The investment industry is undergoing significant transformations, influenced by cost and profitability pressures, as well as advancements in data capabilities and the emergence of new AI technologies. While data is widely recognized as a strategic asset, effectively navigating the often complex and traditionally challenging journeys of data enablement to fully leverage this asset is not always straightforward. The planning and navigation of data journeys are influenced by increasing data demands, stricter regulations, technological advancements, and aspirations for AI. Firms face a multitude of choices, pathways, and varying levels of complexity.

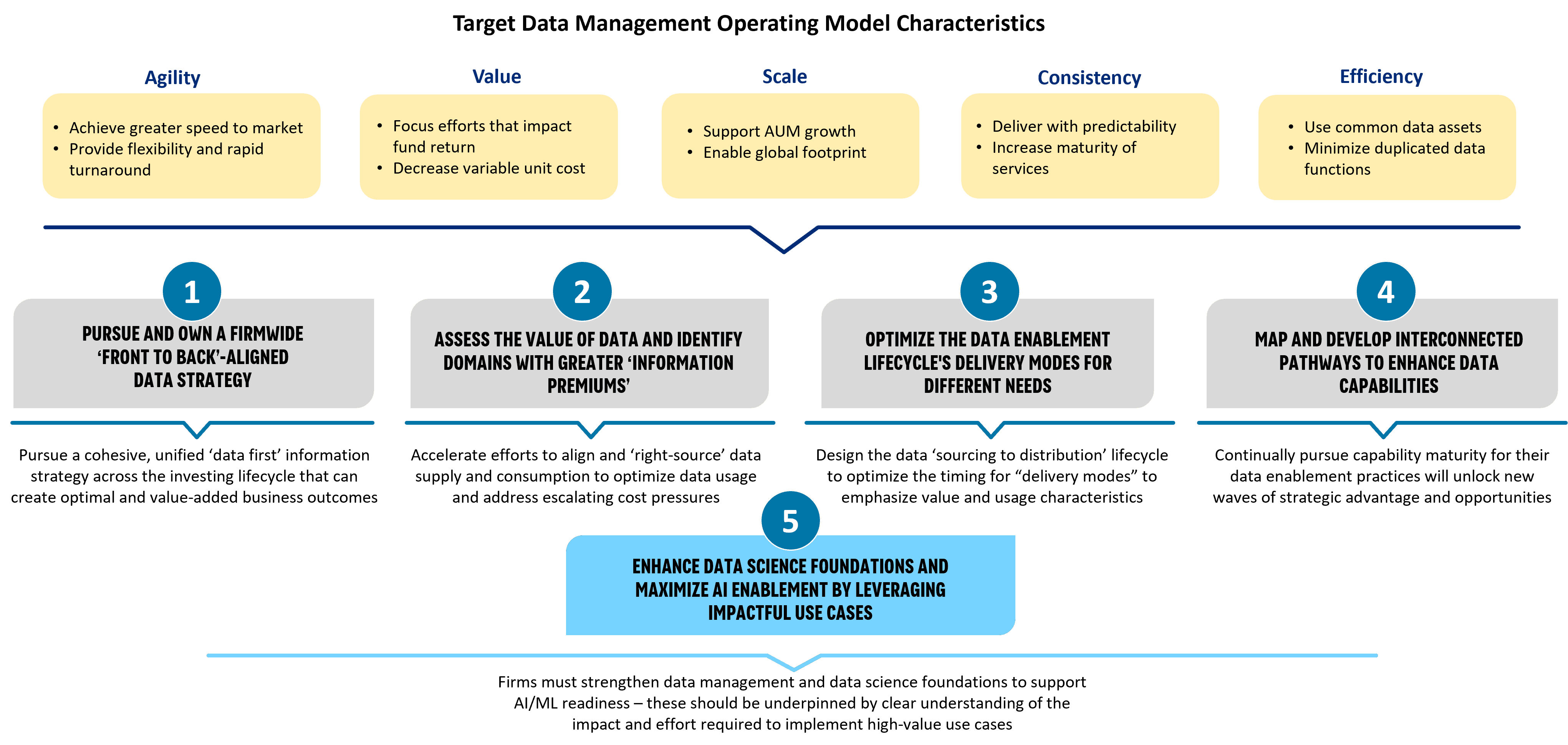

Data enablement extends beyond merely adopting modern data methodologies, tools, and infrastructure. Although these components are essential, they represent only a portion of the overall landscape. Organizations must also consider the intricate interplay of various factors that affect data management and utilization. This includes managing cultural shifts within the organization, as employees may need to adjust to new ways of working and thinking about data. The rewards of this effort include enhanced organizational agility, empowered AI insights, and increased productivity from data operations.

Successful journeys adopt fundamentally different approaches to data and analytics, emphasizing “business-first” objectives. In this context, both the “how” and the “why” of data enablement are crucial, and strong alignment between these aspects can significantly impact outcomes, leading to more favourable benefit realization, payback, and return on investment in data-related initiatives.

Recognizing that data enablement, data operations, and change management efforts are complex and multifaceted, this study is tailored for CXOs, chief data officers, business architects, and IT/data strategists. As the ecosystem of providers, service propositions, and data science technology platforms evolves, investment firms can embrace strategic opportunities to enhance the efficiency of data operations and drive differentiated data insights.

We outline ideas and present insights that highlight the connection between emerging data management trends and considerations related to target operating models, planning, change management, and implementation strategies to ensure successful execution.

----------------------

Subscribing clients can access the full report through their Capital Markets research membership. For more in-depth research around future buyside, sellside and market infrastructure trends and technology insights, please explore Celent's Capital Markets practice.

Other companion studies include:

- Investment Data Ecosystems (Part 1): Sharpening the Data Enablement Edge in an Age of AI

- Top Technology Trends Previsory (Capital Markets): Buy Side, 2025 Edition

- Enterprise Data Management Visions and Trajectories: Capital Markets and Investments Edition Part 1 and Part 2

- ESG Data Management in Capital Markets: A Time of Opportunity

- Overcoming Fractured Data Chains and Achieving Operational Brilliance in Private Markets

- NextGen Investment Accounting Solutioning Guide: A Playbook for Success

- ESG Delivery Under Scrutiny; “Walking the Talk” to Resolve the Credibility Gap