Insurance was built for a world in which the past was a reliable guide to the future. That world is no longer the default. Today, climate volatility, geopolitical fragmentation, technological acceleration, and social tension interact continuously, creating risks that are systemic, interconnected, and constantly evolving — a condition we define as liquid risk.

The challenge is structural: while risk has become fluid and real time, underwriting remains largely static, anchored in historical data, episodic decision cycles, and isolated judgment. The result is a widening Protection Response Gap between how society experiences risk and how insurance responds.

This report introduces liquid underwriting — a new underwriting model designed to interpret risk in motion, operate with continuous signals, align individual decisions to portfolio intent, and combine human judgment with embedded intelligence. It explores:

Why underwriting becomes the first fault line in a liquid-risk world

-

The operating principles that redefine underwriting logic

-

The capabilities required to turn underwriting into a living system

-

The architectural and technological foundations that make this possible

-

That CEOs, CIOs, and Chief Underwriting Officers need to do next

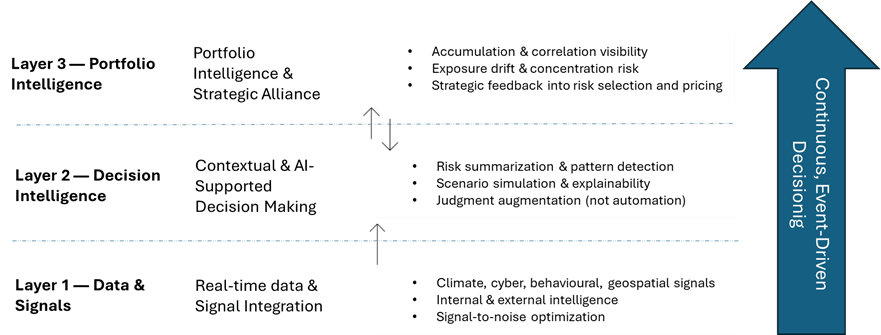

To make this transition actionable, the report presents a set of visual frameworks — including a capability model that illustrates how data, decision intelligence, and portfolio awareness connect into a continuous, event-driven underwriting cycle.

Liquid Underwriting is not a tactical modernization exercise. It is the next evolution of insurance — a way to realign protection with how risk behaves today.