While the US GENIUS Act and the EU’s MiCA are seen as providing clarity for stablecoin issuers, the way forward for crypto-asset regulation seems less clear. With pushbacks on both regulations, market participants may be waiting years for much desired clarity.

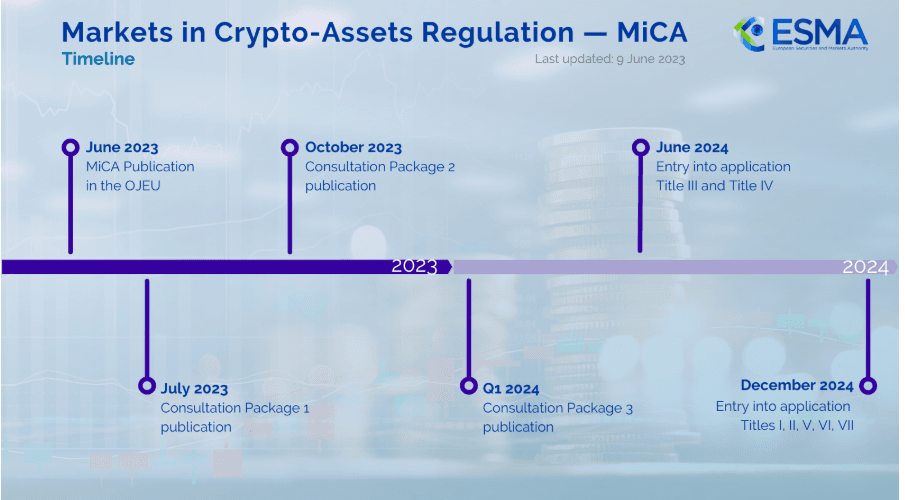

In Europe, a recently published statement from the French, Austrian and Italian financial markets authorities have proposed adjustments to MiCA with regards to crypto-assets to protect the “competitiveness of European players" and "investor protection". MiCA, the Markets in Crypto-Assets Regulation, came into force in 2024, setting a comprehensive framework for crypto assets across the EU., the first legislation globally to do so.

Source: European Securities and Market Authority (ESMA)

Source: European Securities and Market Authority (ESMA)

The statement authors say MiCA is a “major step forward for the regulation of crypto-assets in Europe…[but] its application remains fragmented and that certain provisions do not adequately prevent risks…”. They propose a series of adjustments as follows:

- Centralized supervision of major crypto-asset service providers in Europe

- Stricter rules for global platforms and their activities outside the EU

- Better supervision of service providers in the face of cyberthreats

- The creation of a one-stop shop for token offerings

The last point is specifically aimed at avoiding market fragmentation and the potential for so-called “regulatory arbitrage” by providers seeking to set up in a more favourable (or lax) jurisdiction. The chair of the AMF has since been quoted saying “We do not exclude the possibility of refusing the EU passport”.

Although the paper did not name names, in June ESMA published the “Peer Review Report”, which it conducted into the Malta Financial Services Authority, highlighted concerns about Malta's crypto authorization process. Several leading crypto exchanges, including OKX, Crypto.com and Gemini are authorized there, although EMSA does not point to specific entities. Malta was an early mover on crypto regulation, introducing its Virtual Financial Assets Act in 2018. A Malta spokesperson told Reuters news that it is opposed to a push by other countries to give ESMA more powers in this area.

In the US, despite the House of Representatives approving the Digital Asset Market Clarity Act (CLARITY Act) on July 17, the Senate is leaning in a different direction, releasing a 182-page discussion draft for an alternate bill, called the Responsible Financial Innovation Act of 2025. There has also separately been pushback from the North American Securities Administration Association (NASAA) to the Congress and Senate efforts. The NASAA, represents US state securities regulators, seem to have concerns they are being asked to step aside. Even once a bill is passed there is time needed for implementing measures to be agreed.

Acknowledging the detrimental impact of regulatory uncertainty, the Acting CFTC Chairperson, speaking in London in early September, said that many US crypto firms relocated abroad due to year of regulatory uncertainty, with some establishing trading venues in Europe. The CFTC now is exploring whether EU MiFID- or MiCA-authorized venues could qualify under its cross-border recognition rules. The CFTC is seeking public feedback on listed spot crypto trading in a “Crypto Sprint”, with comments due 20 October. She also recently announced a joint SEC-CFTC roundtable for 29 September to discuss regulatory harmonization.

In the UK meanwhile, the Financial Conduct Authority (FCA) just this month issued a consultation paper titled “Application of FCA Handbook for Regulated Cryptoasset Activities” which follows the April publication from the UK Treasury of a draft Statutory Instrument (SI) and Policy Note, outlining statutory provisions to create new regulatory activities for cryptoassets under the Financial Services and Market Act 2000 (Regulated Activities) Order 2001 (the ROA). When the SI comes into force certain cryptoasset activities will fall under the FCA’s remit, including issuing qualifying stablecoins and operating a qualifying cryptoasset trading platform (CATP), intermediation and staking. The consultation runs to 12 November. The FCA has already consulted on qualifying stablecoin issuance and cryptoasset custody (CP25/14) in May.

All this supervisory and industry back-and-forth means, market participants may need to wait years for clarity when it comes to crypto assets outside of payment oriented stablecoins, and in the meantime, in both the US and the EU this may mean navigating across both regional (state or EU member country) and Federal or supranational levels.

That said, activity, and interest, in the crypto space has ramped up in light of the supportive shift by the US. Legal Nodes, a platform for tech companies operating globally, still included the US, EU and UK in its list of “most crypto-friendly countries for registering a crypto business in 2025”, with each scoring well in the following areas:

- US: stablecoin issuance, CEX, NFT platforms, non-custodial wallets, decentralized AI projects

- UK: CEX, DEXs, DeFi projects, NFT platforms and decentralized AI projects

- EU: Stablecoin issuance, CEX

Other countries with frequent mentions include:

- Switzerland: Token issuance, DEXs, DeFi projects, non-custodial wallets, decentralized AI Projects

- Singapore: Token issuance, stablecoin issuance, DEXs, DeFi projects, non-custodial wallets, decentralized AI projects

- UAE: Stablecoin issuance, CEX, DEXs, DeFi projects, custodial wallets, decentralized AI projects.