Bank of America knew their customers wanted a single mobile experience across product lines to more easily manage their finances and multiple account relationships. At the same time, the bank saw the opportunity to introduce a wider audience of existing customers to its full-bank offering. In the past two years, the firm culminated a multi-year initiative to unify the mobile banking experience and to expand the industry-leading capabilities of Erica©, the conversational banking assistant, beyond deposit banking and across the entire customer relationship.

Celent is pleased to recognize Bank of America as our 2024 Model Bank for Customer Centered Innovation. We have frequently promoted the concept of “engagement banking” to our clients, and two critical components of engagement banking we’ve identified are (1) highly effective onboarding, and (2) refining the blend between digital and human delivery. Bank of America has achieved a mobile product that innovates in both areas.

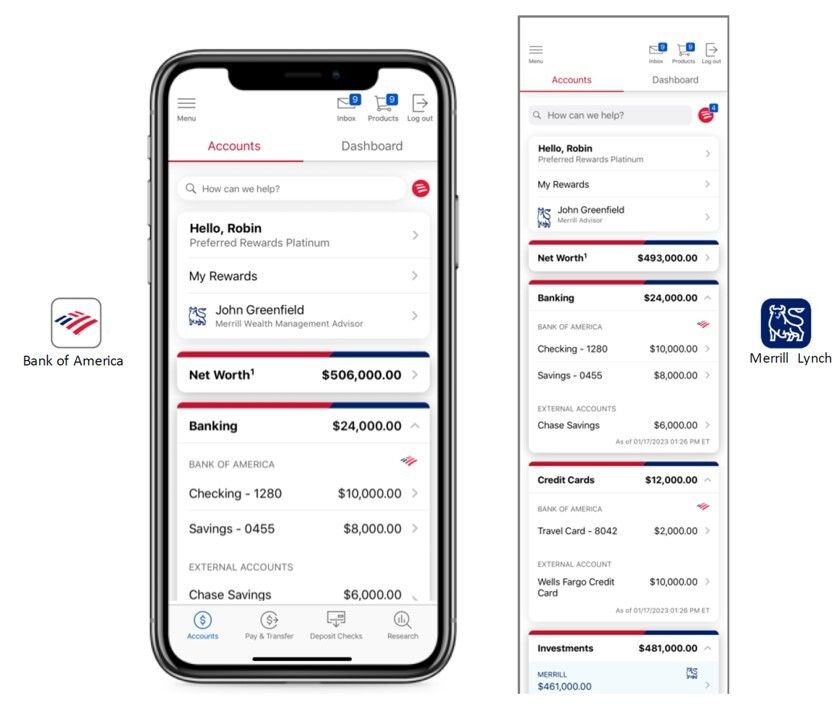

Above: Each Bank of America app displays common, personalized product and service tiles with a unified design.