Remember when omnichannel was a hot topic?

No one seems to be talking about it anymore. Funny, the same thing happened with Big Data, Analytics, and PFM. The one big difference: omnichannel retail delivery remains vital (and largely undelivered) and banks know it.

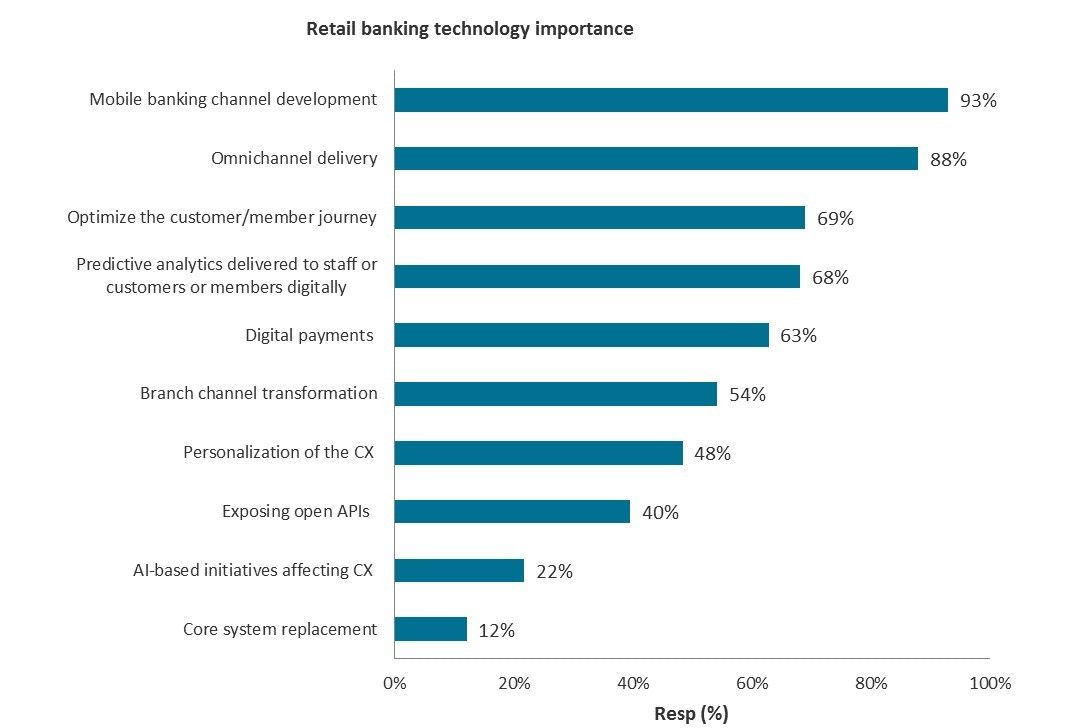

Celent has been tracking the evolution of retail and business banking delivery channel technology since 2010 through biennial surveys of North American financial institutions supplemented by telephone interviews. Our latest closed in January 2019. A forthcoming Celent report will dig into the survey’s insights. In the interim, here’s a sneak peek into surveyed technology priorities among a sample of 160 US banks and credit unions across the asset tiers. These priorities directly stem from those institutions top strategic retail and business banking priorities.

Of note:

Omnichannel retail delivery is nearly statistically tied with mobile channel development as the overwhelming #1 technology priority among surveyed banks and credit unions. You’d never suspect that from a Google Trends search.

If the branch is dead, someone needs to tell banks. It's care and feeding (and redesign) is a higher priority to US institutions than several “hot” technologies.

AI, despite the incessant hype from vendors and many analysts, is second only to core system replacement as the lowest priority technology among US financial institutions. No surprise given AI’s nascent state, its pursuit is the domain of larger institutions.

We could debate the wisdom of these surveyed priorities, but it should at least be moderately reassuring to some readers that mobile has its rightful place amidst a dizzying bevy of alternative pursuits. I'm humored to see omnichannel a close second given all those who insisted it's no longer a thing in banking.

Technology decisions are hugely important to banks. Priorities should be carefully developed with the aid of objective analysis – not by chasing what’s getting all the “buzz” (or not).