scores to enhance credit decisioning

Plaid’s first model, LS1, is trained on a dataset of nearly one billion transactions to predict the likelihood of default in 12 months for unsecured loans. In testing, Plaid reports that LendScore delivered up to a 25% lift in predictive performance compared to bureau data alone. LendScore is independently tested by FairPlay, a provider of advanced AI fairness techniques used by banks and fintechs.

LendScore was trained on a variety of loan types. It is initially designed to help unsecured personal lenders and fintechs. Plaid plans to continue to release additional versions of the LendScore over time, both to improve predictive performance and to serve distinct lending use cases.

Experian Credit + Cashflow Score

On November 10, 2025 Experian announced the Experian Credit + Cashflow Score. It combines consumer-permissioned bank account data, including income, balances, card payments, bank fees and loan transactions. The Experian Credit + Cashflow Score augment’s other Experian products: the Cashflow Score, Cashflow Attributes and cash flow insights dashboards.

The Experian Credit + Cashflow Score:

- is delivered through Experian

- uses traditional credit data and detailed credit account information on more than 220 million U.S. consumers.

- uses Clarity Services (an alternative credit bureau) with alternative data on about 60 million consumers

- uses consumer-permissioned bank account data, including income, balances, card payments, bank fees and loan transactions

- uses Experian proprietary attributes and trended data, which provides a 24-month view of how consumers manage credit over time

Experian reports that its early analysis shows the Experian Credit + Cashflow Score outperforms conventional credit scores and cashflow-only scores across all major lending products (personal loans, lines of credit, bankcards and mortgages).

The cash flow UltraFICO® Score

On November 20, 2025 FICO announced a partnership with Plaid to launch the cash flow UltraFICO® Score. It is an updated version of the UltraFICO® Score that was launched (with the Experian credit bureau and Mastercard-owned data collector Finicity) with a small group of lenders as a pilot program in 2019.

The cash flow UltraFICO® Score:

- will be distributed through Plaid’s consumer reporting agency, Plaid Check

- utilizes Plaid’s internal infrastructure and digital finance network of consumer-permissioned data from over 12,000 financial institutions

- combines the FICO Score with real time cash-flow data from Plaid to create a single, enhanced credit score

- provides lenders with the flexibility to use the traditional FICO Score with a cash flow model irrespective of the channel they use for the FICO Score

- is aligned with the traditional FICO Score to reduce the score testing period

Celent believes that the combination of Plaid’s real-time connectivity, Plaid Check, and analytic experience combined with FICO’s near ubiquitous use in consumer lending will be very attractive to lenders targeting the underbanked, thin file, and nonprime customer segments.

What This Means For Credit Decisioning, Financial Inclusion, and Open Banking

Celent believes that the new cashflow-data augmented credit scores will increase use of bank account activity as an important underwriting input and support financial inclusion. These scores will help lenders underwrite the underbanked and nonprime credit quality customer segments for consumer loans. In 2023, the FDIC National Survey of Unbanked and Underbanked Households reported that 14.2 percent (about 19.0 million) of US households were considered underbanked. The introduction of these scores marks the next chapter in responsible lending and financial inclusion.

Second, Celent also believes that a major requirement for success will be the “account linking conversion rate”, which is the percentage of consumer-permissioned requests that result in data being delivered to the vendor to calculate the enhanced score.

Third, Celent believes that these products signal a clearer change in the direction of the final Open Banking Rule (Section 1033) which was finalized in October 2024 and made data access free for vendors. However:

- Section 1033 is not in effect

- in August 2025 the CFPB issued an advance notice of proposed rule-making to reconsider Rule 1033

- in September 2025 JP Morgan Section 1033 data access and payment agreement with Plaid and other fintech firms sets a new precedent for how a revised Section 1033 will look

Celent believes that vendors will increasingly need to pay for bank data, which is the core input for the new score products. Finally, Celent believes that cash flow data driven credit scores will increase loan application approvals, lower credit default losses, make more precise credit decisions, and help refine loan pricing.

Contact me at info@celent.com or cfocardi@celent.com if you would like to discuss these or other topics.