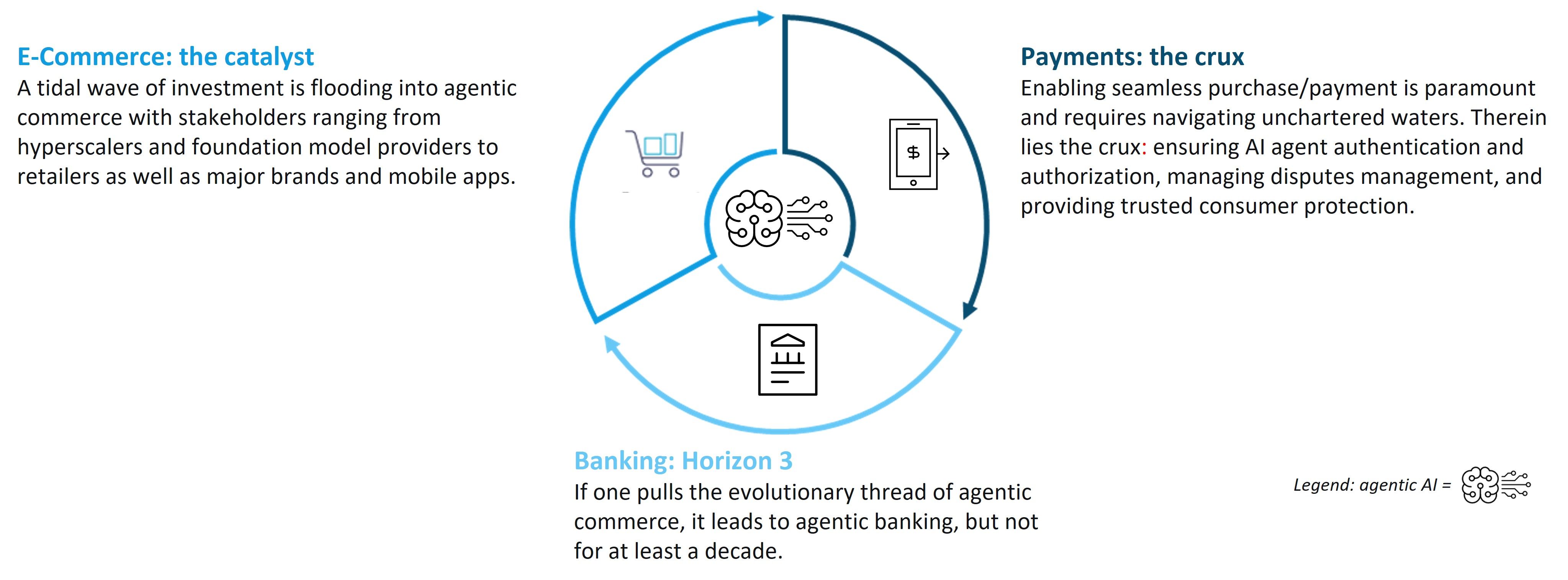

Celent views the rise of agentic commerce as having myriad implications for banking and payments. To cut through the hype and announcement inundation, in this inaugural report, Celent examines the competitive playing field—producing a “field guide”—and extracts relevant insights for financial institutions (FIs) and their tech providers. Celent builds upon its extensive legacy knowledge of critical components of agentic commerce including security (authentication and authorization), payments (rails and fraud mitigation), and banking.

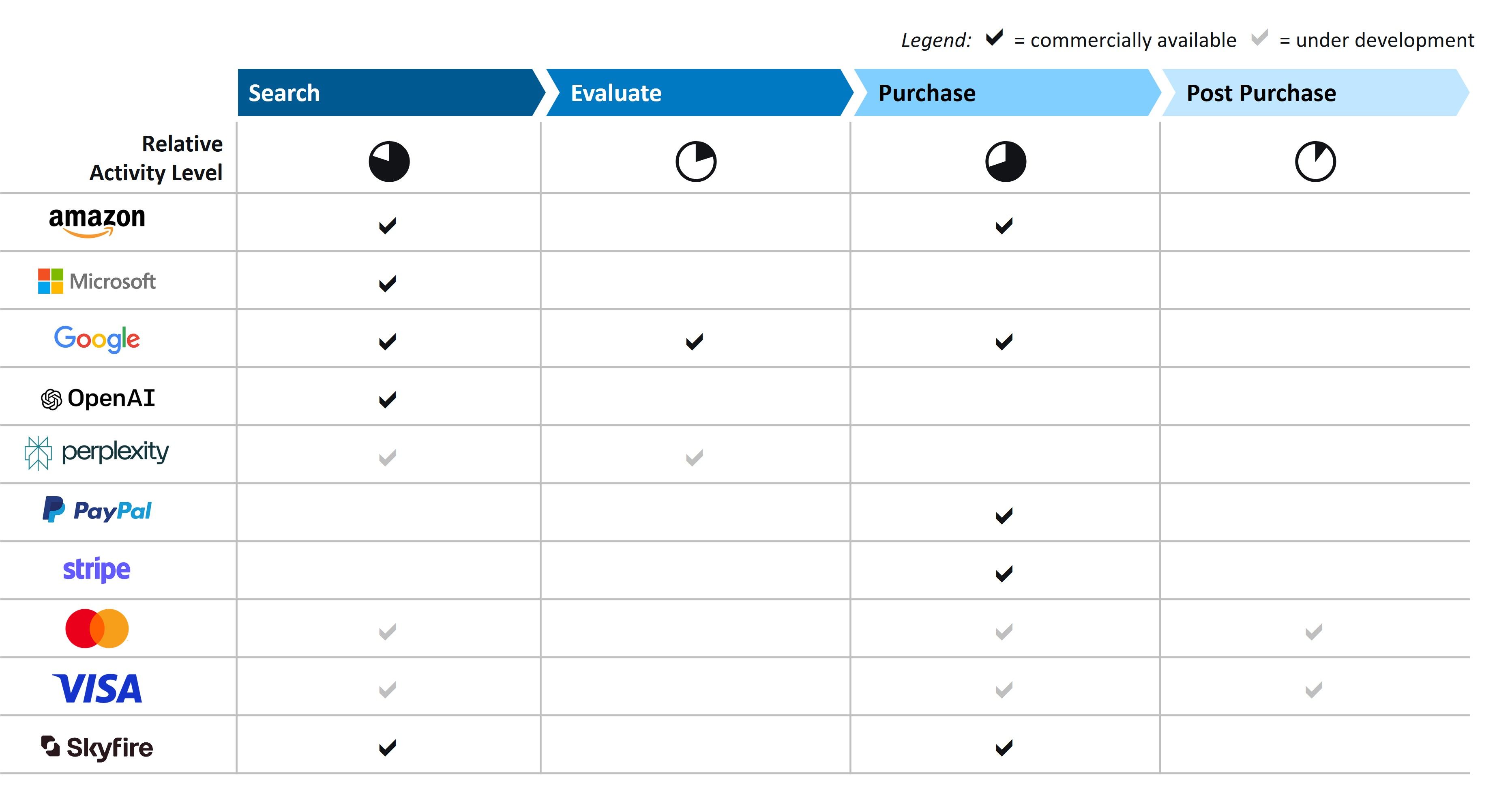

Celent spotlights the following pacesetters.

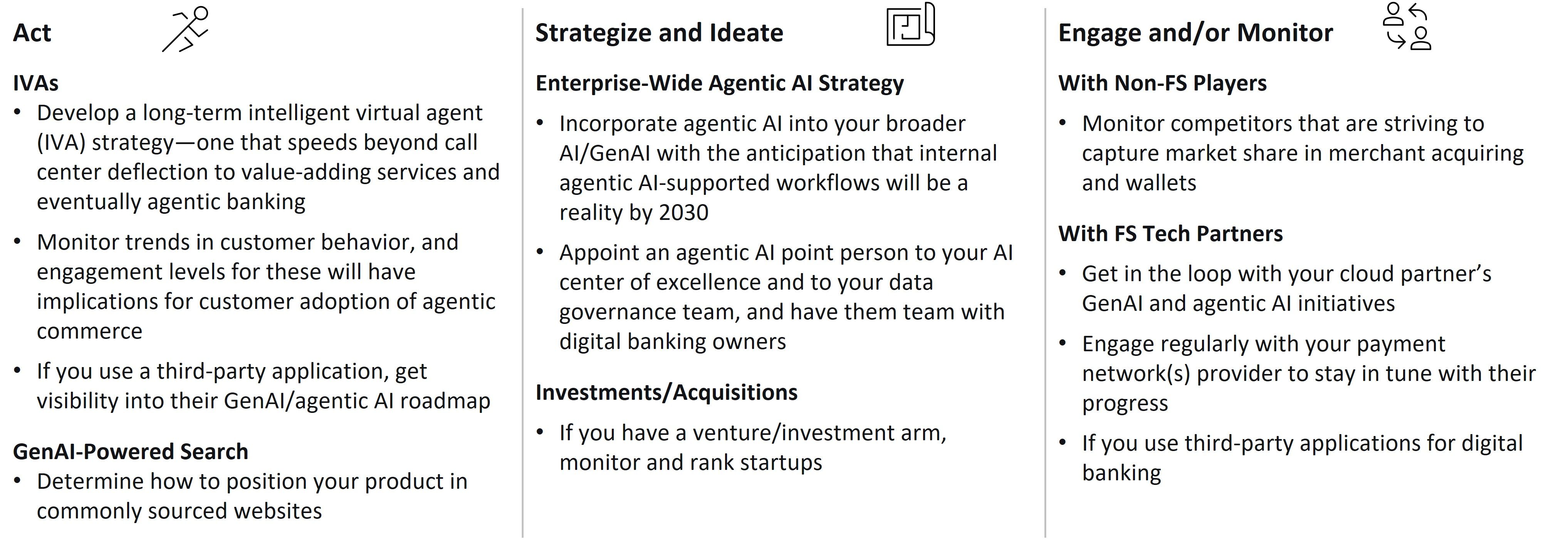

While it is early days for agentic AI adoption overall, Celent recommends that financial institutions pursue a three-pronged approach: act, strategize/ideate, and engage/monitor. The fast pace of developments outside of financial services requires FIs to dedicate resources to understand agentic commerce and gradually build a strong foundation.