The European payments market is undergoing a strategic transformation. The way consumers shop and pay will change significantly in the near future. Having not moved quickly enough to capture the first wave of e-commerce development, banks must now be in the driving seat to capture the opportunities.

This new report blends Celent's strategic analysis with GlobalData’s comprehensive market and consumer preferences data to forecast how the European e-commerce payments market will look in 2030 and in 2035. Celent has developed a model for consumer e-commerce payments volumes in five markets: Germany, the Netherlands, Poland, Spain, and the UK. While we recognise that this isn’t a complete view of Europe, we believe our choices capture the market diversity today and represent the frontier of changes.

Of course, the future is too uncertain for anyone to accurately predict with a high degree of confidence, especially 10 years from now. Nevertheless, Celent believes that outlining “a future” – a plausible scenario based on informed perspectives of how market developments today might shape the outcomes tomorrow – is a helpful exercise to assist clients with their longer-term planning efforts.

Today, digital wallets dominate many e-commerce payment markets, offering customers convenience. However, by 2030, customers will no longer be typing in card numbers at checkout, and the distinction between various wallet-like customer experiences will blur.

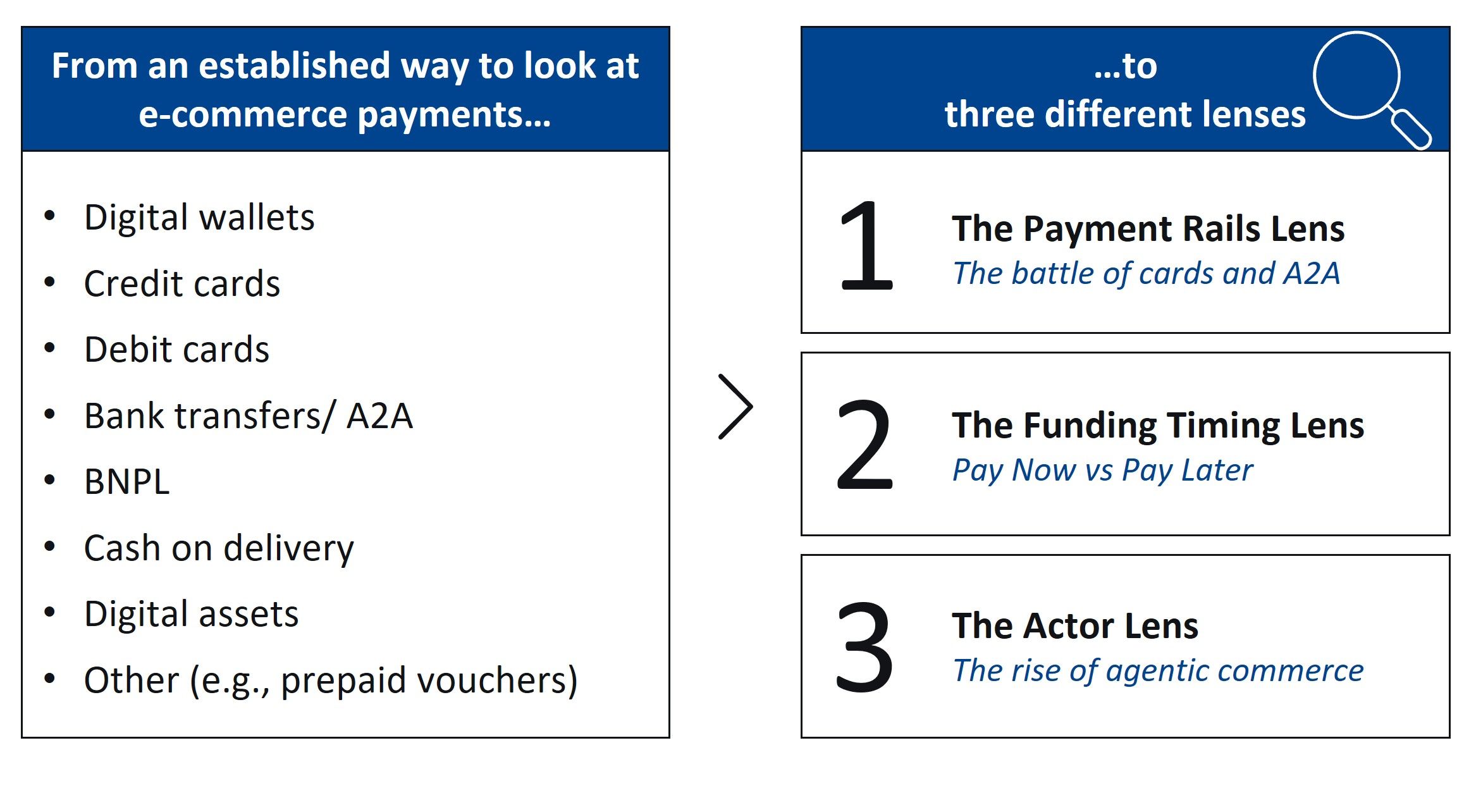

Instead of continuing with the established way of breaking down the e-commerce payments, Celent proposes looking at the market via three different lenses;

- The Payment Rails lens: Account to Account (A2A) payments will grow from 24% in 2025 to nearly 40% of total e-commerce by 2035 across selected European markets; however, card-based transactions will continue to grow in absolute terms.

- The Funding Timing lens: Banks have the opportunity to aggressively target stand-alone Buy Now Pay Later propositions with their own credit offerings, such as instalments and real-time credit extensions for A2A transactions, which will grow to represent 7.6% of all pay later volumes.

- The Actor lens: By 2035, 17.5% of all e-commerce transactions will be initiated by autonomous AI agents, acting on behalf of the customers.

The opportunity ahead for European banks is enormous. To capture it, they must be clear on the role they want to play in e-commerce, digital wallets, and the developing digital identity infrastructure; have a robust and modern payments technology stack; and begin planning for the big shift in how customers and organisations will soon be interacting with each other.