Insurance is no different to other industries when it comes to capturing valuable data to improve business decisions. At Celent we have already discussed how and where in their operations insurance companies can leverage private consumer data they can find on social networks, blogs and so on. For more information you can read a report I have published this year explaining Social Media Intelligence in insurance.

Actually there are various factors influencing insurers' decision to actively use private consumer data out there including among others regulation, resources adequacy, data access and storage. I think that an ethical dimension will play a more important role going forward. More precisely I wonder whether consumers and insurers' perceptions about the use of private consumer data are divergent or similar:

- What do consumers really think about insurance companies using their private data on social networks and other internet platforms?

- What about insurers; does it pose an issue for them?

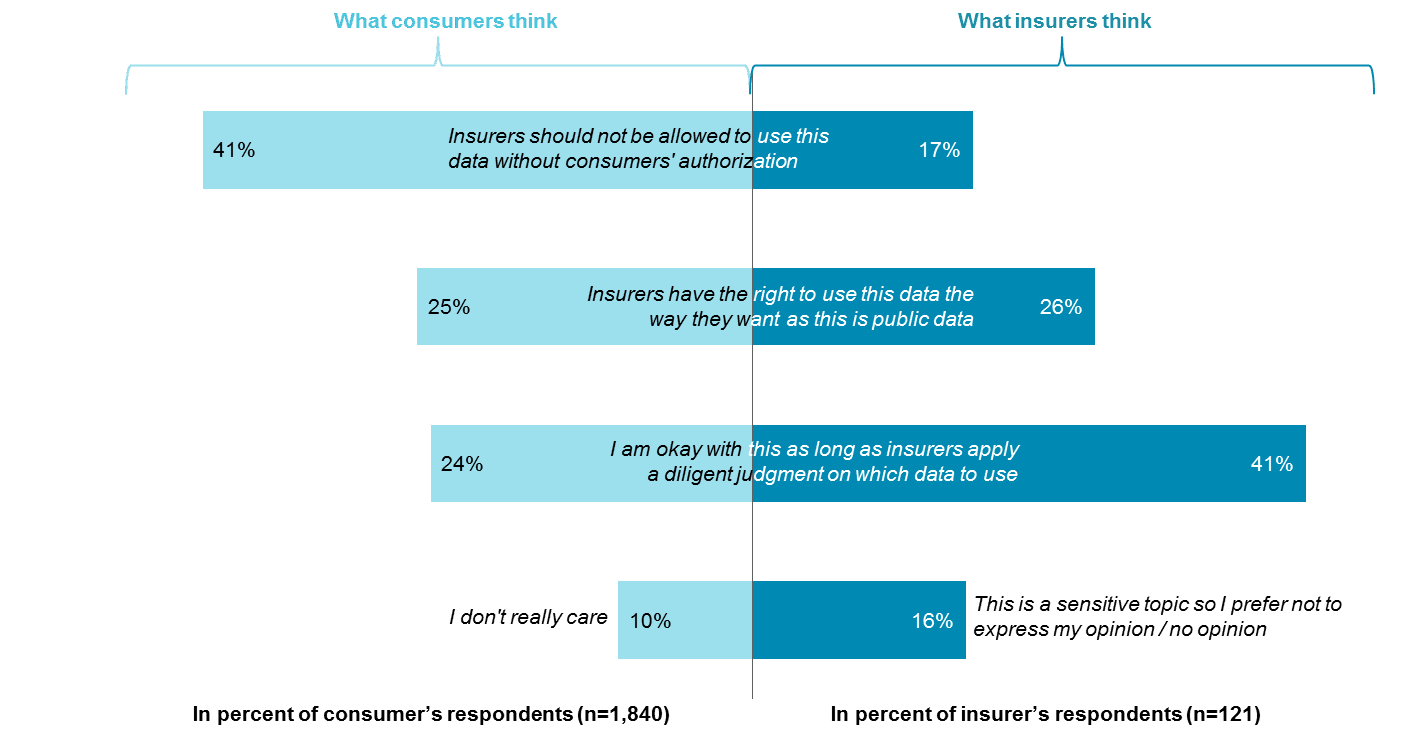

In order to assess this ethical dimension, we have asked both insurers worldwide and also consumers (in the US, UK, France, Germany and Italy) what where their view on this topic. To insurers, we simply asked them what best described their opinion about using consumer data available on social networks (Facebook, Twitter, LinkedIn, etc.) and other data sources on the internet (blogs, forums, etc.). To consumers, we asked what were their opinions about insurers using these open data sources for tracking people potentially engaged in fraud or criminal activity.

The following chart shows the result and indicates that there is a big gap between the two sides:

Overall what is good for consumers is not necessarily good for insurers. In the same way, what insurers want is not always in line with what consumers expect from their insurers. Going forward the question for insurance companies will be the find the right balance between the perceived value of private consumer data and customers' satisfaction. In addition, it will be tough for them to figure out the impact (pros and cons) of all factors at play in the decision to invest in technologies allowing for the efficient use of private consumer data accessible on the Internet.

At Celent, we are trying to define a framework that can help them structure their reasoning and make an optimal decision. So more to come in the coming weeks on this topic...