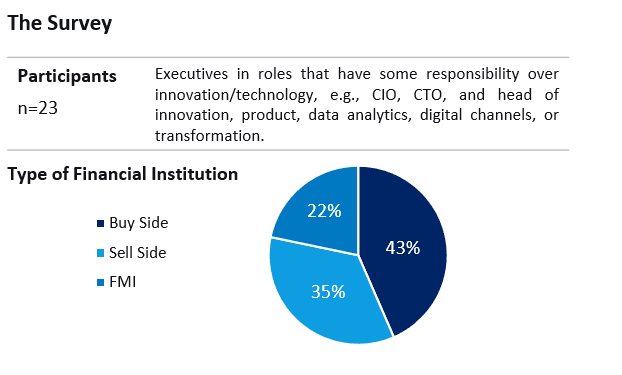

GenAI has become the buzz word of the last few years with financial institutions evaluating and implementing innovative new use cases. In this year's survey, we asked how respondents' sentiment toward GenAI had changed over the year, their state of adoption by area, their view of expected impact by use case, and their technology approach, as well as the key success factors they have identified through their recent experience. To flesh out the reality for FIs in Capital Markets, Celent surveyed buy side, FMI, and sell side executives in roles tied to innovation. Below you will find a high-level breakdown on this years survey respondents.

A key takeaway from this year's survey is that the majority of respondents have progressed from ‘Early Majority’ phase into the ‘Late Majority’ category. Early adopters are typically more tech-savvy organizations with larger budgets to explore innovative technologies. As adoption becomes more widespread, the focus tends to shift towards practical business use cases and measurable ROI. This finding has been further supported by the increase in both live employee and customer-facing GenAI use cases.

In the current, challenging regulatory climate, it is key for firms to evaluate and improve their data sources and infrastructure to ensure they are training their models with the highest quality data to generate better, more informed and accurate outputs. Celent believes that it is vital to see beyond the current incremental use cases and develop a forward-looking strategic, enterprise view of GenAI and Agentic AI to harness its full potential.