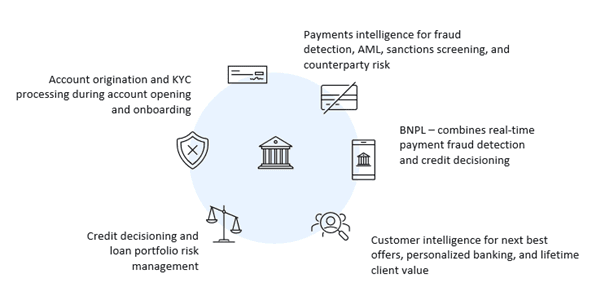

Banking is essentially an exercise in risk management. Whether credit approval, fraud detection, or gaining new customer insights, decision intelligence hinges on the ability to harness data effectively. As AI models become more prolific, can new data architectures enable better decision intelligence?

In an industry where there is increasing dependence on data science and quant-developed models for advanced analytics and AI, successfully and reliably building and managing models (and the data that supplies them) is more important than ever before. In addition to creating more disparate data across the bank’s systems, banks must also ensure they are managing this data well. Many banks struggle to match the speed of data creation and required decisions with correspondingly fast and robust overall data management and processing.

Examples of Bank Decision Intelligence Functions

Source: Celent

Source: Celent

Celent surveyed over 100 bankers from large banks across Canada, the UK, and US to understand the priorities and challenges of building and managing models and data across their banking businesses. Despite all the investments banks have made in data platforms and data management over the past 10 or so years, data issues remain pervasive! In many organizations, the traditional techniques are being replaced by data fabric—a data architecture paradigm that can help solve the root cause of data issues identified by the banks that participated in Celent’s research. As banks navigate this complex environment, leveraging data fabric architectures can provide a pathway to improved data quality and model performance.