The investment management landscape is undergoing a profound transformation marked by mega themes that signal the dawn of a new era. Forward-looking firms are executing towards future ambitions for AI to be embedded into the fabric of their investment, advisory and client strategies. Digitization, data, and democratization serve as the pivotal forces reshaping investment strategies and opportunities. As traditional boundaries blur, the crossover of public and private capital emerges as a critical trend, offering a more diversified blend of assets and innovative solutions for both issuers and investors.

Beyond the hype, the journey is only beginning in earnest. We anticipate stronger imperatives in the coming year for investment managers and investors to catch the next wave—a wave characterized by investment convergence, connectivity, and customization. The upcoming era is defined not only by technological advancements but also by a shift toward more personalized investment solutions that cater to various investment and financial outcomes. Investments in AI are becoming a double-edged sword, with exuberant valuations and high capital expenditures across markets. This is reflected in the strategic operationalization of AI/GenAI initiatives for investment managers, where scaled efficiencies and ROI have yet to tangibly emerge.

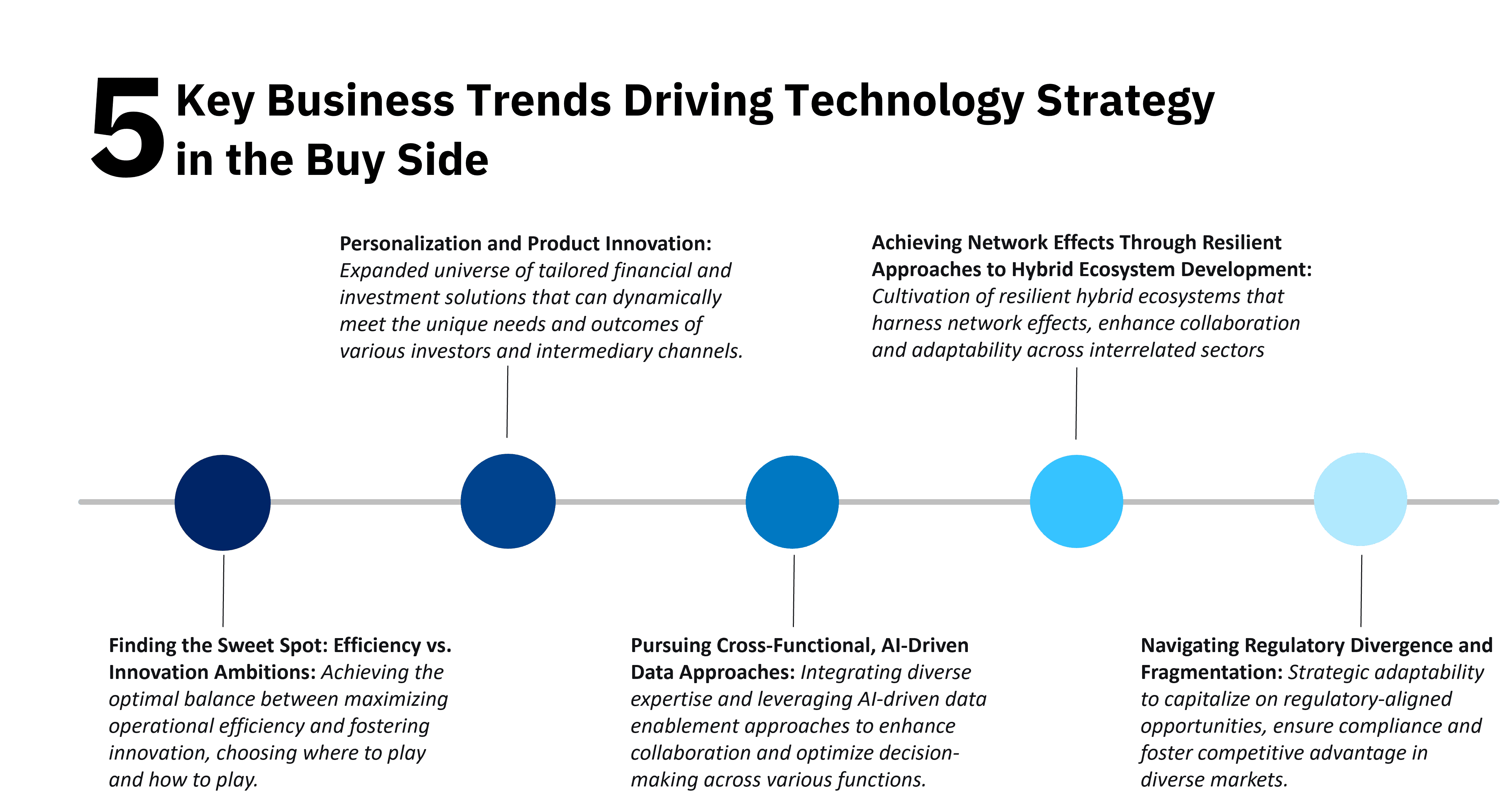

As markets reach a crossroads of opportunity and caution, we anticipate that firms must look to embrace capabilities around the coming year's Previsory themes.

- Finding the Sweet Spot: Efficiency vs. Innovation Ambitions

- Personalization and Product Innovation

- Pursuing Cross-Functional, AI-Driven Data Approaches

- Achieving Network Effects Through Resilient Approaches to Hybrid Ecosystem Development

- Navigating Regulatory Divergence and Fragmentation

----------

For more in-depth research around buyside, sellside and market infrastructure trends and technology insights, please explore Celent's Capital Markets practice.