Historically small business banking has been fraught with trade-offs between lowering cost-to-serve and improving customer experience. As a result, small businesses are often underserved. No longer. Artificial intelligence (AI) can mitigate the trade-offs and enable high-touch tech.

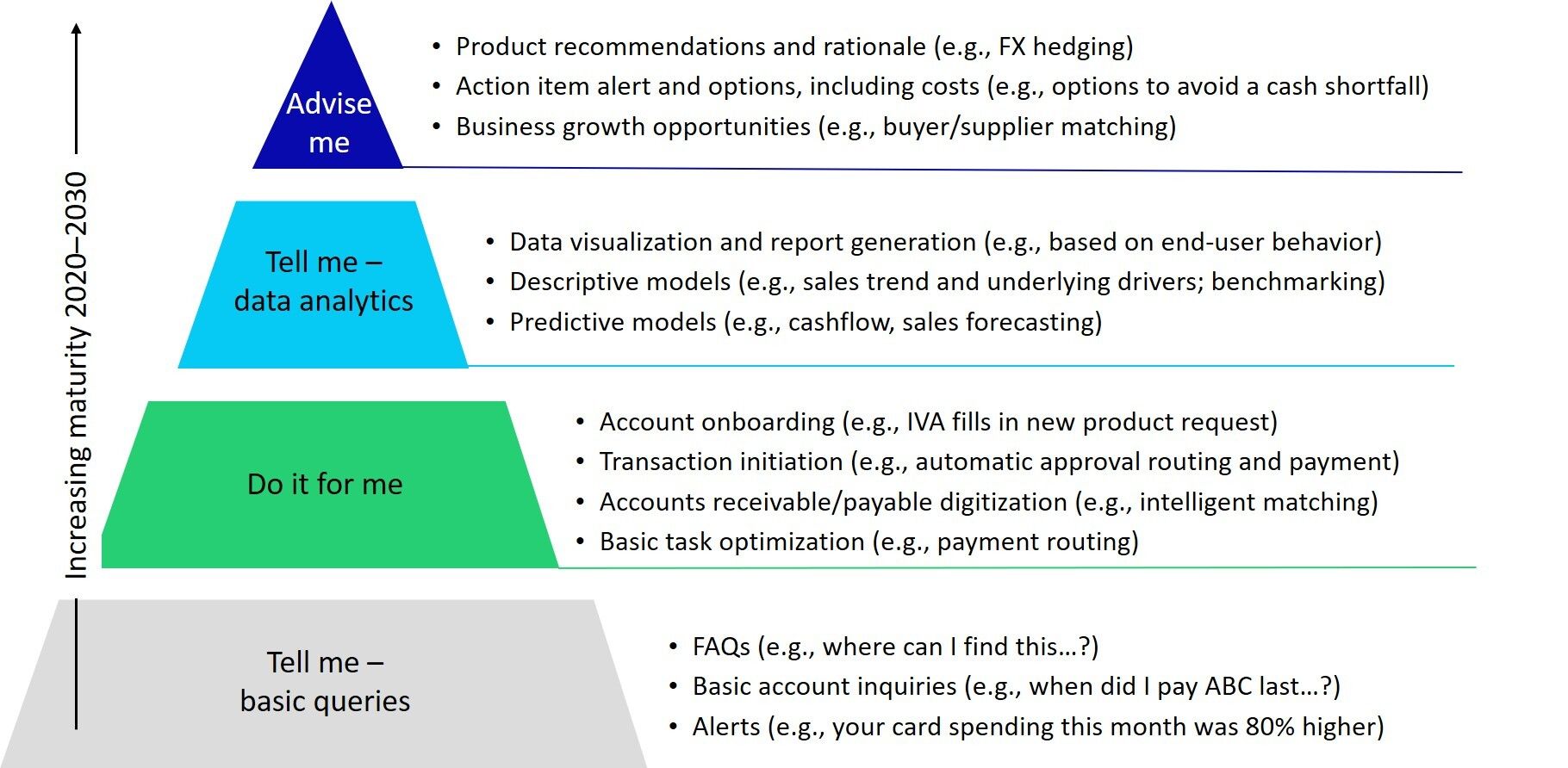

Small business banking is ripe for disruption as evidenced by the onslaught of fintech and big tech players vying to capture traditional as well as new revenue streams. The winners over the next decade will not look like today’s banks. Already, the pacesetters are achieving step change by taking a customer-centric approach and delivering easier financial workflows, simple smart analytics, and actionable advice. To generate a sustainable competitive advantage in this heated competitive environment, however, banks must go beyond step change and realize game changing moves. A few are beginning to change the game entirely by applying AI at scale to personalize customer support and deliver advanced analytical tools and actionable insights. They are moving beyond foundational AI applications (e.g., “Tell me”) to apex applications (e.g., “Advise me’).

Figure: AI Delivering on a Small Business Customer's Hierarchy of Needs

We begin this report by answering the question on top of many bankers’ mind: “why AI now?” We then recap the call to action broadcasted in Reinventing Small Business Banking Part 1: Pacesetters in Embedded Finance. Next, we discuss how AI will change the economics of small business banking while improving customer engagement. We then show AI in action, profiling accounting software exemplars Sage and Xero. We close with profiles of three mature AI tech vendors supporting small business banking use cases: Creative Virtual, Kasisto, and Personetics, as well as one new entrant, Monit. In addition, we provide vignettes of their client success stories.