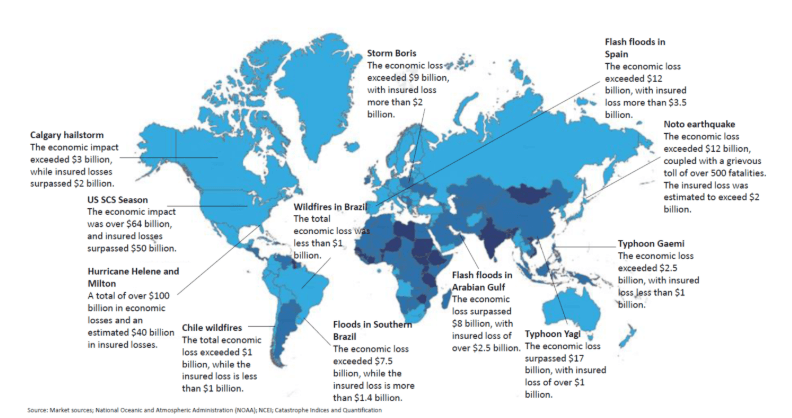

In 2024, there were 336 global catastrophe events, causing total economic losses of USD 318 billion. Of that amount, USD 137 billion represented insured losses from natural catastrophes. Fifty-seven percent of total losses — equivalent to USD 181 billion — were uninsured (Swiss Re Institute). In the first half of 2025, Munich Re estimated global losses of USD 131 billion, 20% above the average of the last decade.

The 2025 Global Natural Catastrophe Insurance Market Report highlights the major events of 2024 and their widespread impact across all regions. These figures not only reflect the growing frequency and severity of extreme events but also expose the limitations of traditional insurance models in addressing climate-driven risks at scale.

Global Natural Catastrophes in 2024

Source: GlobalData

Source: GlobalData

March 2025 marked the third warmest March on record, with global surface temperatures 1.31 °C above the 20th-century average (NCEI). Looking ahead, GlobalData projects the natural catastrophe insurance market to grow at a 7.7% CAGR through 2029, reaching $224.8 billion — driven by both the rising incidence of extreme events and technology-fueled innovation in coverage and monitoring. Yet this growth will only be sustainable if insurers can modernize how they operate.

The Real Challenge: Operating in Real Time

While innovative products exist, insurers still face structural constraints that limit their ability to respond in real time:

Legacy systems and low analytics maturity block the use of real-time climate data in underwriting.

Parametric insurance and dynamic pricing models are gaining traction but often remain loosely integrated with core systems — limiting automation, scalability, and real-time responsiveness.

The perception–protection gap persists as contractual rigidity, lack of open data, and technical language hinder adoption — even when risk awareness is high.

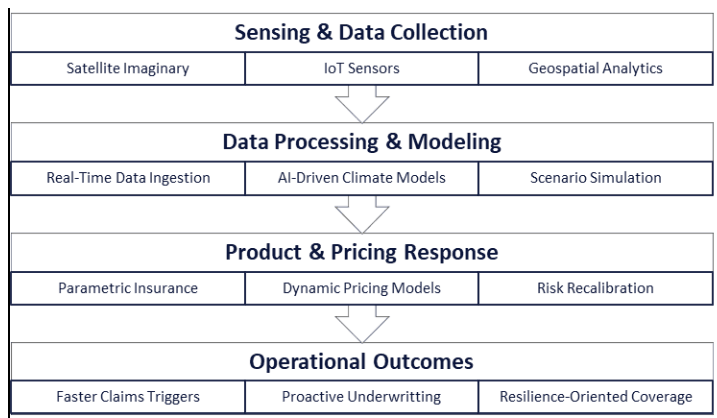

To tackle this challenge, Celent’s recent report Navigating Liquid Risk: Rethinking Insurance for a World of Disruption introduces the Climate Tech Enablement for Real-Time Insurance Response framework — a structured model that maps insurer capabilities across four functional layers.

Climate Tech Enablement for Real-Time Insurance

Source: Celent

This approach turns insurance from a static contract into a dynamic service — enabling adaptation, not just indemnification.

Alternative Capital and Strategic Alliances

To scale protection at the speed of risk, insurers must complement core innovation with financial engineering and ecosystem partnerships:

Catastrophe bonds (ILS): Now exceeding $50 billion in issuance (GlobalData), ILS are a growing tool to transfer risk and access alternative capital.

Public-private partnerships (PPP): Governments and insurers can co-finance or reinsure coverage for vulnerable populations, combining public funding with private expertise.

Integrated solutions: Parametric products tied to ILS or sovereign risk pools enable faster payouts and scalable protection.

Cloud and data infrastructure: Powering AI-based climate modeling and responsive underwriting capabilities.

Final Thought

The protection gap isn’t just a technical failure — it reflects an industry still built to react to the past. In a world shaped by volatility, hyperconnectivity, and climate disruption, insurance must evolve into something anticipatory, adaptive, and real-time.

Because in today’s world, protection is no longer about covering the past — it’s about responding to the moment as it unfolds.