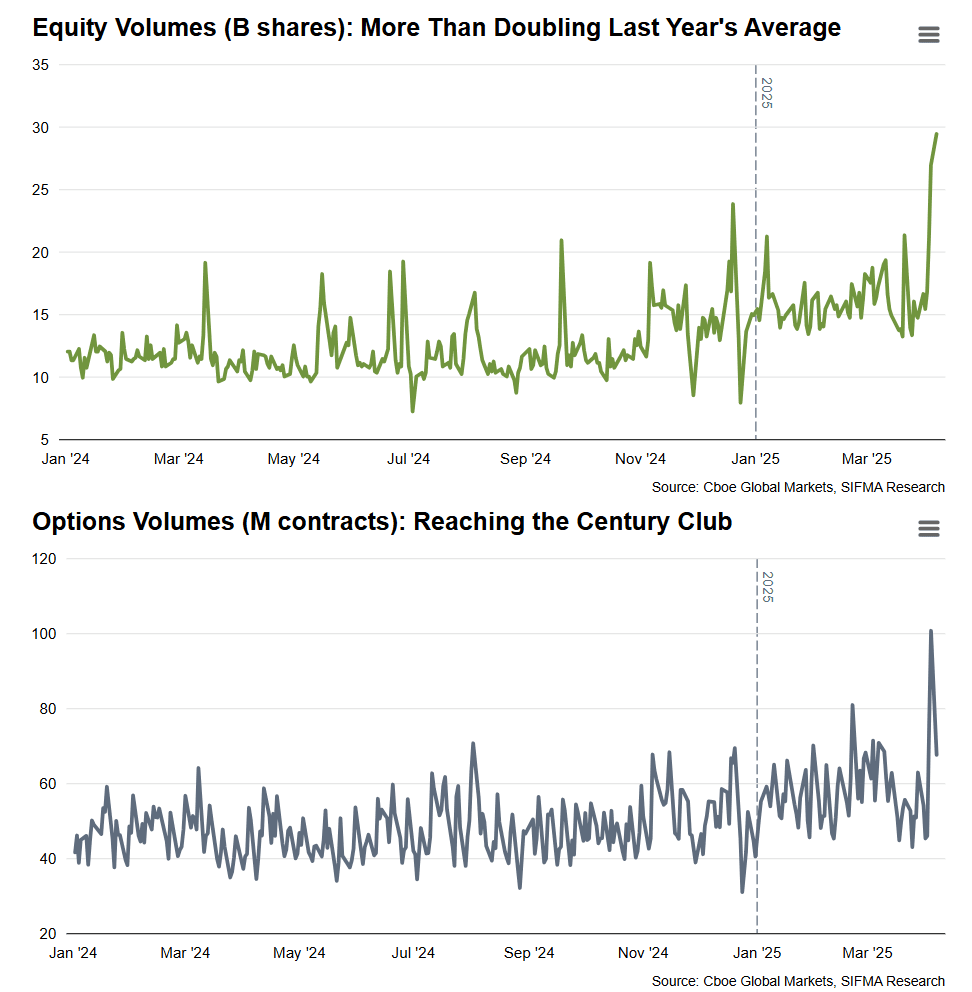

It seems like record-breaking trading volumes are starting to be the rule not the exception, and the latest round of market volatility, due to the recent imposition of trade tariffs have certainly broken records when it comes to markets activity (see Figure 1).

However, the world’s capital markets infrastructures have proved resilient. In speaking with market participants Celent found factors supporting this success include adoption of modern cloud-based approaches and technologies and “lessons learned” from previous periods of crisis- or policy-induced volatility.

This aligns with data from Celent’s recent Dimensions IT Priorities & Pressures survey of capital markets sell side and buy side executives, which found that cloud adoption is a key focus, with nearly two-thirds of capital markets respondents planning to move critical business workloads to public cloud in the next 18 months.

The impact on markets, and market infrastructures, from the latest round of disruption has been significant. Major indices such as the FTSE, Nasdaq, CAC 40, have swung between massive declines to increases, with significant selloffs including a 10.5% drop in the S&P 500 within just two sessions following tariff announcements. In early April, the tech-heavy Nasdaq-100® index closed more than 20% below its most recent peak.

A “risk-off” sentiment saw investors rushing to reallocate portfolios. While market volatility has bolstered trading revenues for Markets divisions of investment banks and brokers, volatility has led to increased margin calls and price fluctuations impacting securities financing. Higher trading incomes are the silver lining for these banks.

This environment however can present a huge potential stress on financial markets infrastructures such as exchanges and post trade infrastructures

U.S. Financial Markets, the largest globally, were tested

The U.S. financial markets are the largest globally, and Nasdaq, a leading exchange, (it is number one in terms of market share in multi-listed U.S. options trading and the number one single venue of liquidity for listed U.S. cash equities). Celent spoke with Chuck Mack, SVP and Head of Strategic Operations and Public Policy, who shared that Nasdaq saw peaks in the last few weeks that were four times those of Covid times, and that in general the exchange runs at about 50-100% above Covid peak in a typical day. He told Celent, “Capacity is constantly being assessed and updated. When we saw peaks during Covid we invested significantly in our infrastructure. We have our normal investment cycle as well, but we went above and beyond the regular investment cycle during Covid…during the recent volatility driven peaks we had no issues.” Clearly those extra investments are paying off.

Nasdaq is a cloud migration leader in the FMI space, partnering with AWS over the last 15 years. In addition to operating its own markets and post trade infrastructures, Nasdaq is the trusted technology partner to 130+ financial markets infrastructures (FMIs) globally. It was the first exchange to migrate its markets to the cloud and just recently announced a “modernization blueprint”, partnering again with AWS, to drive the benefits of the cloud into local market infrastructures. As part of this the exchange group has launched Nasdaq Eqlipse, a suite of next generation marketplace technology solutions delivering cloud-ready capabilities across the full trade lifecycle for FMIs.

Celent also spoke with AWS who confirmed that they see firms moving increasingly latency sensitive trading platforms to the cloud, both on the FMI and both sell side and buy side firms. Alex Mirarchi, Principal Industry Specialist, Capital Markets, told us that “on the trading side, the big trend is that firms are moving increasing latency sensitive trading platform to the cloud. Exchanges and capital markets firms have been using cloud to run trading engines, order management systems and algorithms for some time”. He also pointed out that many crypto and fixed income exchanges were “born in the cloud.”

Nasdaq was not alone in experiencing record breaking market traffic. Cboe processed more than a trillion message events on its options market in a single day without any performance issues (the U.S options market currently processes 300 billion message daily). The U.S. listed options market is averaging ~59.7 million contracts traded each day, up 21% from 2024.

**Post trade market infrastructures saw fresh peaks **

On the post trade side, the U.S. Depository Trust & Clearing Corporation (DTCC) is a key FMI; it handled close to $530 trillion in equity transactions in 2024 and successfully implemented T+1 settlement last year. It recently also experienced what it described as “unprecedented market volatility”, reaching new peak value and volumes across platforms and services. In the last month, its subsidiary, the National Securities Clearing Corp (NSCC) saw a 33% increase from previous peak with Q1 2025 monthly volume average 29% higher YoY. Other DTCC businesses saw peaks as well: the Fixed Income Clearing Corporation (FICC) saw Q1 2025 monthly volume average increase 32% YoY and TradeSuite, a post trade automation suite of services, saw a 27.7% increase versus a previous peak in March this year.

Despite record-breaking peaks DTCC reported that fail rates remain consistent with a T+2 environment (T+1 was introduced to the U.S. in May 2024 – see Celent research “Settling for Success in Implementing T+1". DTCC highlighted benefits of the T+1 transition by pointing to NSCC margin levels which were comparable across these new peaks this year to those in 2020 (margin requirements averaged 18.3 billion in April 2025 versus 18.5 billion in June 2020), even though cleared 1-day trading values during the recent market volatility were consistently larger than the cleared 2-day trading value in the 2020 period.

In a statement shared with Celent, Lynn Bishop, Managing Director and Chief Information Officer, DTCC said, “DTCC remains steadfast in its commitment to providing robust, resilient, and scalable infrastructure that ensures the smooth functioning of markets, including during times of market stress and volatility. All DTCC’s services, including our FICC and NSCC clearing houses, effectively managed the recent increases in volumes."

DTCC isn’t standing still with its infrastructure. It recently announced the launch of a multi-year transformational initiative across its core Equity business, aimed at boosting resiliency and scalability. A key part of this is the introduction of a new data center rotation program to strengthen resilience; the new model will go live in 2026. The transformation will also support extended trading by offering 24/5 Extended Clearing.

Will industry be ready for potential shock waves to follow?

Industry participants suspect the tariff policy fallout could have wide reaching implications for capital markets. In an article for the Financial Times, Huw van Steenis, vice-chair Oliver Wyman looked to the consequence of Richard Nixon, then president of the U.S., taking the dollar off the gold standard, resulting in global economic instability and uncertainty and contributing to the huge inflation of the 1970s. The shock waves he argued “rippled through the decades… the creation of the euro stems from it”. He wonders if a digital euro or deeper European capital markets is next. Whatever the consequences however, it seems that the world’s financial markets infrastructure is ready.

Looking forward Magnus Haglind, SVP and Head of Marketplace Technology Products, Nasdaq, told Celent that operational excellence when running critical software is a given, saying, “there is going to be a stronger push for infrastructure modernization including scaling networks and processing capabilities. Processing orders and transactions is one type of challenge, but managing all the data, storing it in a quick and scalable way, and making it available is another engineering challenge.” He said Nasdaq has been working with AWS on how to optimize their infrastructure to support capital markets use cases.

Chuck Mack told Celent that the industry needs to talk about “surrounding systems”. He said, “there is other plumbing that people don’t highlight and that is the next frontier where the industry neds to invest and think through. It is not just more machines or compute, its thinking about architecture, risk controls. He told Celent that “There is a tremendous opportunity to re-engineer processes across the parts of the ecosystem…this is the time to do it.”

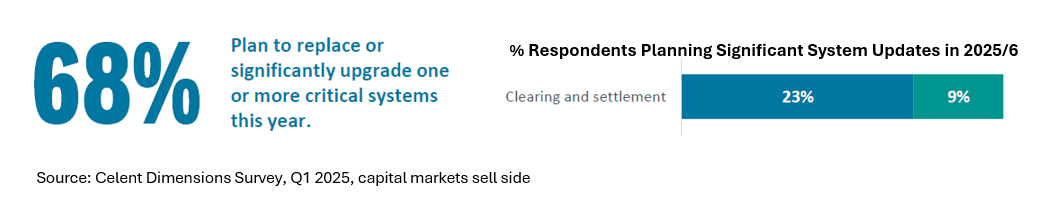

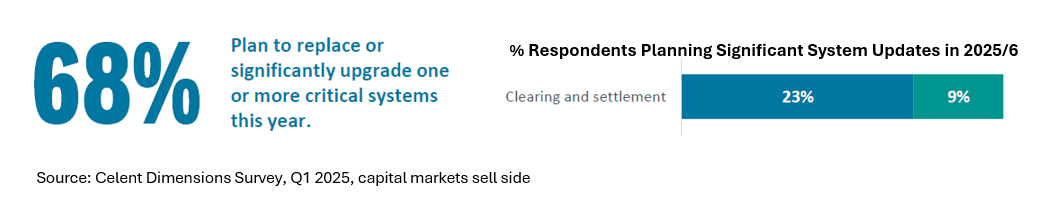

Capital markets respondents to Celent’s latest Dimensions IT Pressures & Priorities (n=219) agreed, with data showing more than 60% of respondents are planning to replace or significantly upgrade one or more critical systems this year, including transactional systems (buy side) and clearing and settlement (sell side) as top ranked systems targeted for replacement or modernization. Celent subscribers can read more about buy side and sell side survey responses (see links below) or contact your account manage to arrange time to discuss with an analyst.

Related Research

Capital Markets Dimensions: IT Pressures & Priorities Webinar, 2025 Edition Dimensions: Capital Markets IT Pressures & Priorities, Sell Side 2025 Edition Dimensions: Capital Markets IT pressures & Priorities, Buy Side 2025 Edition Settling for Success in Implementing T+1 Game Changing” Initiative Aims to Channel €10 Trillion Savings into Investment, Spurring EU Capital Markets Financial Market Infrastructures: Building on Blockchain Technology Trends Previsory: Capital Markets FMI/Post Trade 2024 Edition