In early 2024, nearly half of all capital markets financial institutions Celent surveyed told us that “greater speed and agility” was one of the top three priorities driving their technology strategy through 2024/25. Events this year, whether political, market or regulatory, have only served to validate that as the right focus for this year and next. Sell side firms have always looked to gain agility through technology investments, but offering optionality to the business has increased in priority due to shift to client-centric product innovation and the evolving nature of capital markets ecosystems.

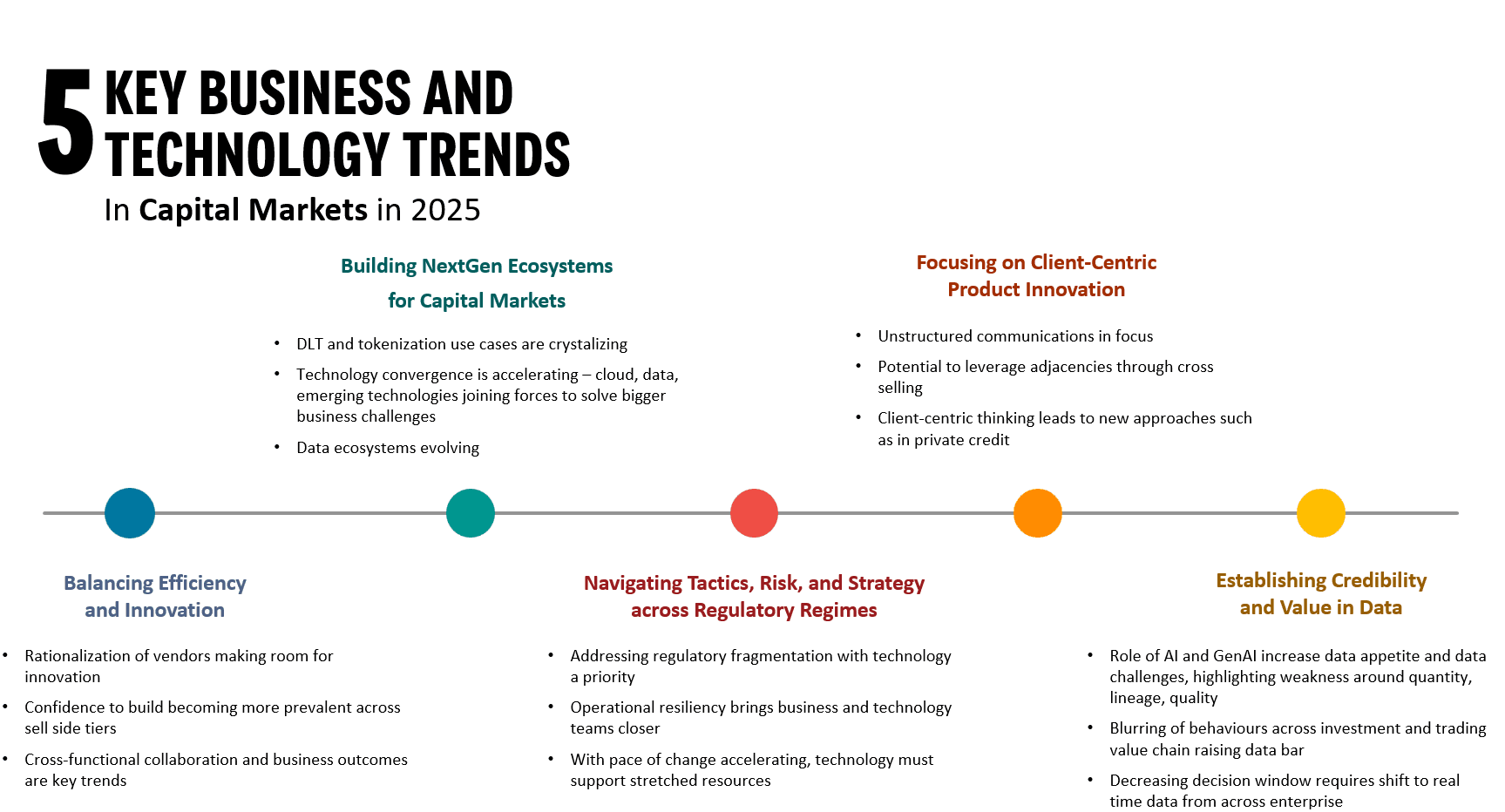

In our annual Previsory, Top Technology Trends Reports, the capital markets team leverage our proprietary research and contacts to identify the business themes that will be driving technology strategy and investment in 2025 across capital markets. For 2025 we identified five business trends that are key to driving technology investment across capital markets and in this report we review key takeaways for sell side firms.

----------

Celent clients can also access relevant studies:

- Top Technology Trends Previsory: Capital Markets/Buy Side

- Dimensions: Capital Markets IT Pressures & Prioriities (Webinar and reports)

- Turning the Tide: Transaction Reporting Vendor Landscape

- Envisioning the Future of Capital Markets Post Trade

- Alternatives and Private Markets: Charting New Technology Frontiers and Digital Pathways for Next-gen Operational Ecosystems

- ESG Delivery Under Scrutiny: "Walking the Talk" to Resolve the Credibility Gap

- Enterprise Data Management Visions and Trajectories: Capital Markets and Investments Edition Part 1 and Part 2

- GenAI-oneers in Capital Markets

For more in-depth research around buyside, sellside and market infrastructure trends and technology insights, please explore Celent's Capital Markets practice.