Much of the focus on digital transformation in banking is on customer-facing, well-funded challenger banks (think Fidor, Monzo, Starling, Tide, and Oak North). A key differentiator for these emerging firms is the ability to offer a differentiated customer experience at a lower operating cost per customer. Without legacy technology “debt”, their underlying cost structure is very lean, enabling the digital bank to offer acquisition bonuses, higher interest rates, lower fees, and increase investment in compelling financial management tools.

Traditional banks struggle to serve fast-moving customers with rapidly changing expectations, hampered by layers of monolithic, legacy systems across their front, middle, and back offices. The recently published Celent report, Legacy Modernization in the World of APIs, DevOps, and Microservices, discusses how creative heritage banks are turning to APIs, DevOps, and Microservices to transform their legacy architecture and to move to a modern, digital architecture, highlighting key modernization trends:

API-First Architecture: The current shift from a web-services architecture to an API-first one highlights the quality of the API layer as the primary driver of value. The API is the asset that allows for innovation and for participation in a wider ecosystem, reducing both cost and delivery timescales.

Enabling Innovation: While some believe that fintechs will eventually make banks obsolete, the current reality is that banks and fintech companies are entering collaborative partnerships for innovation, giving banks access to innovative products, new technologies, and startup culture. Many of these partnerships depend on customer data and services embedded in legacy technology. By working together and taking advantage of APIs, banks leverage their distinct strengths, enhancing the customer experience much more than each entity could do on its own.

Modular Financial Services: Microservices, DevOps, and Open APIs are not ends in and of themselves but rather a means to modularization. In harnessing these technologies and development approach, financial institutions can undertake a paradigm shift to transform themselves into providers of modular financial services, rather than monolithic, integrated financial services.

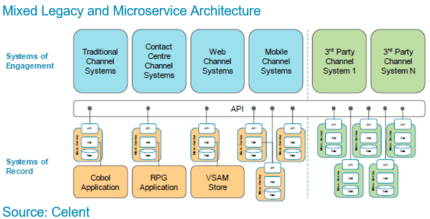

A Pragmatic Approach to Digital: For the foreseeable future many incumbent organizations will target an architecture like that shown below, where multiple legacy systems coexist with microservices to deliver an API consumed by multiple clients.

Real-world case studies for implementing APIs, DevOps, and Microservices, either alone or in combination are growing. This year’s Model Bank awards will highlight legacy transformation across different use cases in banking:

- Digital Platform Transformation— for the most compelling initiative to transform a technology platform focusing on front-end solutions.

- Core Technology Replatforming — for the most compelling initiative to transform a core banking platform and adjacent systems.

- API Strategy — for the most holistic and pervasive API strategy.

- Transforming Enterprise Integration — for the most innovative approach to enterprise integration.

We’ll be announcing the winners of these awards at Celent Innovation & Insight Day in New York on Friday, April 12. We hope to see you there!