Using AI To Modernize Loan Servicing and Deliver Greater Customer Engagement and Operating Efficiency

October 14, 2025 Craig Focardi, CMB

The foundation of customer engagement is built on core banking systems (CBS) and core loan servicing systems (LSS). These systems house the main customer information file (CIF), store loan/deposit product information, collect payments, and enable loan retention, refinance, and cross-sell. Both types of systems were originally built during the 1970 and 1980s; are tightly coupled, mainframe systems; and need replacement.

However, new, cloud-based loan servicing system development lagged CBS development until in the 2020s, when firms like Canopy Servicing, LoanPro.io, Peach Finance, Ranieri Systems, and Sagent emerged. The opportunity for financial institutions to replace core loan servicing systems is unprecedented if lenders identify the right technology modernization strategy and undergo internal technology assessment and external vendor evaluations.

Next Generation Loan Servicing Systems

This new generation of loan servicing platform providers will help lenders transform how loans are serviced, how data is managed, and how customers are engaged with. This renaissance in loan servicing technology is giving lenders an unprecedented opportunity to transform the lending back office through system replacement (instead of endless progressive renovation).

Modern systems will provide better, faster, and cheaper transaction processing; enhance customer engagement, connect the back-office loan servicing to front office customer engagement; and enable lenders to more easily adopt machine learning (AI/ML), GenAI and Agentic AI.

Celent Loan Servicing Technology Research

Celent is researching this technology topic in anticipation of growing demand for lender strategy development, technology planning, and vendor assessment and selection. This builds on prior loan collections vendor assessments and technology trends analysis.

Celent is writing a series of reports covering loan servicing technology innovation, the servicing tech vendor landscape, the growing role of all forms of AI, and use cases/case studies of AI applications in loan servicing. This research will provide an analysis of the underlying servicing technology architecture transformation, paths to system modernization and replacement, an overview of the servicing technology vendor landscape, and use cases/case studies of AI applications in loan servicing.

A Preview of Loan Servicing Case Studies on Innovation with AI

Loan servicing case studies will focus on AI/ML and GenAI system implementations. The case study categories are focused on core servicing platform technologies, loan collections systems, customer engagement, payments, and contact centers.

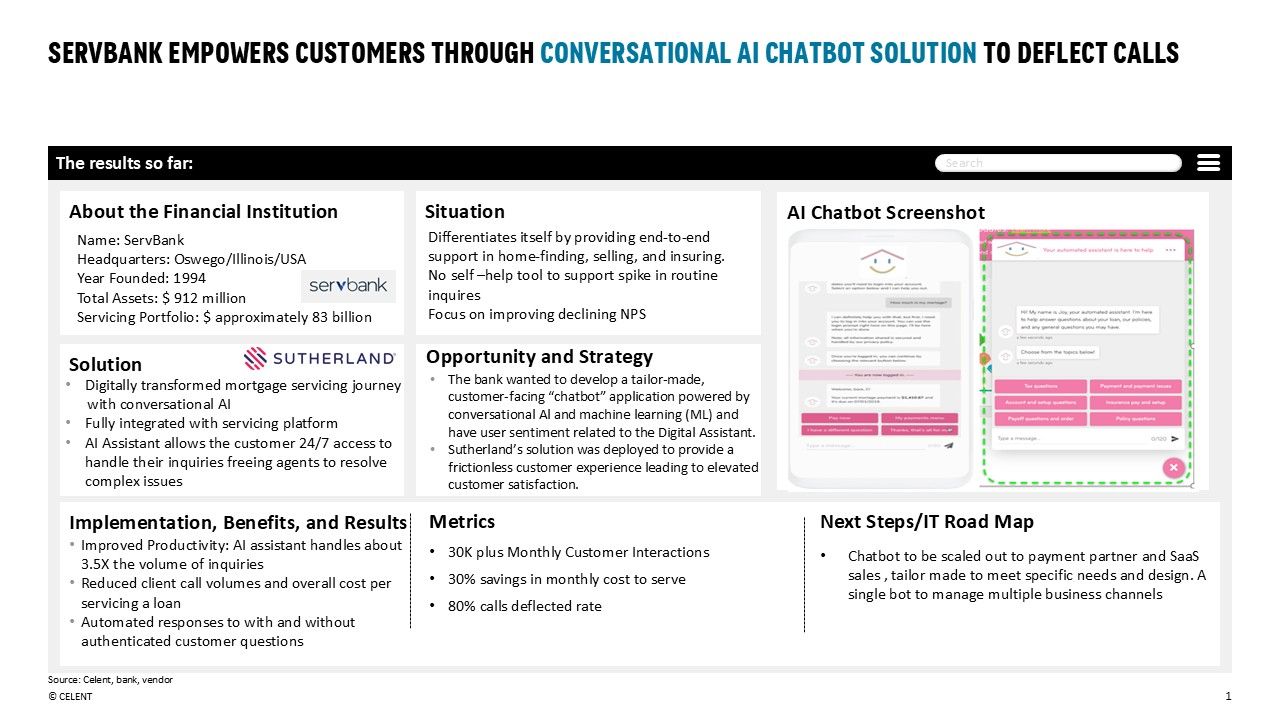

Figure 1 presents an AI in loan servicing case study that illustrates how ServBank successfully leveraged a conversational AI chatbot to cut servicing costs by 30%, deflect 80% of routine calls, and boost customer satisfaction—showcasing how mid-sized banks can digitally transform mortgage servicing at scale.

ServBank, headquartered in Oswego, Illinois, wanted to differentiate itself by providing end-to-end customer support in home search, home selling, financing, and insuring. However, its contact center relied heavily on human engagement and lacked a self-help tool for handling spikes in incoming calls for routine issues. It wanted to improve its Net Promoter Score (NPS) by improving customer engagement.

ServBank partnered with Sutherland Global Services to deploy a conversational AI chatbot powered by AI/ML and fully integrated with ServBank’s mortgage servicing platform. The chatbot provides 24/7 access, handles authenticated and unauthenticated inquiries, and deflects routine calls. The ServBank and Sutherland strategy focused on intelligent automation for proactive support:

• Development of a Customer-Facing Chatbot: Sutherland designed and implemented a conversational AI chatbot powered by machine learning to handle frequently asked questions and provide self-service options for customers.

• Real-Time Interaction Analysis: the solution scanned agent-customer interactions across all channels to predict potential negative outcomes and identify areas for improvement.

• Agent Training Enhancement: the solution provided agents with insights from customer interactions and tips to guide customers effectively, improving overall service quality.

ServBank achieved an 80% call deflection rate (an AI-driven call deflection rate measures the percentage of customer inquiries that are successfully resolved by self-service channels, like chatbots or intelligent IVR systems, without requiring the involvement of a live agent). This reduced burden on human agents improved overall efficiency and customer satisfaction with always-on support. It also saved 30% of its monthly cost to service.

Strategically, ServBank demonstrates how smaller asset-sized banks ($912 million) can leverage AI to manage outsized servicing portfolios (approximately $88 billion), leveling the playing field against larger institutions. Their roadmap suggests a shift from AI as a cost-saver to AI as a multi-channel engagement engine.

Next Steps

Contact me at info@celent.com or cfocardi@celent.com if you would like to discuss these topics. If you are a client email me or your relationship manager to set up a call.