Celent has released a new report titled Increasing the Adoption of Data and Analytics in Insurance. The report was written by Michael Fitzgerald, a Senior Analyst with Celent's Insurance practice.

In order to gain a detailed understanding of the needs of insurance professionals regarding data and analytics, Celent partnered with The Institutes’ Enterprise Research group to analyze survey response data from over 2,000 insurance company professionals.

A growing number of insurers are looking for solutions that help them make better decisions. Data and analytics are key enablers. Over half of insurance CIOs surveyed state that investments in predictive analytics and business intelligence projects will be “significantly enhanced” next year.

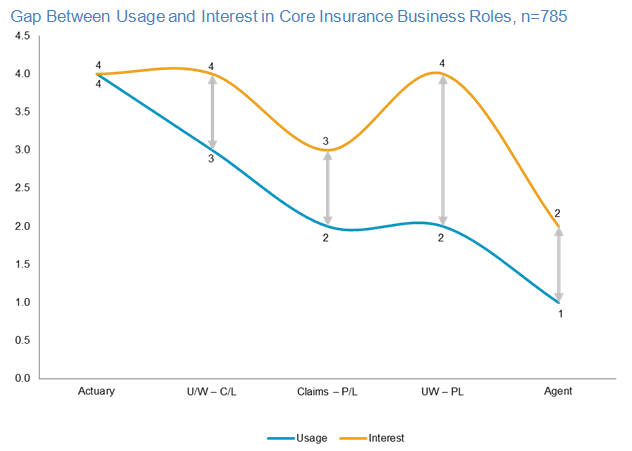

However, investment is a necessary, but not a sufficient condition for success. Adoption is the key. Insurers and solution providers need to maximize adoption of data and analysis tools and techniques by meeting the needs of users in the core insurance roles of underwriter, claims adjuster, actuary, and agent.

Analytics and business intelligence are the number one and two areas of investment in the Celent 2017 insurance CIO study. There are gaps between interest in data and analytics and usage of these solutions in key insurance professionals. Practical, industry-specific topics and accessible educational materials will increase adoption and return on investments.

“Insurers investing in data and analytics solutions will find practical direction in the analysis of this survey data. Solution providers can use this information to guide product development and client engagement,” commented Fitzgerald.