Behavioral economics fuses the teachings of psychology and economics. The field strives to explain why humans do things the way we do and what motivates us. In academia, it has become the dominant approach to understand consumer decisions.This report demystifies the burgeoning subject and explores how certain fundamental principles such as heuristics, cognitive bias, and nudge theory can be applied to the insurance realm.

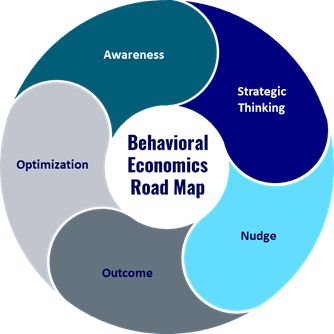

Inside are several examples of organizations that have been able to effectively employ insights from behavioral economics and reap concrete benefits. Celent’s also provides a proposed road map for carriers looking to apply the principles of behavioral economics and turn theory into practice.

Topics discussed are:

- What is behavioral economics?

- Why should you care about it?

- Which behavioral economics principles are relevant to insurance?

- How can human error impact underwriting decisions?

- How can insurers use behavioral economics to positively impact their organization?