Underwriting has always been at the heart of insurance. But today, underwriters face mounting pressure to balance speed, precision, and profitability in a context that grows more complex every day.

The challenges are clear. Strategic portfolio management is critical as carriers allocate scarce capacity to the most valuable opportunities. Risk selection is harder than ever when historical data cannot capture the volatility of climate, geopolitical, and technological disruption. And with submission volumes rising, triaging and prioritizing is no longer optional — it is a crucial skill.

At the same time, clients and brokers demand faster responses, transparency, and tailored solutions. This tension between speed and accuracy exposes the limits of traditional underwriting cycles — designed for a solid, predictable world that no longer exists.

As I wrote in my report Navigating Liquid Risk: “Volatility has become permanent. The past is no longer a reliable predictor of the future.” Climate events, technological disruptions, systemic shocks, and social fragmentation are creating what I call liquid risks — interconnected, unpredictable, and often self-inflicted. Traditional underwriting models, based on stability and history, begin to crack.

At Celent, we see this gap clearly when analyzing Policy Administration System (PAS) solutions. Even though some PAS offer rules-based capabilities — risk scoring, data capture automation, incremental efficiency gains — these systems were built to manufacture policies and manage core processes, not to serve as decisioning engines for underwriters. They cannot orchestrate the complex judgments that define underwriting.

Because of this, many insurers still rely on Excel spreadsheets for risk analysis, pricing support, and submission triage. Flexible, yes, but not scalable, transparent, or collaborative enough for today’s environment — and certainly not capable of responding quickly to risk signals in real time. This highlights how urgently underwriters need purpose-built decisioning tools.

At the same time, a growing ecosystem of specialized data providers is emerging. Real-time intelligence — from geopolitical news to supply chain disruptions, climate APIs, or cyber risk monitors — can enrich the underwriting process. When integrated into workflows, these signals help reassess exposures dynamically and act on risks as they emerge, rather than after the fact.

To bridge these gaps, carriers are increasingly turning to purpose-built platforms. This is why solutions such as Underwriting Workbenches are gaining traction. The most advanced workbenches go far beyond efficiency: they integrate third-party data, embed AI insights, and offer collaborative workflows that enhance decision-making. By connecting multiple data streams and enabling event-driven decisioning, they provide the foundation for real-time underwriting response.

On the decisioning side, underwriters need support across critical activities — most importantly, risk selection and strategic portfolio management, but also risk analysis, reinsurance, pricing, and submission prioritization. These are not back-office tasks; they are the core of underwriting judgment. Workbenches, by unifying internal and external data with analytics and AI, can augment these decisions and help underwriters focus on the highest-value opportunities.

This is the essence of what I call Liquid Underwriting: underwriting that is adaptive, continuous, and context-aware. Instead of a one-off decision, it becomes a living process, reassessing risks as conditions evolve and responding in real time — enabling insurers to remain both resilient and relevant.

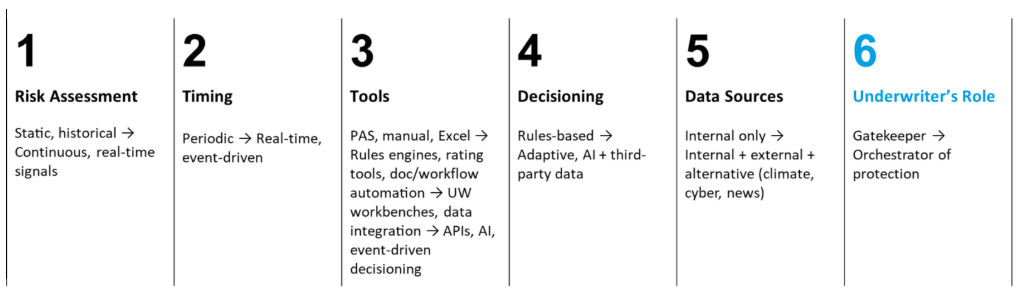

The difference between solid and liquid underwriting can be summarized across six dimensions:

Such an approach directly addresses today’s challenges: portfolio management that adapts in real time, risk selection that integrates new signals instantly, and submission prioritization powered by intelligent triage.

The enablers are already here: event-driven architectures, UW workbenches, AI decision support, and real-time risk data. The industry must move beyond the illusion of solidity and embrace underwriting as an orchestration of protection in a liquid world.

Insurance built for yesterday’s solid risks is like a brick. But today’s risks behave like water — fluid, fast, and interconnected. Underwriting must learn to flow with them, or risk being washed away.

Over the coming months, I will publish a report exploring Liquid Underwriting in depth: its foundations, enablers, and implications across commercial, specialty, and personal lines. The key question: are we ready to transform underwriting from a static gatekeeper into the dynamic orchestrator of protection in a liquid world?