Externally-facing APIs in financial services have been around a long time, with many initially emerging in the e-commerce and cards space. The growth in APIs for payments, banking, and other financial applications has skyrocketed over the past few years, with more than 530 new APIs published from 2015 to 2017.

Regulatory-Driven Open Banking APIs

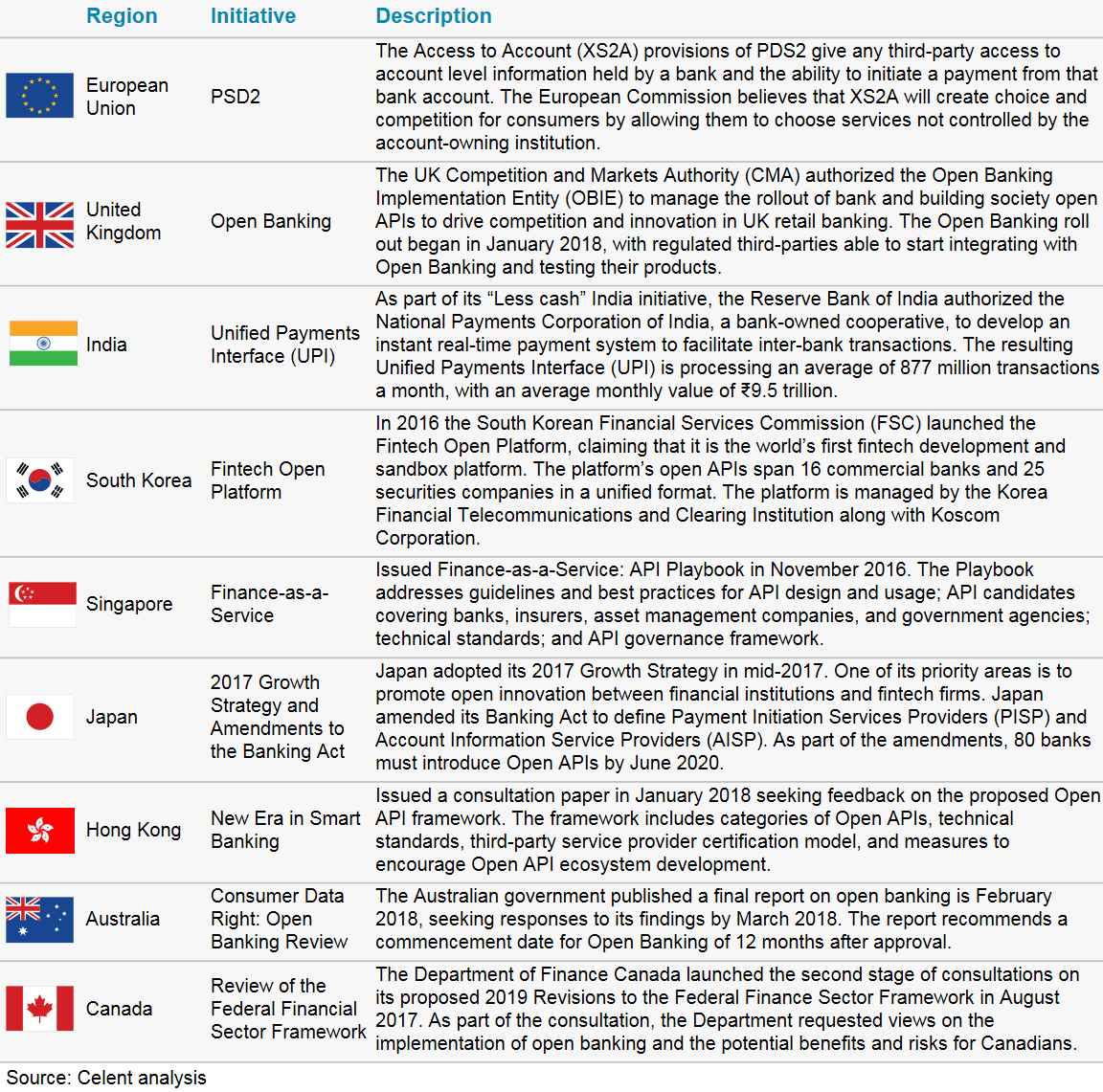

Regulatory requirements drive much of the growth in newly-published open banking APIs. The intent of open banking legislation is to provide consumers with more choice — by allowing third-party providers to create new financial services offerings with aggregated bank account data. Regulators across the globe are moving towards open account access, and in some counties, payment initiation.

Market-Driven Open Banking APIs

A handful of market-leading banks launched open APIs long before regulatory mandates.

- Credit Agricole: Credit Agricole launched its API marketplace, CA Store, in 2012. The CA Store API site gives developers access to a software development toolkit (SDK) with which to build their own applications. The customer-facing CA Store now has 50 applications in their marketplace.

- BBVA: BBVA began hosting hackathons in 2013 under the InnovaChallenge brand. For the hackathons, BBVA provided participants with anonymized credit card data sets, offering prize money for the applications best adding value to BBVA’s data. The BBVA API_Market now offers two sets of APIs, one covering BBVA Spain and the other, BBVA US.

- Fidor Bank: Fidor, now part of Groupe BPCE, received its German de novo banking license in 2009. It built its banking platform from scratch, creating an integrated experience with complete control over the products and services suite. It published its first public APIs in 2014 and now offers more than 50 APIs.

Like these pioneers, banks around the globe aren’t waiting for regulators to force the issue. Banks such as Citi, Bank of America, Capital One, Banco do Brasil, Absa, Emirates NBD, DBS, Mitsubishi UFJ, and YES BANK offer freely available access to their developer portals, unlocking business value with open banking APIs.

Look for my upcoming Celent report, titled “APIs in Banking: Four Approaches to Unlocking Business Value.” In the report, I discuss how banks are benefitting from APIs for Integration, Banking as a Platform, Innovation, and Customer Connectivity. The report contains updated case studies from CBW Bank, Fidor Bank, JB Financial Group, Citi, and YES BANK detailing their API journey, including technology architecture, monetization approach, and latest results. For banks seeking to begin their API journey, I recommend a series of guideposts that banks can follow to unlock business value with APIs.