The operational challenges of AML compliance and the technical capabilities of anti-money laundering (AML) software have hit an impasse.

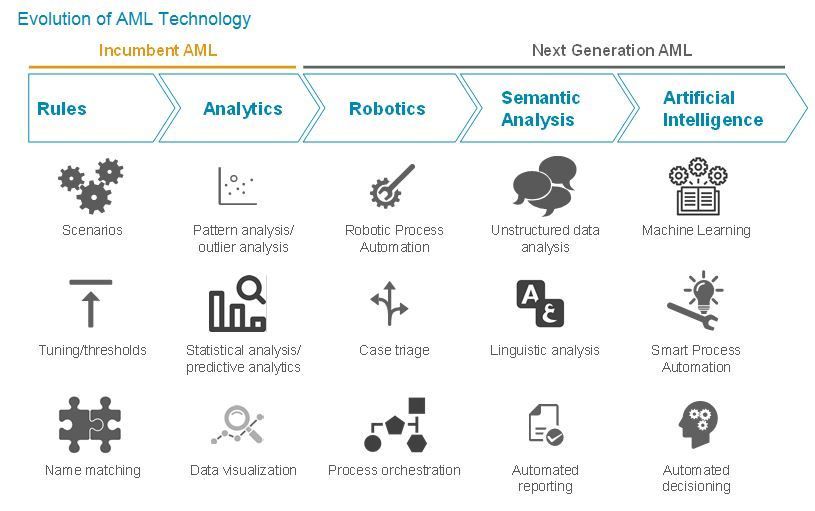

This is leading financial institutions to look at new technologies such as artificial intelligence (AI) and software robotics to bring additional efficiencies to AML processes. Eventually, such technologies could be used to automate decisions that are today made by humans.

In this report Celent explores the use of big data, advanced analytics, and cognitive computing in the anti-money laundering domain, with a special focus on innovative approaches to tackling AML and know your customer (KYC) requirements. The report introduces more than 30 companies offering innovative solutions.

Many financial institutions are already applying supplemental technologies to their AML technology stack to alleviate pain points. On the behavior analysis side, banks may run advanced analytic models through their transaction monitoring engines, instead of using the vendor-supplied scenarios. Specialized name matching, linguistic analysis software and predictive analytics can be used to enhance the screening process.

There is now a striking emergence of new firms providing solutions for KYC (screening and due diligence) and AML (monitoring and behavior detection) that employ advanced computing techniques. This includes the rapidly expanding universe of regtech startups, as well as technology and compliance pioneers that introduced solutions a decade ago.